WPX Energy (ticker: WPX) added 14,300 net acres to its San Juan Basin asset on June 22, 2015, increasing its overall position in the region to 100,000 net acres. WPX believes it holds 500 gross drilling locations across the Gallup oil window, including approximately 100 new locations from its recent acquisition. The assets were purchased from an undisclosed buyer for $26 million.

WPX’s Strongholds

The exploration and production company, headquartered in Tulsa, Oklahoma, has three somewhat unconventional core areas located in the Williston, San Juan and Piceance Basins.

The company divested virtually its entire position in the Marcellus Shale for $500 million in two separate transactions dating back to the beginning of the year. It also sold off assets in Argentina and Colombia, centralizing its focus on its three North American plays. The transition is a significant shift from when it spun off from Williams Companies (ticker: WMB) in January 2012, when it had interests in eight different regions. The three core areas have been the focal point for a handful of quarters, however. Even management said the Marcellus holdings “couldn’t compete” with the assets to the west.

WPX Energy Purchases |

|||||

|

Date |

Region | Seller | Acreage | Production |

Price (MM) |

| 6/23/15 |

San Juan |

Undisclosed | 14,300 | N/A |

$26 |

| 8/18/14 | San Juan | Undisclosed | 26,000 | 800 BOEPD |

Undisclosed |

As indicated by the table below, WPX has sold more than $1.8 billion in interests and assets since its initial public offering.

WPX Energy Sales |

|||||

|

Date |

Region | Buyer | Acreage | Production |

Price (MM) |

|

5/4/15 |

Marcellus | Undisclosed | Midstream/Marketing Assets | $200 | |

|

12/2/14 |

Marcellus | Southwestern | 46,700 | 50 MMcf/d | $300 |

|

10/3/14 |

Argentina | PlusPetrol | 69% non-op interest | $294 | |

|

8/26/14 |

Piceance | TRDC | 49% interest in portion of assets |

$200* |

|

| 8/18/14 | Powder River | Undisclosed | N/A | 154 MMcf/d |

$155^ |

| 5/6/14 | Piceance | Legacy Reserves | 30% working interest |

$355^^ |

|

| 4/2/12 | Arkoma/Barnett | Private | 93,000 | 67 MMcf/d |

$306 |

*overall agreement value

^no activity in the Powder River since 2011

^^ working interest increases to 37.5% in 2015 and to 42% in 2016 on all WPX wells drilled prior to 2009

Confidence in the Gallup

WPX has nearly doubled its position in the Gallup in the last 12 months, and its operational team is developing a greater knowledge of the company’s core asset.

More than 100 wells have been spud since an initial discovery in 2013, and drilling times have declined by 75%. Wells were being drilled and completed in less than 10 days in Q2’15, and overall costs were down 24% on a year-over-year comparison.

Rick Muncrief, Chief Executive Officer of WPX, said, “This acquisition reflects our confidence in our ability to achieve $4 million well costs and estimated ultimate recoveries of 450,000 barrels of oil equivalent per well.”

Additional cost-saving measures are being developed through infrastructure buildout. WPX hopes to lower basis differentials to less than $10 per barrel compared to its current spread of $13. The company believes it can achieve the improvements in the second half of 2015.

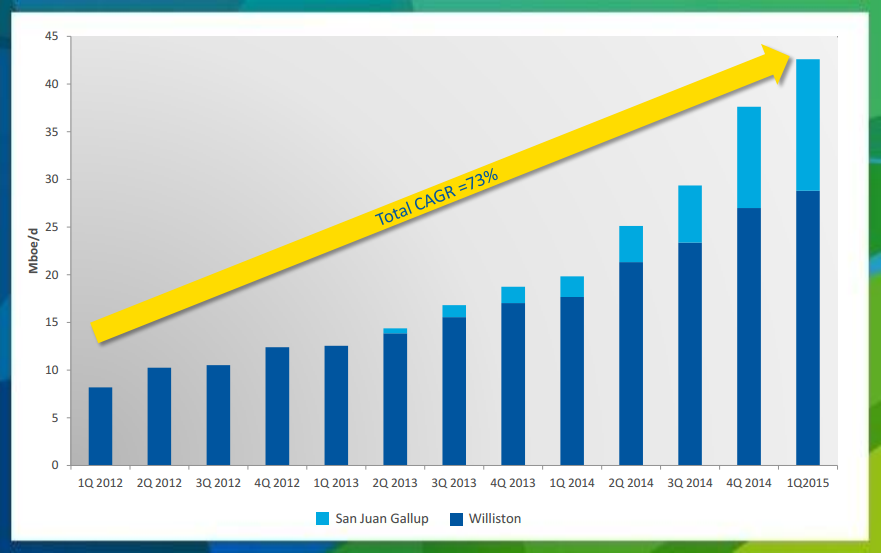

Although the majority of activity is still focused on the Piceance (20 wells were drilled in Q1’15, compared to 15 and 9 in the Gallup and Williston, respectively), WPX management believes its other two core properties are the drivers moving forward. “These two represent our growth story,” said Muncrief in the company’s Q1’15 conference call. “Our Williston and San Juan Gallup oil volumes jumped an impressive 60% and 376% respectively versus a year ago.”

The drilling programs of its emerging core areas are expected to receive about 80% of budgeted capital expenditures moving forward. Management said acquisitions will be made pragmatically, but Clay Gaspar, Senior Vice President of Operations, spoke very highly of WPX’s Gallup assets in the call. “We’re really proud of our acreage position,” he said. “I wish we had more of it.”