Latest action from energy M&A front line

Apache Corporation (ticker: APA) rejected an unsolicited bid of $18 billion over the weekend, according to a report from Bloomberg. Apache has not commented on the report, but the company is said to be working with Goldman Sachs Group Inc. on a defense strategy.

The development is the latest chapter in an energy market that is arguably becoming more cutthroat by the day as companies adjust to a commodity slump that has persisted for nearly 12 months. Suncor (ticker: SU) is currently trying to acquire Canadian Oil Sands (ticker: COS), but the board of COS shot down SU’s $5 billion proposal and has adopted a “poison pill” to entice its shareholders.

Many speculated that Energy Transfer Equity (ticker: ETE) would launch a hostile takeover attempt for Williams Companies (ticker: WMB) after the latter rejected ETE’s initial offer of $53 billion and opened up a bidding war among the energy community. Energy Transfer ultimately acquired Williams for $37.7 billion in September, about three months after the process began.

Apache Corp. Primer

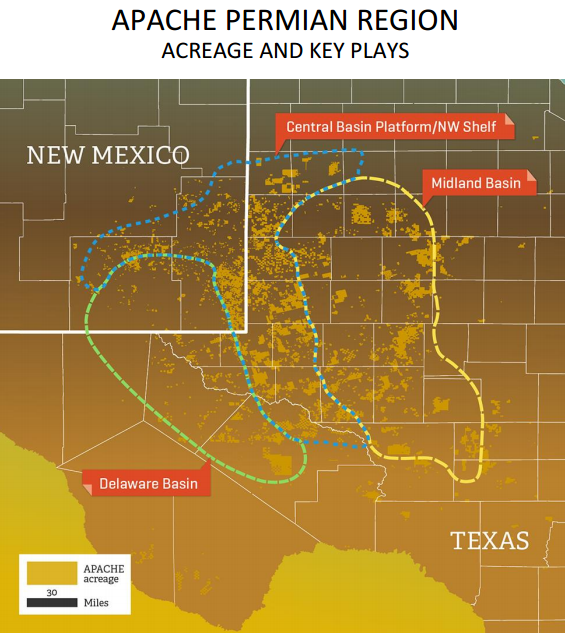

Apache Corporation, based in Houston, is one of the largest exploration and production companies in the United States and holds assets in North America, Egypt and the North Sea. Its footprint has shrunk in recent years when the E&P downsized by selling off its position in Argentina and Australia for a total of $2.9 billion.

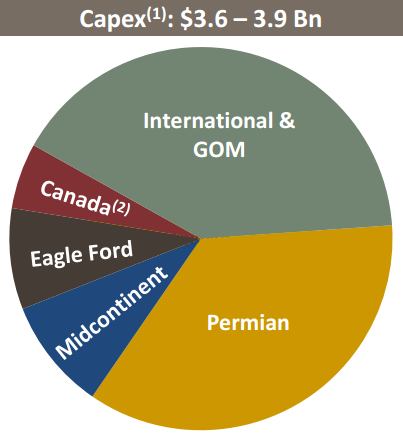

Approximately $5 billion in divestures have been executed since December 2015, strengthening its balance sheet. Its volumes for Q3’15 averaged 542 MBOEPD, with onshore United States operations (in the Eagle Ford, Midcontinent and Permian) accounting for about 56% of the flows.

The company has about $8.8 billion in debt with no maturities until 2018. About $2.5 billion in debt has been paid down in the first nine months of 2015. Its debt to market capitalization, according to EnerCom’s E&P Weekly Benchmarking Report, is 54% – coming in above the 44% median of its 19 large-cap peers. The company entered into a $3.5 billion credit facility in June and exited the quarter with $1.7 billion of cash on hand.

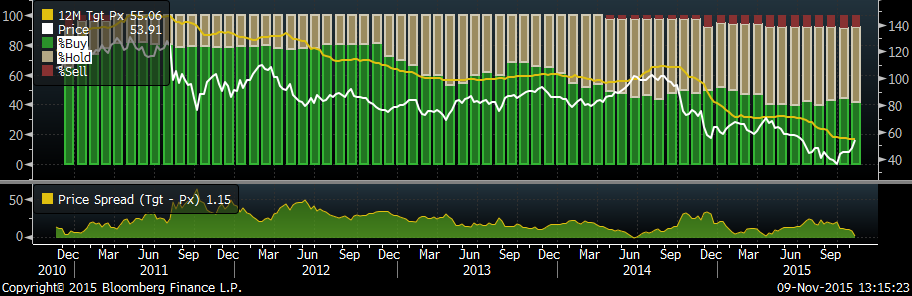

Its shares rose more than 10% in trading on November 9, increasing its market capitalization to roughly $20 billion. Its capitalization as of market close on Friday, November 6, was about $18 billion, meaning the unsolicited offer represented a premium of approximately 17%. For reference, Apache’s market capitalization one year ago in Q3’14 was approximately $28 billion. A year ago, Nov. 9, 2014, WTI crude was trading at $80.33.

The company’s next publicly scheduled appearance is a conference call on November 17 regarding its North Sea operations. Multiple discoveries were announced in October and will add to its 140 MMBOE of proved reserves as of year-end 2014.

The company’s next publicly scheduled appearance is a conference call on November 17 regarding its North Sea operations. Multiple discoveries were announced in October and will add to its 140 MMBOE of proved reserves as of year-end 2014.

APA Stock Performance

Although they have now been divested, Apache’s Argentina and Australia assets were cost-intensive ventures and the results weighed on its stock price even when energy stock prices seemed to have no ceiling. Analysis from Bloomberg says APA shares climbed about 34% in the five years leading up to June 2014, while the Standard & Poor’s 500 energy index jumped more than 100% in the same time frame. In June 2015, analysts were projecting that Apache could generate up to $1 billion of free cash flow in the current fiscal year. That estimate has been revised downward by about 75%. Its stock, year-to-date, has generally performed in line with its peers, with its share value falling by 24% compared to a median drop of 21% among its large-cap peers.

Analysts have also cooled on APA in recent years: in 2011 and 2012, an average of 80% of firms awarded Apache with a “Buy” rating. That number dipped to 65% in the third quarter of 2013 and has fallen even further south since the commodity crash. In Q3’14, the Buy-Hold-Sell breakup, percentage-wise, was 47-50-3, respectively. Today, more have shifted to the “Sell” side, as the current breakup is 42-50-8, while many have not reevaluated APA following the price rise associated with the rumored takeover.

Who’s Making the Offer?

The size of Apache Corp. restricts its buyout candidates, essentially limiting its potential suitors to those classified as supermajors. Simmons & Co. believes BP plc (ticker: BP) could be in the mix, citing the pair’s previous asset sale relationships and BP’s sizeable position in Egypt. ExxonMobil (ticker: XOM), the world’s largest oil and gas company, is an obvious addition to the list. Regardless of the buyer, Simmons calls APA’s Permian position of 3.2 million gross acres the “object of affection for any acquirer.” APA believes more than 10,000 drilling locations remain in its elite acreage and reported Q3’15 averages of about 170 MBOEPD.

XOM holds about 135,000 acres in the region, and added 48,000 acres for an undisclosed amount in August 2015. WPX Energy made a splash in July by acquiring a private Permian pure-play for $2.75 billion. The valuation of the deal placed existing production costs at $125,000/ flowing BOE, not accounting for existing infrastructure in the area.