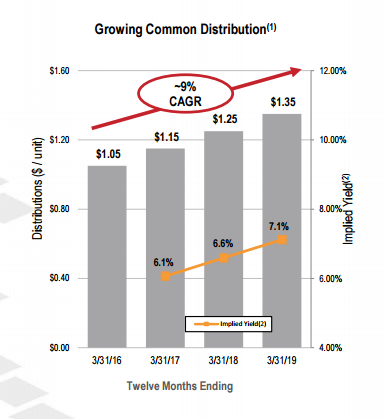

Black Stone Minerals is on track to maintain 9% CAGR for its common units

Increasing distribution to stockholders and unitholders has become difficult over the course of the downcycle. Low commodity prices stymied growth, reducing cash flow for companies and stressing company balance sheets. Despite that, some companies, like Black Stone Minerals (ticker: BSM) have been able to continue to grow the payout to their common shareholders thanks to their unique structure.

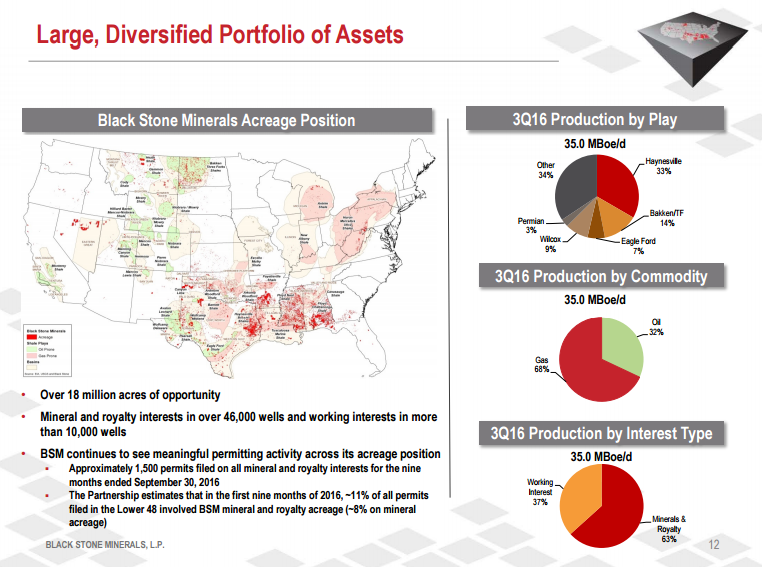

Black Stone holds the mineral and royalty interests on approximately 17 million gross acres. The company does not pay for drilling new wells, but it benefits from the production coming out of the ground throughout the U.S. through its mineral and royalty stakes.

“An important goal for us is to increase the distribution that we pay to our common unitholders,” Black Stone Minerals Vice President of Investor Relations Brent Collins told Oil & Gas 360®. “We are scheduled to increase our distribution to the common by 9% in the second quarter.”

Black Stone Minerals common units are scheduled to receive an increasing minimum quarterly distribution for four years from IPO, growing at an approximate 9% CAGR, according to the company’s investor presentation. The company priced its initial public offering in May of 2015.

Black Stone Minerals is able to offer this type of distribution growth thanks to its diverse asset base of mineral and royalty interests in the United States. The company holds over 18 million mineral and royalty acres with interests in over 40 states and 60 producing basins.

“Our main advantage as a mineral and royalty owner lies in the fact that we don’t expend capital to develop our properties – that is done by the E&P companies,” said Collins. “Since we don’t have to fund large capex budgets year after year, we are able to operate our business at a much lower leverage profile than most E&P companies.”

For the fourth quarter of 2016, the company reported a cash distribution of approximately $0.29 per common unit and approximately $0.18 per subordinated unit, according to a company press release.

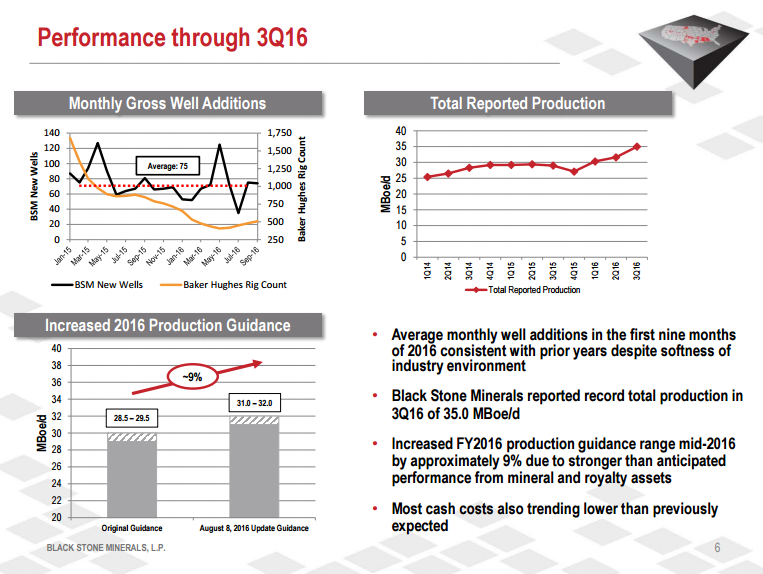

Over the course of the first nine months of 2016, the company reported average well additions of 75 wells per month despite market conditions. Production from the same quarter hit a record of 35.0 MBOEPD, prompting the company to increase its full-year production guidance, according to the most recent presentation available from the company.

“In February of 2016, we saw oil and gas prices bottom out and the industry was in a state of shock. The rig count plummeted,” said Collins. Despite this, Black Stone’s mineral and royalty volumes increased.

“Since that time, commodity prices have recovered off those lows, which has certainly helped the industry psychologically. E&P companies have also been able in large part to shore up their balance sheets through capital market activity or asset sales. There are lots of quantitative and qualitative things one could point to that would tell you we are much healthier today [than at this time last year].”

Black Stone Minerals presenting at EnerCom Dallas

Black Stone Minerals will be presenting its story at the Tower Club Downtown Dallas on Thursday, March 2, as part of EnerCom Dallas, an investor conference which is modeled after EnerCom’s The Oil & Gas Conference® in Denver.

The Dallas conference is designed to offer investment professionals a unique opportunity to listen to a wide variety of oil and gas company senior management teams update investors on their operational and financial strategies and learn how the leading independent energy companies are building value in 2017.

The forum offers healthy dialogue and informal networking opportunities for attendees.

To sign up for EnerCom Dallas and hear Black Stone Minerals, or to find out more information about presenting companies at EnerCom Dallas, click here to visit the conference website.

Buyside institutions wishing to have one-on-one meetings with Black Stone Minerals and other presenting company executives may login at the conference website and request meetings.