Cabot remains focused on cutting costs

Houston-based Cabot Oil & Gas (ticker: COG) reported its second quarter results today, showing that the company continues to focus on cutting costs. Cabot continued to reduce its capital spending in the Marcellus.

Cabot reported total per unit costs (including financing) decreased to $2.52 per thousand cubic feet equivalent (Mcfe) in the second quarter, a 3% decline from the same time last year. “Our cash unit costs in the Marcellus during the second quarter were approximately $0.85 per Mcf, while our Eagle Ford cash unit costs were approximately $15.00 per barrel,” say Cabot President and CEO Dan Dinges.

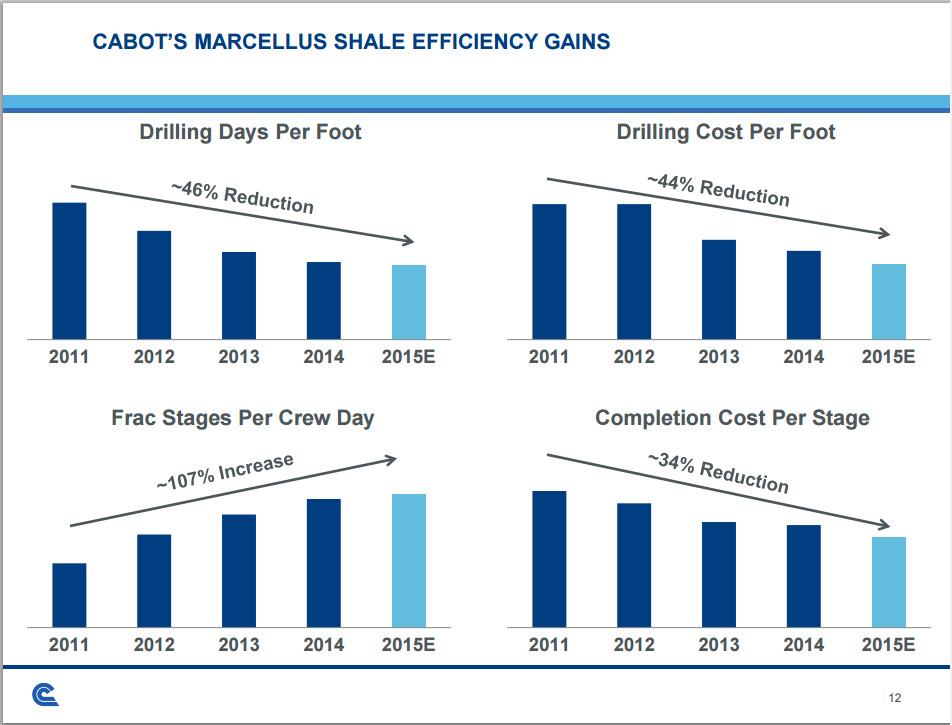

During the company’s conference call, Dinges said drilling at the company’s Marcellus operations continue to set records. “Our spud-to-spud cycle time during the quarter was under 15 days as compared to approximately 19 days for full year 2014… As a result of these efficiencies, we have seen a 15% reduction in cost at rig leased year-to-date.” Dinges added that the company plans to see further cost reductions in December as two rig contracts expire.

Lower gas prices hit profits

The Appalachia region heavyweight guided investors last quarter that Q2’15 volumes would be lower sequentially due to a reduced drilling program.

In its Q2’15 release, Cabot said it produced 138.0 billion cubic feet equivalent (Bcfe), consisting of 128.4 Bcf of natural gas and 1.6 million barrels of liquids. Compared to the second quarter of 2014, these numbers represent increases of 8%, 5% and 68%, respectively. Its rising activity in the Eagle Ford Shale is contributing to the drastic jump in liquids volumes.

Cash flow from operations was down on a year-over-year basis due to lower gas prices. Cabot reported $171.2 million in cash flow from operations in the second quarter, down from $329.6 million in the same period last year. The company reported a net loss of $0.07 per share, or $27.5 million in the second quarter. Excluding the effect of selected items including a $36.5 million after-tax non-cash mark-to-market loss on natural gas derivatives, net income for the company was $0.03 per share, or $14.6 million.

The Constitution Pipeline

Cabot said both in its Q2 release and the company’s conference call that it does not intend to accelerate its drilling program during the current down cycle, and instead is planning to focus on its Constitution Pipeline. “We do not believe that accelerating activity and allocating incremental capital in this commodity price environment is the appropriate investment decision, especially in light of a more favorable outlook for Cabot’s realized natural gas prices upon in-service of Constitution Pipeline in the second half of 2016,” said Dinges.

Constitution is now awaiting approval from the Federal Energy Regulatory Committee (FERC), Dinges said in the conference call. On May 19, Cabot filed its implementation plan with the FERC, marking the final step before receiving the go-ahead for construction. “Constitution filed its final reroute variance report with the FERC last week,” said Dinges. “This completes all outstanding issues regarding the route, and Constitution now has 100% of the required right-of-ways.”

The Constitution Pipeline is planned to be a 30-inch, 124-mile long pipeline designed to transport 650,000 dekatherms of natural gas a day from Pennsylvania to northeastern markets. Construction is expected to generate $130 million in new labor income and generate up to 1,300 new construction jobs, according to the companies involved in the project.

The project is anticipated to result in $13 million in new annual sales, income and property tax revenue and more than $600,000 in new income in the region. Barclays estimates the addition of Constitution could add 15% to 20% in COG’s cash flow as a result of higher volumes and lower differentials. The pipeline will be filled immediately upon commissioning.