OPEC appears to be struggling to close on a production agreement

Oil prices dropped Monday as markets continue to lose faith that OPEC will be able to reach a production agreement by the end of November.

A meeting this weekend among the group’s members ended without any definitive progress, and non-OPEC members like Azerbaijan, Brazil, Kazakhstan, Mexico, Oman and Russia all refused to commit to cut, or even freeze, production until OPEC is able to come to an agreement.

“After meeting in Vienna, OPEC remains at an impasse. Non-OPEC members are also refusing to join until OPEC formalizes an agreement, with several refusing to cut at all,” a note from Morgan Stanley said.

U.S. crude oil benchmark WTI was down to $46.63 in trading today, while international benchmark Brent was down at one point to $47.99. Both were above $50 per barrel last week.

OPEC is expected to offer exemptions to Iran, Libya and Nigeria as each looks for ways to increase production following various disruptions. Last week, Iraq said that it will also seek an exemption as OPEC’s second-largest producer disputes the data being used to report its total production, and looks for increased revenue amid its fight with ISIS.

“There’s plenty of time for the market to shift, and perhaps shift again before the meeting on Nov. 30,” Tim Evans, an energy analyst at Citi Futures Perspective told Bloomberg. “Even the official OPEC meeting might not answer all the questions we have. We’ll need additional time to evaluate compliance with the agreement and see if it has any actual impact on the market.”

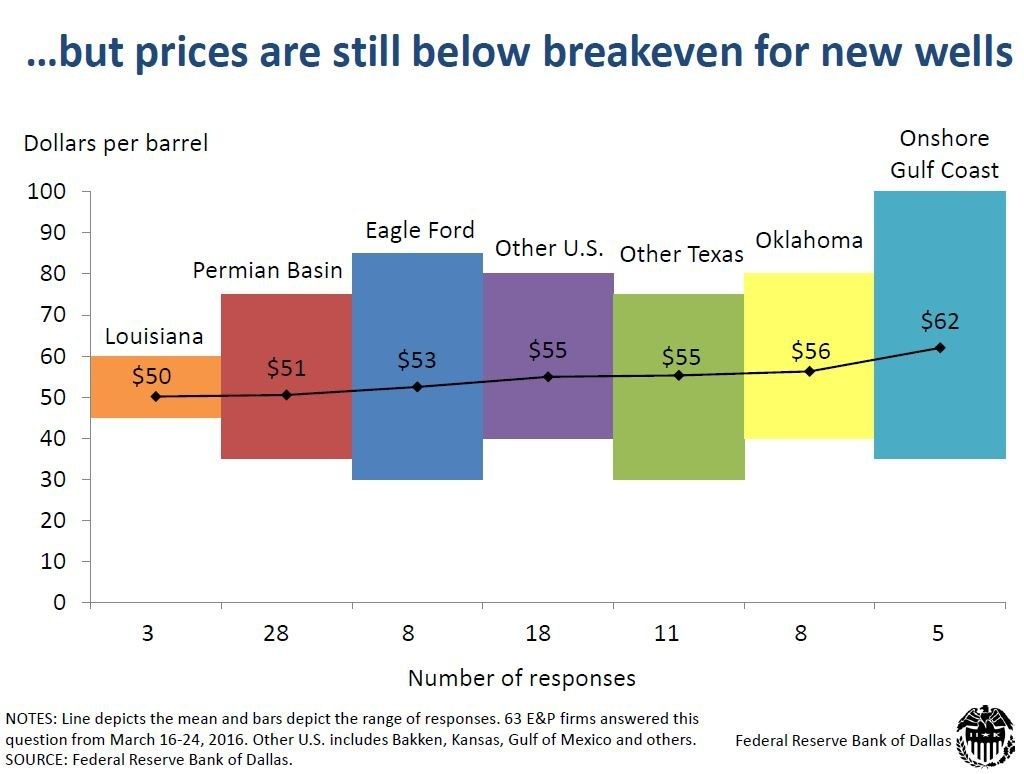

At an energy finance meeting in Denver last week, Dallas Fed SVP and Director of Research Mine Yucel told her audience that the Saudis drive the decisions. “You know we said with the shale boom it was the end of OPEC. And here they are. They have a lot of cheap oil still. When you say OPEC, it’s really Saudi Arabia. The other OPEC members are actually producing at capacity. They need the money and they are producing at capacity. They don’t have any excess capacity at all. So it’s really the Saudis that have the 12 or 12.5 [MMBOPD]. They still have a lot of cheap oil.

“What’s going to happen if OPEC does cut output and prices go up a little bit—you saw those breakevens—it may mean more oil coming out of the U.S. It’s going to be uncertain, let’s put it that way. The U.S. has now shown that we’re not declining, we’re going to come back when the prices go up, so it’s a different ballgame right now. But I don’t think we’ve seen the end of OPEC, as long as Saudi Arabia has all that cheap oil.

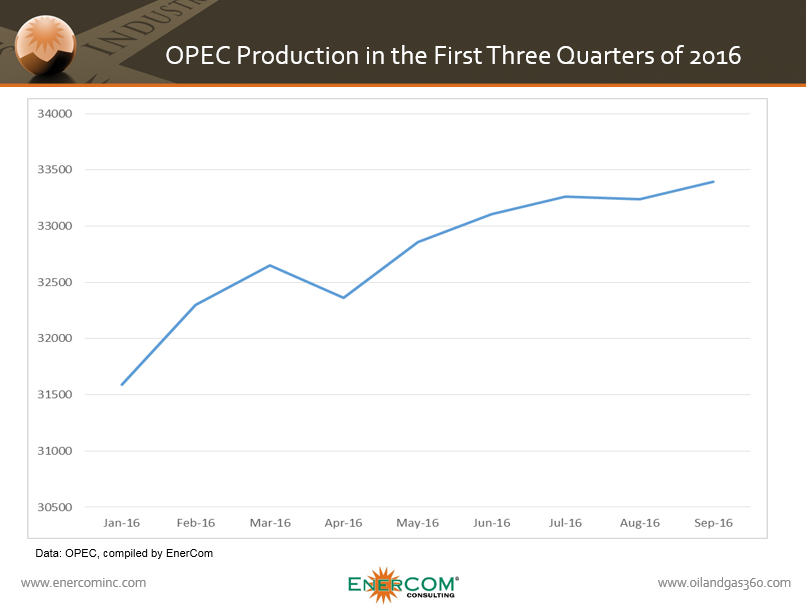

OPEC production may still be rising

Production from the group of oil exporting countries continued to rise in recent months even as OPEC began to discuss looking for ways to support oil prices. In September, the group pumped 33.4 MMBOPD according to secondary sources cited in its report.

“OPEC total production might still be rising,” Evans said. “It looks like there’s some added output in both Nigeria and Libya, so we might find out that OPEC production reached another record high in October. That would underscore the challenge OPEC faces and ratchet up the pressure.”

OPEC’s next official meeting will take place in Vienna November 30. The group hopes to come out of the meeting with a definitive production agreement.