WPX Energy acquires 6.5 MBOEPD of production and 120,000 net acres in the Delaware Basin

WPX Energy (ticker: WPX) announced today that the company has acquired Panther Energy Company II, LLC and Carrier Energy Partners, LLC, expanding its footprint in the Delaware Basin. The acquisitions includes approximately 6.5 MBOEPD (55% oil) of existing production from 23 producing wells (17 horizontals), two drilled but uncompleted horizontal laterals, 18,100 net acres in Reeves, Loving, Ward and Winkler counties in Texas and 920 gross undeveloped locations in the Delaware, WPX said in a press release Thursday.

Acquisition highlights

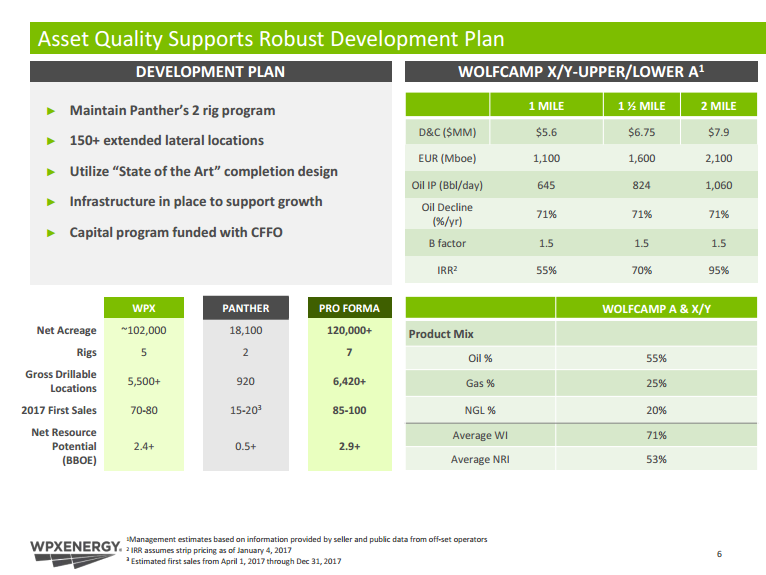

- Expected to be immediately accretive to WPX shareholders on a cash flow and NAV basis

- Projected IRR on wells ranging from 55%-95% at current strip pricing

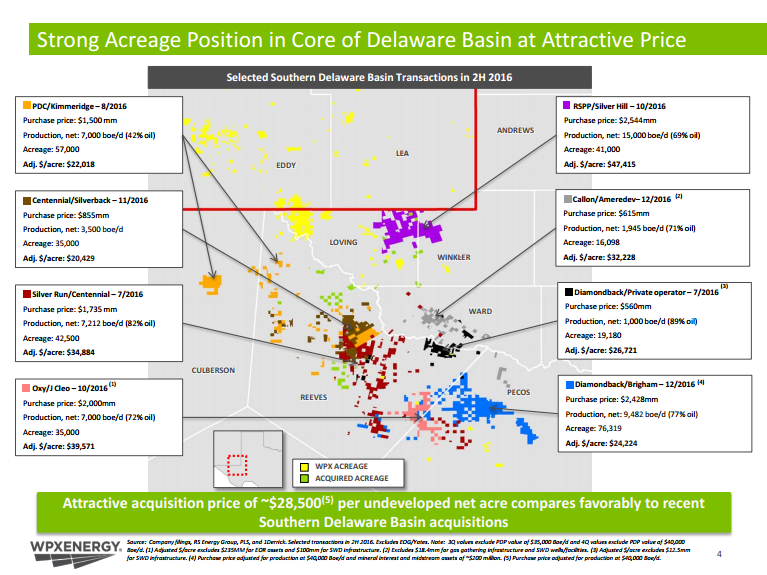

- Estimated acreage cost excluding flowing production is ~ $28,500 per acre

- Transaction valued primarily on three zones with upside in five additional zones

- EUR’s of ~ 1.0 MMBOE for Wolfcamp A and X/Y 1-mile laterals (55% oil)

- Increases WPX’s total gross drillable Delaware locations from ~5,500 to ~6,400

- New drillable locations include more than 150 long laterals (1.5-2 miles)

- Increases WPX’s growth trajectory for 2017-2020

- Offset operators: RSP Permian, Anadarko, Shell, Matador, Cimarex, Concho and Centennial.

Including the Panther transaction, WPX has added approximately 32,000 net acres in the core of the Delaware Basin at an average cost of $18,600 per acre since its transformative purchase of RKI Exploration and Production in August 2015. The average cost excludes flowing production.

A note from BMO Capital Markets following the deal estimates the transaction at $29,000 per acre, and notes that, at that price, the deal is accretive to where WPX trades ($42,000), while 2018EV/EBITDAX is reduced by 0.6x, and 2018 Debt/EBITDAX is lowered by 0.1x.

WPX expects the incremental cash flow from the purchase to fund the existing two-rig program on the acquired acreage, bringing WPX’s total rig program to seven rigs.

WPX also reaffirmed its full-year 2016 production guidance and announced that its fourth-quarter 2016 oil production is expected to exceed the company’s 42-44 MBOPD range, despite recent weather conditions in North Dakota’s Williston Basin. Additionally, WPX’s 2017 guidance remains unchanged prior to the pro forma impact of the bolt-on acquisition.

On a pro forma basis, WPX is now targeting 30 percent oil growth and 25 percent overall production growth in 2017, along with a targeted net debt/EBITDAX ratio at the lower end of the company’s previously announced range of 2.0x to 2.5x by year-end 2018.

WPX finances the deal with $600 million public offering

WPX plans to use cash on hand and the proceeds from an equity offering the company announced following the acquisition to finance its most recent Delaware expansion. The company announced Thursday that it has priced 45 million shares of its common stock at a price of approximately $13.35 per share for gross proceeds of approximately $600.8 million, according to a press release from WPX. The company is also granting underwriters a 30-day option to purchase up to an additional 6,675,000 shares of WPX stock.

The offering was upsized from the previously announced offering of 42,000,000 shares of common stock with an option to purchase up to an additional 6,300,000 shares.

The completion of the offering is not conditioned upon the acquisition, and if the acquisition is not consummated, WPX would use the net proceeds from the offering for working capital needs or general corporate purposes (which may include the repayment of indebtedness and other acquisitions), WPX said in the release.

The public offering will dilute WPX’s share by approximately 15%, according to a note from SunTrust Robinson Humphrey following the deal.

Analyst Commentary

KLR Group

This announcement should have a negligible value impact as the acceleration of our forecasted drilling activity (incremental two Permian rigs in ’17 forward) is offset by the equity issuance, although the improvement in net-debt-to-EBITDA metric and 40%+ increase in the company’s Wolfcamp X/Y and Wolfcamp A inventory (we believe this is WPX’s most economic inventory in the Permian) could be viewed as a positive optic by the market.

BMO Capital Markets

WPX announced the acquisition of 18,100 net acres in the Delaware Basin for $775mm. While equity financing results in a 12-14% increase to share count, we estimate the transaction at $29,000 per acre is accretive to where WPX trades ($42,000), while 2018EV/EBITDAX is reduced by 0.6x, and 2018 Debt/EBITDAX is lowered by 0.1x. We view acreage quality to be in line with the Delaware average and WPX’s existing State Line position.

SunTrust Robinson Humphrey

The new deal adds core Delaware Basin acreage (contiguous to existing company position) that should help de-lever the company given the incremental current/upcoming cash flow. ~85% of the deal was financed with an equity offering (~15% dilution) with the remainder of the $775mm paid with cash on hand. The $28,500/acre (after backing out production) is at the low end versus recent Permian transactions. WPX is now targeting higher 2017 production growth that should lead to lower than previous estimated year-end 2018 leverage. The company also suggested 4Q16 production should top prior guidance.

Wunderlich WPX Energy (WPX) started the year with a sizable land grab. After the close last night, WPX announced that it has agreed to acquire 18,100 net acres for $775 million. The acreage is located in Reeves, Loving, Ward, and Winkler counties in Texas, expanding the company’s footprint and inventory count. The company provided detailed guidance for 2017 to reflect nine months of incremental activities reflecting the acquisitions. WPX issued 45 million shares concurrently and raised $600.8 million. The company has cash on hand to finance the remainder. We revised our estimates and NAV and the impact is neutral. We reiterate our Buy rating on WPX Energy.