$16.7 billion in 2013

Tax season is nearing a close for Americans, and earnings season is just around the corner for oil and gas companies preparing their quarterly results. E&Ps and service providers have felt the impact from the oil price slide, even though both spot prices closed about 5% higher today.

Those companies are not alone. The budgets of several hydrocarbon-producing states are also feeling the squeeze. Last month, the Energy Information Administration issued a report detailing the effects of lower realized commodity prices, claiming states like North Dakota, Texas and Alaska were losing hundreds of millions of dollars and adjusting their respective budgets.

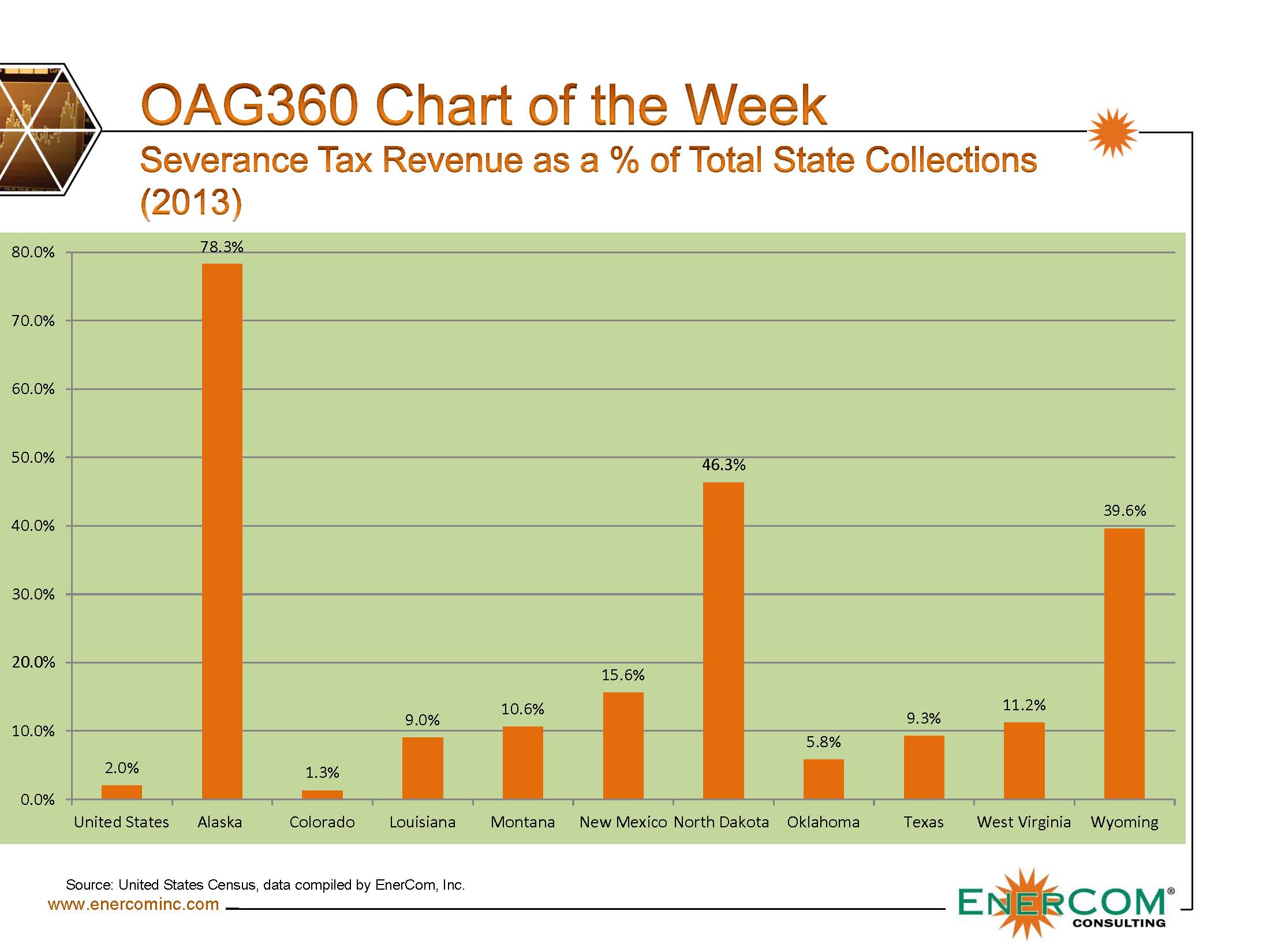

But just how dependent are individual states on oil and gas production? Oil & Gas 360® compiled a list of ten of the greatest producing hydrocarbon states for our Chart of the Week. Each state’s various tax schemes work differently, but we compiled a list of severance tax revenue as a percentage of each state’s total tax return. Severance taxes include all nonrenewable resources, including coal, and were compiled by information from the United States Census.

*Note: Pennsylvania does not use a severance tax*

In all, the United States collected more than $16.7 billion in 2013 severance taxes. The top ten states listed above account for about 91% of the total – Texas and Alaska alone account for more than half of the collected revenue. Total severances tax revenues outpaced property taxes ($13.2 billion) and equaled more total taxes received by 30 of 50 states.

| Total Severance Tax (in millions) | |

| United States | $16,774 |

| Alaska | $4,017 |

| Colorado | $147 |

| Louisiana | $834 |

| Montana | $282 |

| New Mexico | $843 |

| North Dakota | $2,457 |

| Oklahoma | $515 |

| Texas | $4,799 |

| West Virginia | $608 |

| Wyoming | $867 |

How Each State Collects and Allocates Taxes from Oil and Gas Production

The National Conference of State Legislatures completed an in-depth analysis of oil and gas production taxes in 2013 entitled “STATE REVENUES AND THE NATURAL GAS BOOM: AN ASSESSMENT OF STATE OIL AND GAS PRODUCTION TAXES.” The report breaks down state-by-state the various taxes levied on oil and gas producers in each state and how the revenue is allocated. “Taxes on the Production and Severance of Oil and Gas and Tax Revenue Allocation” maybe be viewed here.

The pdf file of this analysis may be downloaded here.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.