The Australian government will no longer allow the Clean Energy Finance Corporation to invest in wind

Australia’s Clean Energy Finance Corporation (CEFC) received a directive from the Australian government to stop investing in future wind power projects. Australian Prime Minister Tony Abbott said the decision was made in hopes of refocusing the CEFC on developing new technologies, rather than supporting well established ones.

The CEFC was created in 2012 to increase funding for Australia-based renewable energy and energy efficiency technologies, with a focus on innovations instead of mature technologies. Funding for CEFC comes from the Clean Energy Finance Corporation Act, which provides AUD $2 billion per year from 2013 to 2017 to be invested in renewable technologies. As of July, 33% of the funding has gone to solar power, 30% to energy efficiency projects, 21% to wind power, and 16% to other projects, according to the United States Energy Information Administration (EIA).

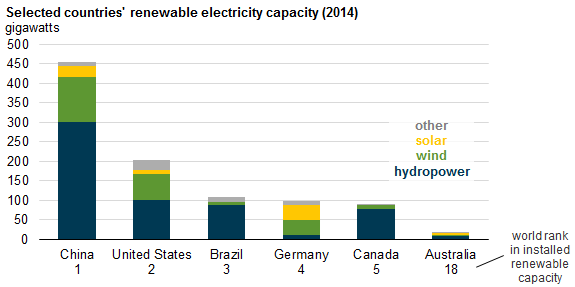

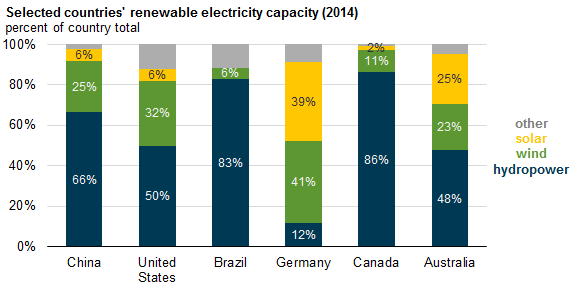

In 2014, Australia had a total renewable energy capacity of 16.8 gigawatts (GW), giving it the 18th-largest renewable electricity generating capacity in the world. The top five renewable electricity producing countries, with the exception of Germany, generate most of their renewable electricity from hydropower, followed by wind and solar sources, respectively.

According to EIA data, renewable generation sources in Australia provided more than 24 terawatt hours (TWh) of electricity in 2012, 11% of Australia’s total generation in that year. Australia currently has a target to produce 33 TWh from large-scale renewable energy sources by 2020. The previous target of 41 TWh by 2020 was reduced this year.

With less funding for wind power, electricity generation from other sources of renewable power will need to be developed to attain even the reduced goal. In addition, the instruction to no longer invest in new wind projects could potentially affect financing and construction of the proposed 1.2 GW Bulgana wind farm in northern Australia, although the 63-turbine wind power facility received a construction permit in March 2015.

Australia has high potential for energy production from wind power, particularly in the southern parts of the country where wind resources are the highest. As of 2014, there were 61 operational wind farms in the country, with a total capacity of 3.8 GW. In addition, there were 86 other projects in permitting, financing, or construction stages with an estimated combined capacity of more than 12 GW.

Decision ignites tempers

The decision from the Abbott government to remove wind energy projects from the CEFC’s programs initiated a storm of complaints, reports The Guardian. “How a prime minister … can so blatantly undermine thousands of Australian jobs and billions of dollars in investment is beyond comprehension,” said the opposition’s environment spokesman, Mark Butler. “An overt directive preventing CEFC from investing in wind reinforces a growing perception that renewable energy investors are not welcome in Australia,” added Clean Energy Council CEO Kane Thornton.

Others took a more measured response to the news. “Wind power is something that has been well established,” said independent senator Nick Xenophon. “So long as we see a shift from wind to large-scale solar and other forms of renewables, that is a good thing.”

“There will be some negotiation, but the essence of it is that the money is to be spent on emerging technology, not mature technology,” said Australian Trade Minister Andrew Robb.