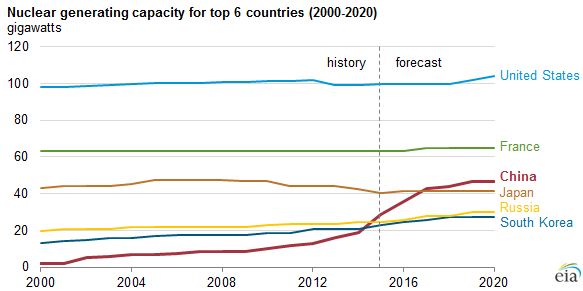

Additions to capacity would give China the third largest nuclear capacity worldwide

China plans to reach a nuclear capacity of 58 gigawatts (GW) and have another 30 GW of capacity under construction by 2020 in a push to reduce carbon emitting fuel sources. The added nuclear capacity would make China’s nuclear supply the third largest in the world following the United States and France, and the largest in Asia.

Nuclear power currently makes up slightly more than 2% of the country’s total power generation, according to the Energy Information Administration (EIA). By the end of 2015, China is expected to surpass South Korea and Russia in nuclear generating capacity, putting it behind the U.S., France and Japan. China plans to continue adding nuclear capacity into 2020, adding another 23 GW before the end of the decade.

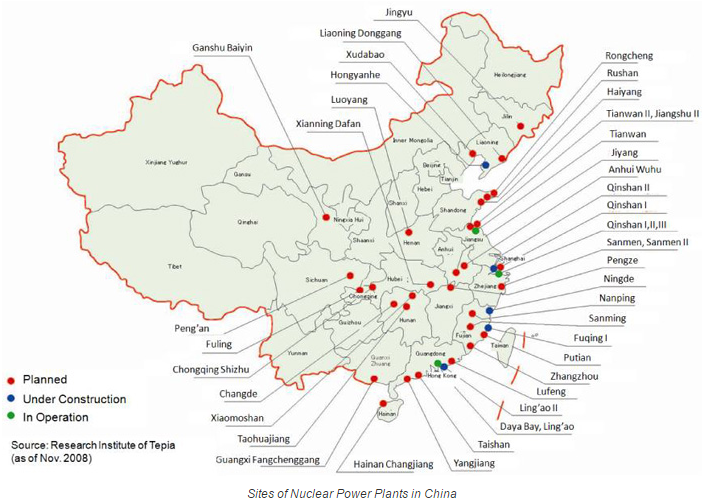

According to the World Nuclear Association (WNA), mainland China currently has 26 nuclear power reactors in operation, with 24 more under construction and plans to begin construction on several others. The country has been trying to develop alternatives to coal-produced power in order to reduce the amount of air pollution in the country. The World Bank estimates the economic loss due to pollution is nearly 6% of GDP, strongly incentivizing alternative fuel sources.

In 2012, the country generated 4,994 TWh of electricity, of which 3,785 TWh came from coal, 872 TWh from hydro power, 147 TWh from non-hydro renewables, and just 97 TWh came from nuclear power.

China plans to continue expanding its nuclear capacity beyond 2020, with the goal of 150 GW of capacity by 2030 and even more by 2050, according to the WNA. Much of the country’s nuclear capacity, both operating and planned, is located along its east coast. The Fukushima nuclear incident in Japan has prompted the government to consider more inland nuclear capacity, however.

China has become largely self-sufficient in reactor design and construction, as well as other aspects of the fuel cycle, but is making full use of western technology while adapting and improving it, according to the WNA. Most of the technology transfer is done through U.S.-based Westinghouse, according to the EIA. China hopes to eventually be able to export its nuclear technology, and in 2014 signed agreements with several countries (Romania, Argentina, Turkey and South Africa) to finance the construction of nuclear reactors and export technology.