Project expansions to be funded from internally generated cash flow

The United States’ first liquefied natural gas (LNG) export terminal is on target for completion by year-end 2015, and its operator, Cheniere Energy (ticker: LNG) is ramping up additional operations.

On June 11, 2015, Cheniere announced two additional project developments that could increase the company’s nominal production capacity by as much as 50%. The latest developments would boost output to 60.0 million tons per annum (mtpa) by 2025, up from its current projected output of roughly 40.5 mtpa.

About half of the additional capacity will be aimed at expanding the Corpus Christi plant – the facility expected to be operational by year-end. The new developments include two trains with 4.5 mtpa of capacity apiece, bringing the facility’s total capacity to 22.5 mtpa.

The other 10.0 mtpa will be based on two projects with Parallax Enterprises, LLC. Parallax is operating two mid-scale LNG projects near the Louisiana coast and will partner with Cheniere to accelerate the buildout. Each plant will receive two trains with 2.5 mtpa of capacity.

Pending government approval, both projects are expected to begin construction by 2017. Cheniere expects to fund both expansions with internally generated cash flow.

Eastern Countries Show Upside

Near-term demand in China is being revised downward, but the world’s most populated country is expected to be a major energy importer by the end of the decade. “There’s a lot of interest from Chinese buyers for long-term LNG volume, especially for 2020 onwards,” said Nicolas Zanen, Vice President of Cheniere, at a conference last month in Kuala Lumpur.

Relations between the United States and China are tense at the moment, and Cheniere said the U.S. Department of Energy specifically warned them about the implications of securing a contract with a large Chinese customer. “They said it would not be looked at as politically correct,” explained Zanen, even though Cheniere received approval to trade with non-free trade agreement countries last week.

“Authorizations are granted to companies that apply, not for the countries themselves,” Lindsey Geisler, a spokeswoman for the Energy Department in Washington, said. “The final destinations for LNG cargoes will be dependent upon commercial arrangements and factors, and are only reported to the Department after delivery.”

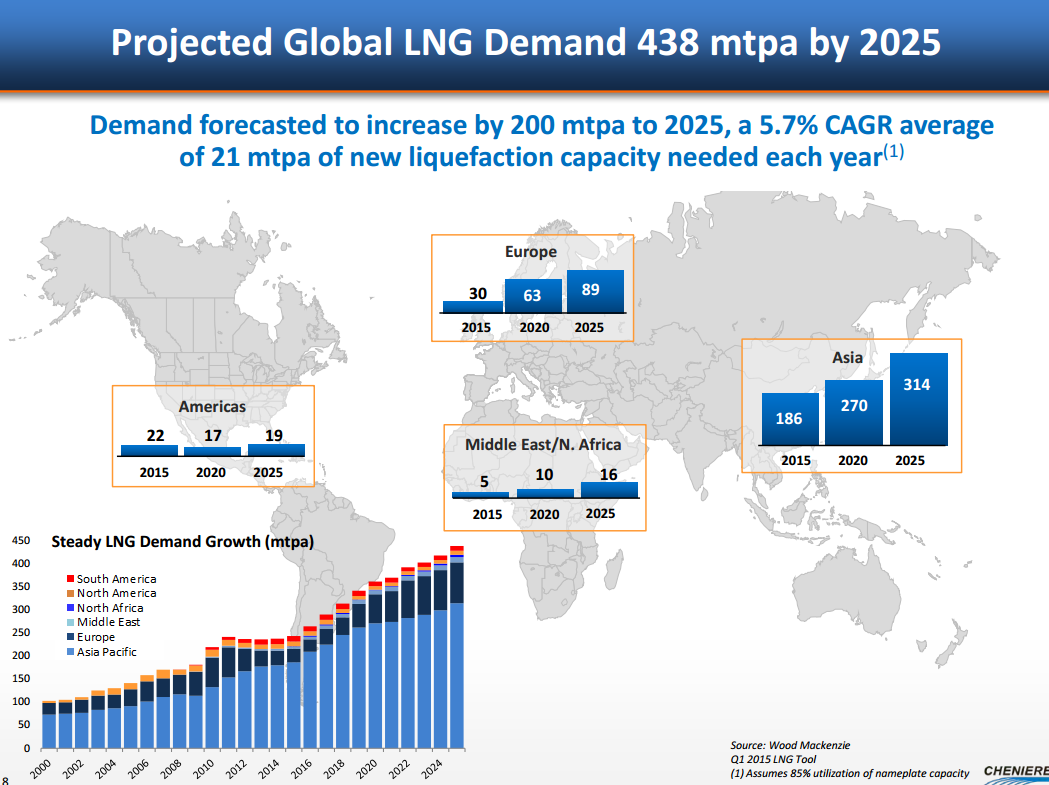

Projections from Wood Mackenzie expect global demand for LNG is expected to reach 438 mtpa by 2025. If correct, Cheniere would hold about 14% of the world’s export market if its projects begin as scheduled.