Block Island wind project is expected to generate 30 MW of electricity

Deepwater Wind’s Block Island project is beginning construction three miles off the coast of Rhode Island, making it the first offshore wind energy project to reach the construction phase in the United States.

With the full $360 million in project financing in its coffers, the Block Island Wind Farm, when completed, will consist of five offshore turbines totaling 30 megawatts (MW) of generation capacity, and is expected to come online sometime in 2016, according to Deepwater Wind. The project is expected to generate enough power to meet the annual energy demands of more than 17,000 households, according to a UPI story.

The company said Societe Generale of Paris, France, and KeyBank National Association of Cleveland, Ohio, are providing $290 in project financing in addition to the $70 million in equity funding already provided by the company’s existing owners.

According to the company, the project will create 300 jobs in Rhode Island, and reduce energy bills for residents of Block Island by as much as 40%. Block Island is the first, and smallest, of three offshore projects that Deepwater Wind is planning along the Atlantic Coast.

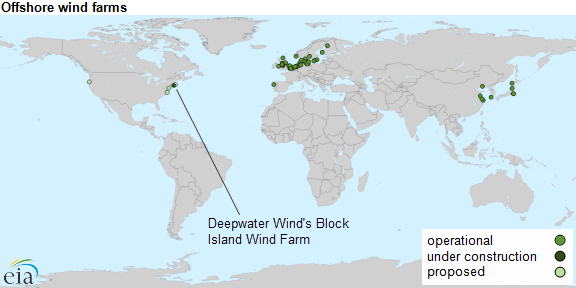

Offshore Wind Energy Potential

The National Renewable Energy Laboratory (NREL) estimates that the United States has 4,200 gigawatts (GW) of developable offshore wind potential, compared to its estimate of 11,000 GW of onshore wind potential, according to the Energy Information Administration (EIA). Developers in the U.S. have proposed building nearly 4.9 GW of offshore wind capacity of the coasts of nine different states, but most projects have run into major litigation and development problems.

Europe has seen much greater expansion of its offshore wind capacity, which currently accounts for 90% of the estimated 8.8 GW of installed global offshore wind turbine capacity.

The United States is estimated to have more abundant and favorable onshore wind resources, which are largely located in areas with low population density. So far, economic and policy pressures have generally made domestic offshore wind projects unattractive, while onshore installations have grown by more than a factor of 25 since 2000, according to the EIA.

Building and maintaining offshore wind technology is expensive compared with onshore wind projects because of challenges such as transporting equipment and workers to the sites, securing turbines to the seafloor, and operating in fewer periods of fair weather. The harsher offshore environment not only makes it difficult and more costly to perform maintenance, but it also increases the frequency that these activities have to take place.

Comparing Costs of Wind Plant v. Gas Plant

By way of comparison, the Panda Patriot Power Project under construction near Williamsport, Penn., is a natural gas-fueled, 829-megawatt combined-cycle generating station. Once built, the plant is expected to supply the power needs of up to 1 million homes. Estimated construction costs are $800 million.

Construction costs for the two plants, when divided by the number of households they will serve, calculates as follows:

- Block Island Wind Project = $21,176 per household

- Panda Patriot NatGas Project = $800 per household