WPX Energy, Inc. (ticker: WPX) reported a net loss of $119 million, or $(0.30) per common share for the first quarter of 2018. Production for the quarter reached 102.7 MBOEPD, a 6% sequential increase over Q4 2017 and 76% higher than Q1 2017. WPX had oil volumes of 65,800 BOPD.

WPX completed 36 gross operated wells (34 net) in its two core basins during Q1 2018 and participated in another two gross (one net) non-operated wells in the Delaware Basin.

Capital spending during the first quarter was $349 million, including $13 million in midstream development expenses, $4.6 million in land purchases and $26.3 million in San Juan activity that is reimbursable to WPX in conjunction with the closing adjustments for the Gallup divestiture, WPX said.

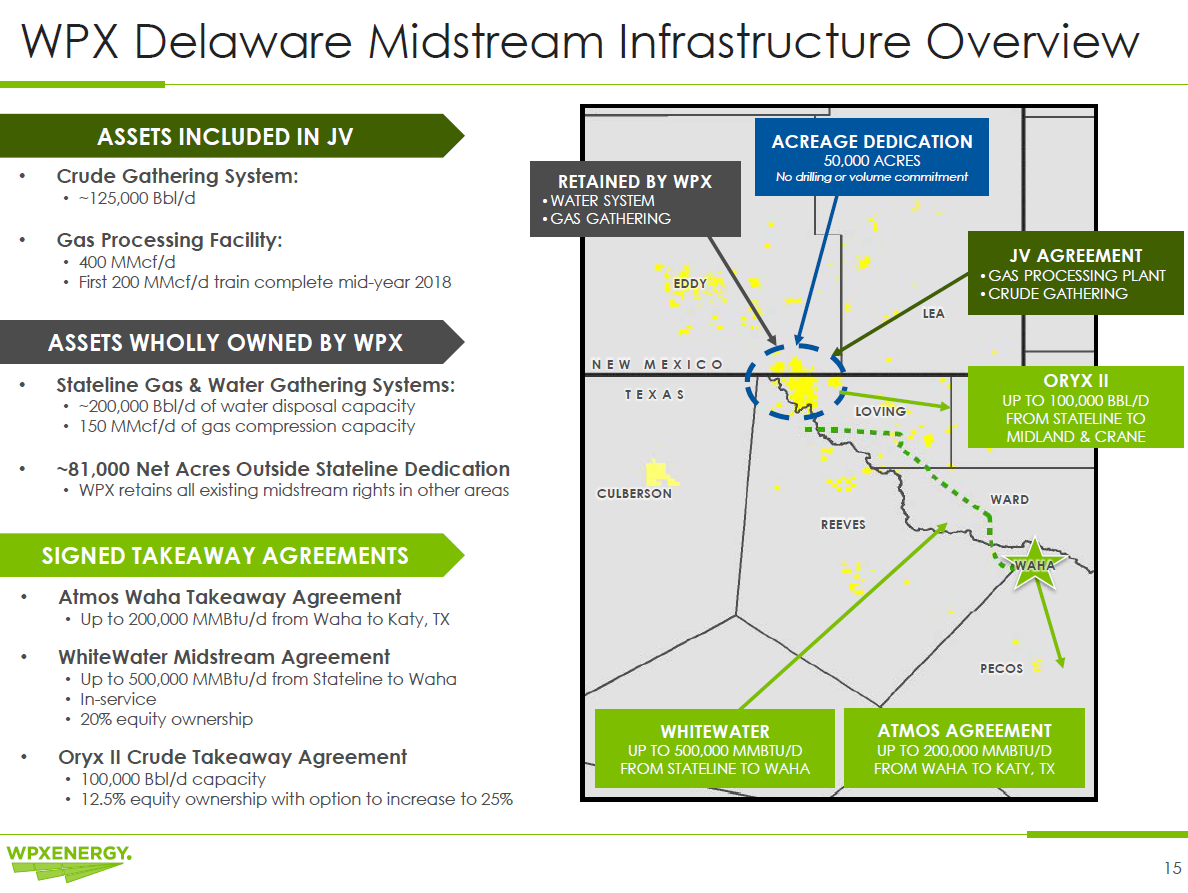

Infrastructure matters

“The market is seeing just how much infrastructure matters in the Permian, which we’ve articulated since we entered the basin three years ago with our RKI acquisition that included gas gathering and water systems,” says Rick Muncrief, WPX chairman and CEO.

“We’re also witnessing impressive recoveries in the Williston Basin with record-setting wells that are among the best in the Lower 48… And we’re also adjusting our capital structure by proactively paying down debt, which transfers value to our equity holders. Our strategy is even more compelling against the backdrop of global demand growth for light sweet crude oil,” Muncrief said.

WPX said that winter weather in the Williston delayed first sales from the seven-well Arikara pad by ~50 days – impacting Q1 production by 3,500 BOPD. However, once the Arikara came online, the wells had an IP-30 rate of more than 406,000 BOE, despite being choked back “considerably” due to takeaway limitations imposed by winter road restrictions.

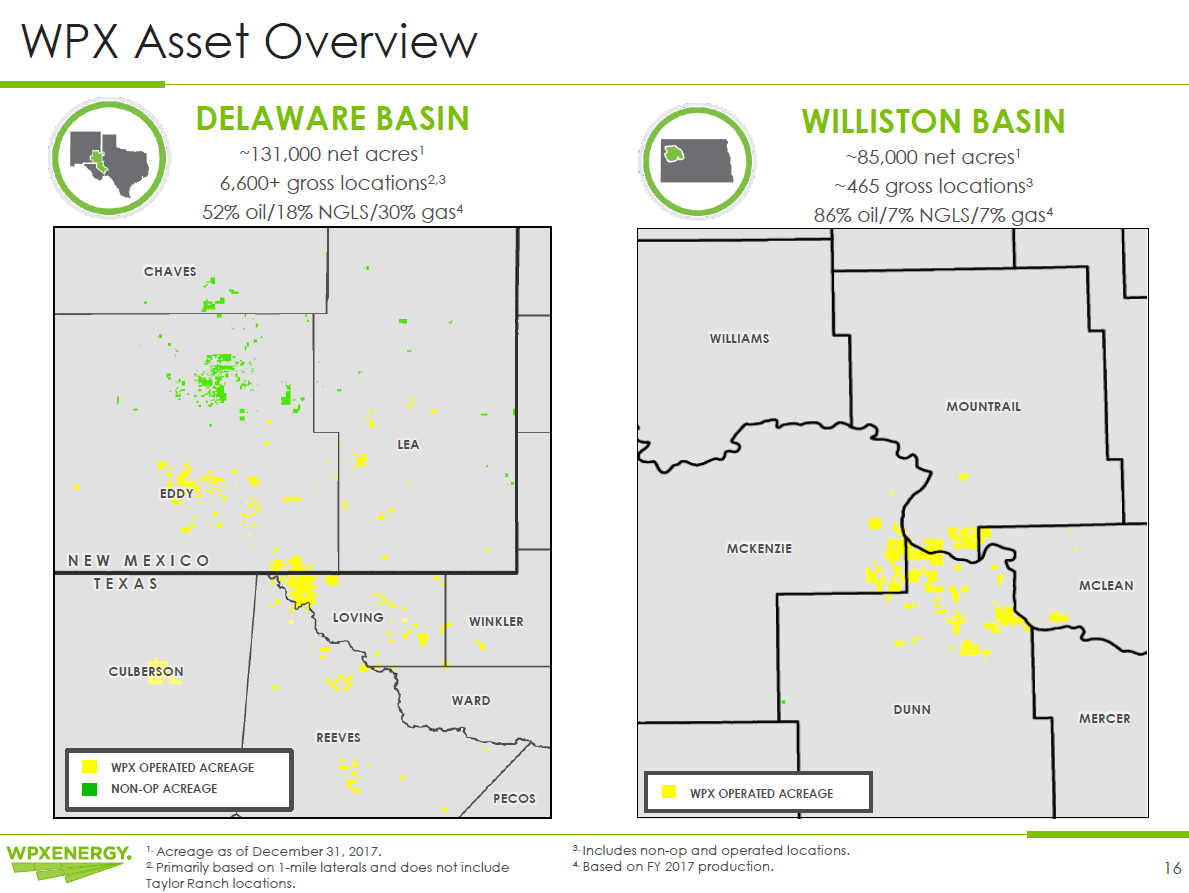

Delaware Basin

WPX’s Delaware production averaged 63.2 MBOEPD in Q1 2018. The company had 25 wells with first sales in the basin during the first quarter – roughly double the number of completions in the first quarter a year ago.

There were 15 completions in the Wolfcamp A interval, seven Wolfcamp X/Y wells, one well in the Wolfcamp B interval, one well in the Wolfcamp D interval and a well in the Third Bone Spring.

- The Quinn pad, with six wells, has a combined 60-day cumulative production of 610,000 BOE

- The Boyd pad, with four wells, has a combined 60-day cumulative production of 325,000 BOE

Williston Basin

Williston Basin production averaged 39.5 MBOEPD in Q1. WPX completed 10 Williston wells during the first quarter, including three wells on the Big Horn pad in January and seven wells on the Arikara pad in March.

Two of the 23 planned North Sunday Island wells, Hidatsa North 14-23HX and Mandan North 13-24HW, now have 180-day combined cumulative production of approximately 685,000 BOE (81% oil).

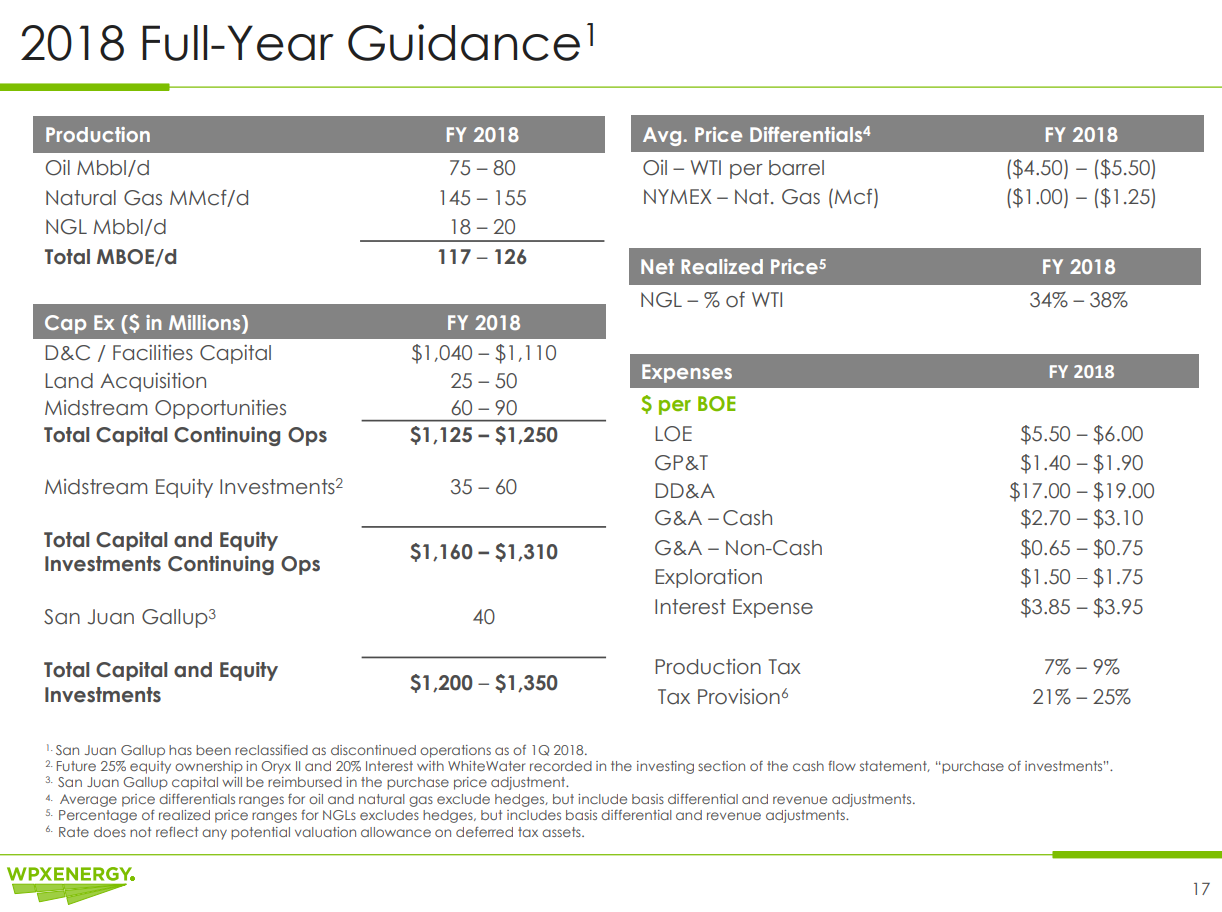

2018 guidance

For the balance of 2018, WPX has 57,500 BOPD hedged at a weighted average price of $52.82/barrel, 130,000 MMBTU/d of natural gas hedged at a weighted average price of $2.99/MMBTU and 12,100 BPD of NGL hedged.

For 2019, WPX has 34,000 BOPD hedged at a weighted average price of $52.30/barrel and 50,000 MMBTU/d of natural gas hedged at a weighted average price of $2.88/MMBTU.

Transforming WPX

WPX President and CEO Rick Muncrief talks about the company’s transformational transaction that solidifies the company’s premier position in the western United States: