Nation’s fiscal update points to promising growth during the next 5 years

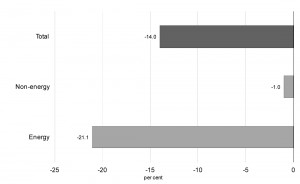

Canada’s fall fiscal update was released and it shows promising growth for the country, despite the 25% drop in the price of oil since July of this year. The decline of crude oil prices due to lower demand and oversupply drove the Department of Finance total commodity index down 14%, according to the fiscal update.

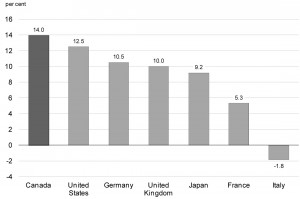

Despite the economic uncertainty created by global markets and lower oil prices the Canadian economy continued to strengthen through the end of 2014. Canada has seen the largest growth in real GDP among G-7 countries since 2009 at 14%, and the second largest growth in employment after the U.S. at 7.3% since July of 2009.

Finance Minister Joe Oliver warned that falling oil prices will hurt federal revenues and impact the Canadian economy – but maintains the Conservative Party will still balance the books in 2015, reports the Financial Post. A prolonged period of low energy prices would erode federal tax revenue and hurt parts of the Canadian labor market, even though it will translate into lower prices at the pumps for motorists.

Some forecasters thought there would be a small surplus in the current fiscal year, but recently announced tax cuts for families, which cost $2.83 billion, led to an overall deficit of $2.56 billion for the current fiscal year. Despite the tax cut creating a deficit for the current fiscal year, the fiscal update reported that it expects a surplus of $1.9 billion in 2015-16, steadily growing to $13.1 billion in 2019-20.

The Canadian fall forecast also included a survey of private sector economists. Economists surveyed expect Canadian real GDP growth to average 2.5% over the second half of 2014, compared to 2.3% in the first half of the year, and then to pick up to 2.6% for 2015 as a whole.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.