China hopes to spur demand for natural gas

China’s National Development and Reform Commission (NDRC), the country’s top economic planner, announced this week that it plans to reduce the benchmark city-gate prices for natural gas by 0.7 yuan ($0.11) per cubic meter for industry and commercial users. Analysts believe the move, which was expected, effectively reduces the cost of city-gate natural gas by 28%, reports The Wall Street Journal.

The NDRC also said that it would allow greater negotiation between buyers and sellers of natural gas over price. Under the new mechanism, China will allow industry players to charge up to 20% more than government benchmark prices in the future, based on supply and demand. It set no downward limit for price fluctuations.

The moves are hoped to spur greater demand for natural gas, as China faces slower growth than expected. The country is making a shift from coal to natural gas, but weak demand, in particular for seaborne liquefied natural gas, raised significant questions across the industry over whether the government could meet ambitious gas consumption growth targets.

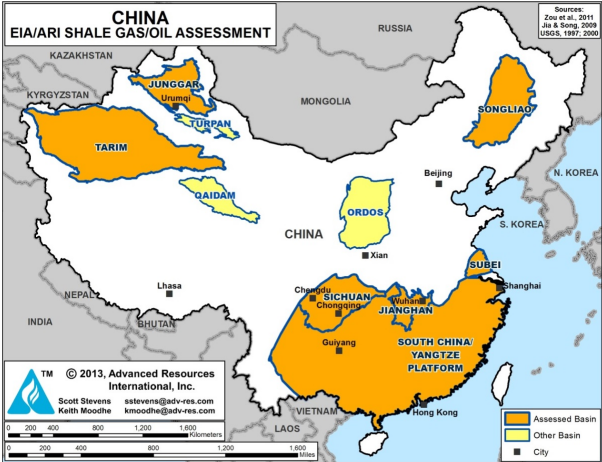

The lower city-gate natural gas prices are expected to slow Chinese shale development, but Dr. Derek Scissors, and economics professor from George Washington University, told Oil & gas 360® China would likely never see a shale boom like the one seen in the United States.

“[China] will continue to be involved in [shale], hoping there is some kind of technological breakthrough made elsewhere that does translate to China, but they are not going to have their own shale expansion. It would have to come from overseas, and it’s going to be very difficult because their market is so tightly controlled.

“Shale is a poster child for individual land-rights and small companies, neither of which China has,” said Scissors.