This time Iran indicates that it would be willing to cooperate with a new production freeze

Oil prices rose today as news that Iran may be ready to join a wider production freeze surfaced.

Both OPEC and non-OPEC producers such as Russia previously tried to implement a production freeze, but were unsuccessful when Saudi Arabia insisted that Iran take part in the deal, and the Islamic Republic refused to slow production growth before reaching pre-sanction levels.

OPEC’s third-largest producer has not yet reached the 4 MMBOPD mark it set prior to the implementation of international sanctions, but it does appear to be softening its stance as it approaches that watermark.

“Iran is reaching its pre-sanctions production level soon and after that it can cooperate with the others,” a source familiar with Iranian thinking told Reuters. “In general, Iran prefers more actions from the OPEC side rather than just freezing at the maximum production level of all members. If this freezing issue helps prices to improve, Iran by positive words of support, will help.”

The idea that Iran might cooperate this time around has helped to inject some bullish sentiment back into markets. Hedge funds trimmed their short position in WTI by 56,907 futures and options during the week ended August, 16, the most in data going back to 2006, reports Bloomberg. WTI is up 20% from its August 2 low, meeting the common definition of a bull market.

Headlines driving prices

While the increased oil price is certainly good news, it is largely being driven by headlines, much in the same way it was the last time OPEC discussed a production freeze.

“You can’t put any credence into any of these things,” Ric Navy, a senior vice president for energy futures at brokerage R.J. O’Brien & Associates LLC, said to The Wall Street Journal.

Besides Iran, output levels in Nigeria and Libya could also complicate reaching a deal. While Saudi Arabia, Iran and Russia have reached record production since April, Nigeria saw the lowest levels of production in more than two decades as rebel attacks on the oil and gas infrastructure continue. Libya also continues to produce just a fraction of its total capacity amid a protracted civil war.

“The difficult question for all will be defining the freeze – at what level of production. Agreeing a number may be a challenge – unless they all agree to allow some form of flexibility?” the senior industry source said to Reuters.

An OPEC source from a main Middle East oil producer agreed.

“Freezing output now is difficult, everyone is raising production. And even if, and I am saying ‘if’ … we agreed to a freeze, no one will commit to stick to it,” the source said.

Adding to concerns, increases to oil prices could prompt producers, especially those in the U.S., to ramp up drilling and completions. Most analysts see supply and demand evening out by the end of 2017, but any drastic changes on the supply side could alter those expectations.

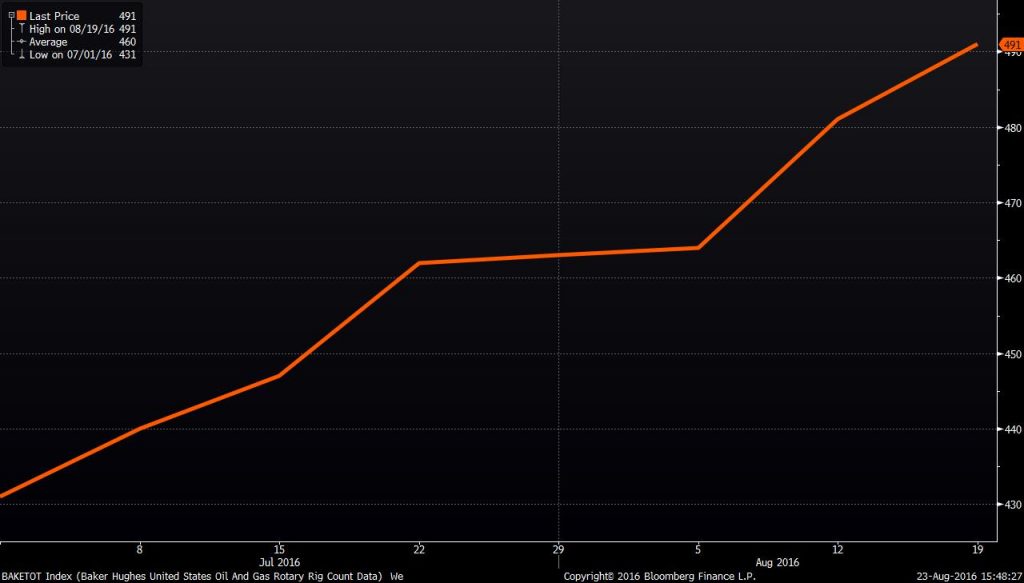

The U.S. rig count increased by 10 last week, according to Baker Hughes industries. As prices begin to recover, companies have been adding more rigs to their programs. The rig count is still 394 below this time last year, but the slow increase has some worried that U.S. producers might cap gains in oil prices.