Assets could be worth $1 billion, according to estimates

ConocoPhillips (ticker: COP), the third-largest North American oil and gas producer, is looking to divest assets in Western Canada to various buyers including Canadian Natural Resources (ticker: CNQ), sources familiar with the matter told Bloomberg. The sources shared the information under the condition of anonymity due to the private nature of the deal, which has yet to be finalized.

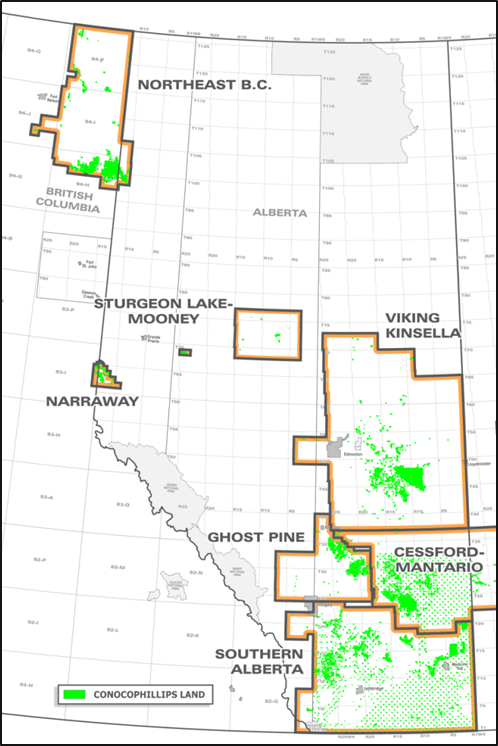

An agreement could be reached as earlier as this week for ConocoPhillips to sell roughly 3.9 million gross acres (2.4 million net), which are producing 34,842 barrels of oil equivalent per day, according to Scotiabank. The assets are gas weighted (81% gas) and include properties at Cessford – Mantario, Viking Kinsella, Southern Alberta, Ghost Pine, Northeast B.C., Narraway, and Sturgeon Lake – Mooney. The properties could be valued at $1 billion or more, according to data compiled by Bloomberg.

The purchase would be an interesting one for Canadian Natural, which 82% oil weighted in its production, according to EnerCom’s Canadian E&P Weekly scorecard.

The sale likely came about as a strategy to shore-up the company’s balance sheet. Many companies have been focusing on their best assets while they divest non-core acreage to ensure the best returns on capital spending. The sale would represent about 20% of ConocoPhillips’ Canadian production outside the oil sands.

The company has a strong debt-to-market cap ratio of 42%, 53% lower than the group median in EnerCom’s E&P Weekly. The company’s asset intensity, defined as the amount of capital required to maintain production flat, was 116%, higher than the group median of 88%.

Spokespeople from both ConocoPhillips and Canadian Natural declined to comment when asked about the potential deal.

Another likely purchaser

In addition to CNQ, Calgary-based Pine Cliff Energy (ticker: PNE) has been identified as a likely buyer for some of ConocoPhillips’ assets. COP’s shallow gas assets would be significant for the company’s growth, said Dan Payne, an analyst at National Bank Financial in Calgary.

Pine Cliff CEO Phil Hodge is meeting with investors to market the company this week and is emphasizing its strategy to acquire producing properties, Payne said. “It’s fair to assume that Pine Cliff would peel something out of it.”