40% oil production growth in 2017

WPX Energy (ticker: WPX) released second quarter results today, showing net income of $72 million, or $0.18 per share.

WPX set a new record for total liquids production this quarter, producing 72,400 BPD. This is 17% higher than the company’s previous best, 62,000 BPD in Q4 2015. This quarter was WPX’s third consecutive record for oil production, with 58,600 BOPD, 27% higher than Q1 oil production. These strong results have led WPX to increase its 2017 oil production growth guidance to 40% from 30%.

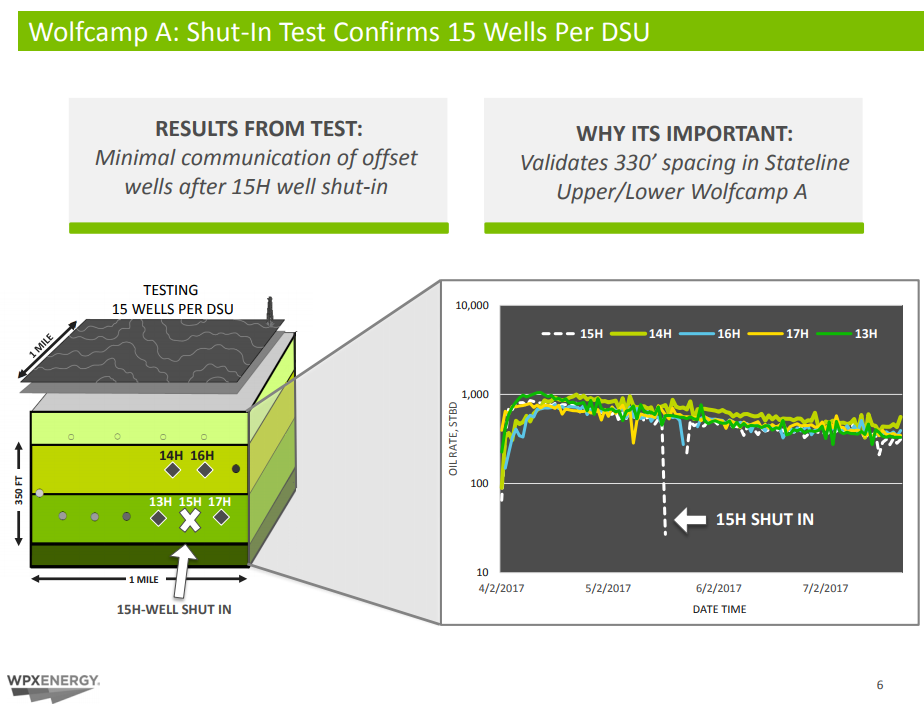

Successful results from spacing test

WPX believes its recent spacing test in the Delaware basin has been highly successful, showing minimal downhole pressure communication between wells. This validates 330-foot winerack spacing in the Wolfcamp A in the company’s Stateline properties, meaning the company can use 15 wells per square mile in the Wolfcamp A.

WPX formed a joint venture for developing midstream capacity in the Delaware basin with Howard Energy Partners this quarter, which will support the company’s development activities. In total, the agreement will cover about 50,000 acres, or 37% of WPX’s total Delaware acreage. The JV will build a crude gathering system supporting WPX’s development in the area, with an estimated capacity of 125 MBOPD. Additionally, the JV will construct a cryogenic natural gas processing complex with a planned initial capacity of 400 MMcf/d. The transaction is expected to close in Q3 2017.

WPX reports that the company has begun the process to market its legacy natural gas properties in the San Juan basin. The company’s oil operations in the area would not be included in a sale, allowing WPX to continue to focus on oil production. If this marketing effort is successful, a transaction would ideally close by year-end.

Rick Muncrief, WPX chairman, president and CEO, commented on the company’s overall transformation and current goals in the release, saying “Since my first quarterly webcast at WPX three years ago, we’ve undertaken more than $7 billion of transactions, transformed the company’s portfolio and doubled our oil production. Without question, we’re reaping attractive results from our long-term strategy. Most importantly, we remain intensely focused on reaching our deleveraging goals by year-end 2018.”

Q&A from WPX Q2 conference call

Q: You guys have had a lot of success on this down space in the Wolfcamp A. Is there further room for improvement there or are you there now, where do you think you’ll be in the next few quarters?

Clay M. Gaspar: Our entry assumptions for the RKI acquisition was eight wells per section. That was one landing zone, eight wells per section. When we really start diving into it, we found that there was really two sweet spot landing zones, once we’re going to communicate, and we had hoped that, hey, this potentially doubling up of that inventory was possible. So, this basin test confirms that it is very possible.

Now, is it ideal? You never really know. So, we are going to test some tighter spacing. We’re going to test some wider spacing, and continue to home into that, but the earlier results from this 15-well pilot is very, very exciting for us, and it’s very encouraging about we have a very good solution to move forward.

Q: You’ve highlighted a lot of productive zones across your acreage position. In the Stateline, I was just wondering if you could just give us a sense of how each of the zones right now are stacking relative to each other in terms of rates of returns and how that may impact your development of the asset moving forward?

Clay M. Gaspar: So, our gold standard today is the Wolfcamp A and that’s a blended upper and lower interval and that’s what everyone else gets measured by the internal competition we have for capital be it a Second Bone, Third Bone, or something deeper in the Wolfcamp, I can tell you, right now, that the risk – on a risk basis because we have so many swings of the bat on the Wolfcamp A, that’s still in the poll position.

The zones that are really showing some interest especially the Second and Third Bone Spring, they’re all cheaper to drill. They come in some really phenomenal rates. The oil cuts holding in really nicely but we need some more iterations to really move those forward. They’re set up nicely for long laterals, so we’ll move quickly to testing 2-mile laterals for those. It will be a very fluid transition to that.

As you move deeper in the horizon, B, C and D, the B is, in some areas, very similar to the A, especially some of the Panther acreage that we picked up. They’re performing really, really well. As you move into the C and D, you get a little bit higher gas cut, and so you’re also getting much higher EURs, and they’re a little bit more expensive to drill, a little bit more expensive to complete.

So, you weigh all that in. They probably fall in a little bit further down the line for development, but we’ll have to watch. I’m really thrilled that we have the C and – well, we have one C well that’s coming on line probably in the next three months.

The D wells that we have on line, we continue to watch, and we’ll weigh in, and see where they fit in the portfolio. My guess today is that as you move deeper into the section, those get pushed off until a brighter day where gas relative to oils is a little bit more in line.

WPX is a presenting company at EnerCom’s The Oil & Gas Conference® which runs Aug. 13-17, 2017, at the Denver Downtown Westin Hotel. To register for the EnerCom conference, please visit the conference website.