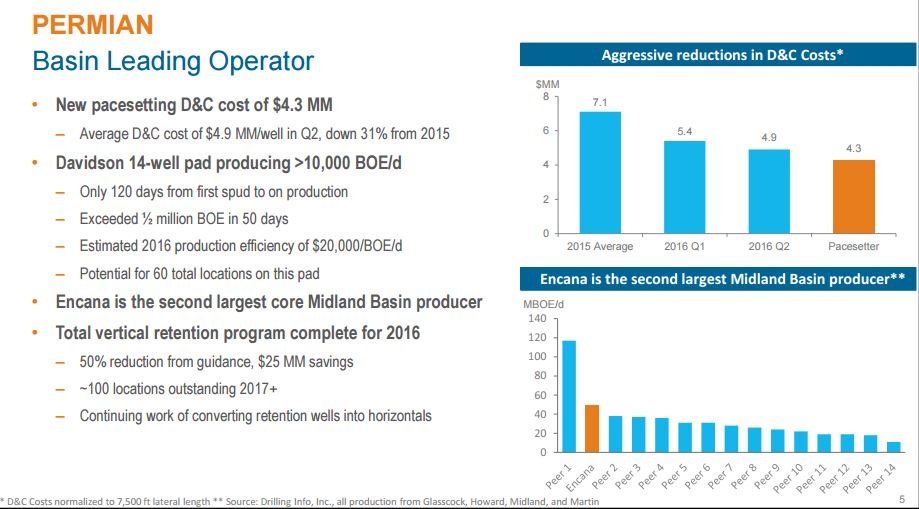

Encana Increases 2016 Capital Spending by US$200 Million, 80% Earmarked for the Permian

The positive news coming out of Calgary this morning that Encana (ticker: ECA) delivered to energy investors with its 2Q results was a refreshing kick off to earnings season for the E&P sector, which has been battered by losses and bankruptcies for the past 18 months.

Encana reported an operating profit of US$89 million for the quarter, reversing a first quarter 2016 loss of US$130 million. The return to profitability along with cash on the way from asset sales and the desire to continue a profitable drilling efficiency model prompted the company to boost its 2016 capital spending plans by $200 million to between US$1.1 billion and US$1.2 billion. Regarding the asset sales, Encana said its Gordondale and DJ Basin divestitures are expected to close by the end of July. The company said cash flow for the second quarter was up over 75% from the previous quarter to $182 million, or $0.21 per share.

Encana reiterated its total focus has been on its “core four assets” – the Eagle Ford, Permian, Duvernay and Montney, with 95% of its capital invested in wells in those basins. It said 73% of its 368,300 BOE/d total production was from those basins.

Big Pad Kicks Off New Encana Permian Drilling Model

Encana reported that a new Permian 14-well pad peaked at 12,000 BOE/d and that pad is currently producing over 10,000 BOE/d gross.

Encana President & CEO Doug Suttles said the company was adding 50% more drilling and completions activity for 2016. “We anticipate this additional activity will deliver approximately 13,000 BOE/d of production from our core four assets in the fourth quarter of this year and between 30,000 to 35,000 BOE/d in 2017, of which approximately 75% will be liquids.”

Innovation Paying Off

“Our belief in innovation is paying off,” Suttles said in the Encana earnings call today. “The majority of our cost reductions are driven by structural changes to how we execute. … Our approach is more than a series of one-off improvements. We have put successful ideas to work across the entire portfolio.”

“We are immediately replacing the bulk of the Gordondale volumes with production from our core four. This is significant, because this additional production has a margin that is five times higher than the volumes we sold. The additional capital activity there is [going to have an] even larger impact in 2017,” Suttles said on the call.

A Story of Pad Drilling Efficiency Gone Bananas: “We don’t need better pricing” – Up to 64 Wells on a Single Pad

The Encana management team filled in details in the conference call Q&A.

Q: Doug, the $200 million number and then the 30,000 BOE a day to 35,000 BOE a day [going] into next year—[it’s] an impressive number. You touched on the reinvestment savings kind of attached to that number. Could you quantify that a little bit? And then just in terms of how you’re going to spend those dollars that is the game plan in the Permian just to continue on with very large pads that you’ve done?

ECA: The simplest headline … is that we’re actually going to increase the activity or scope of our program. In other words … we drilled and completed about 50% of our original plan that we guided to in February for only a 20% increase in capital. And of course these new wells are coming in at these very, very highly efficient costs.

About 80% of that capital is going into the Permian, but … we have capital going into all four. They’re all very, very competitive and they all generate quality returns at today’s price decks.

So, we don’t require better pricing to do that. So, that’s the broad scope. And it’s interesting, if we didn’t increase scope, we’ve gotten to the point that we drill these wells so fast now, we would have basically had to shut our activity down in the fourth quarter because we were fully consumed at our original scope, almost a full quarter early.

And what we’re effectively doing now is that, we’re going to add one rig is all, to the program, to get this additional scope. … It wasn’t very long ago we thought about a rig year in the Permian as delivering about 12 wells; now we think the rig year is 25 wells in a rig year. We look for big and small pads, it’s a mixture but, like our 14-well pad, we expect to reoccupy that pad next year. We think that that pad may ultimately have 64 wells on it.

Q: I was wondering if you can just kind of flesh out the Davidson [well] a little bit more? It sounds like a really big pad; how does the size of the pad compare over industry norms? Which zones are you producing at present? What’s the average lateral length of these wells? And more than anything, is this an evolving prototype for your near-term development in the Permian?

ECA: We actually believe strongly that these big pads are the most efficient way to do development. So on this pad, it is physically large, because we actually had four drilling rigs on it drilling simultaneously, and then, when we completed the 14 wells, we did it with four fracs per head operating simultaneously.

When we were out there, not only does it shorten cycle time, it drives additional efficiency, so we do think this is the model. As we go forward, we ultimately thinks this pad, I think is probably going have 64 wells on it, and Mike maybe you can talk about lateral length in the zones we are developing currently. … Lateral lengths average around 8,400 feet, and it was both Wolfcamp A and Wolfcamp B.

We did a lot of work last year with what we call the box well, or we drilled the vertical well and then drilled five horizontals by that well at different vertical and lateral spacing. So those were all development wells and the monitoring well was producing vertical at the same time. But what we’ve done now, is applied what we’ve learned doing that work to this Davidson and we think it’s the ultimate spacing.

We think we understand frac geometry on this. We haven’t disclosed all those details, because we’ve obviously spent a lot of money learning all this, and we are not going to give that away to our competitors, but we do trade some of that information when others had the information to trade.

We haven’t done the Lower Spraberry at all; there is Wolfcamp C, so there’s considerably more potential and that’s how we see that this pad could probably ultimately end up at 64 wells.