Gulf coast plant expansion set to make new jobs at world’s largest alpha olefins plant

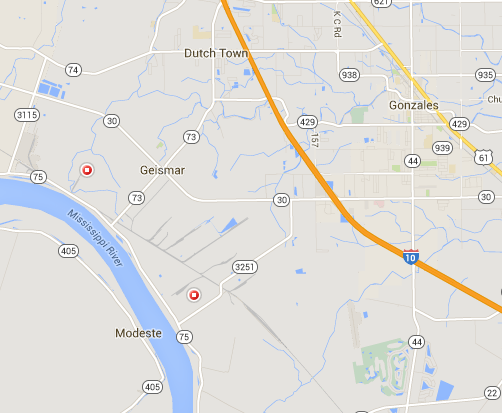

Royal Dutch Shell’s (ticker: RDS.B) Shell Chemical LP announced today that it received a final investment decision to increase alpha olefin (AO) production at its chemical manufacturing site in Geismar, Louisiana. The expansion consists of a fourth AO unit, which will add 425,000 tons of capacity, making the plant the largest in the world, according to the Shell press release.

The new project will require a $717 million capital investment and create 20 direct jobs, with an average annual salary of $104,000, while retaining the 650 existing jobs at the plant, according to a joint release from Governor Bobby Jindal and Shell Geismar General Manager Rhoman Hardy.

Construction of the new unit will begin in the first quarter of 2016. The new capacity brings the total AO production at Shell’s Geismar site to more than 1.3 million tons per annum. The AOs produced from the site will be used to produce a variety of consumer and industrial products including plastics, synthetic lubricants, drilling fluids and household detergents.