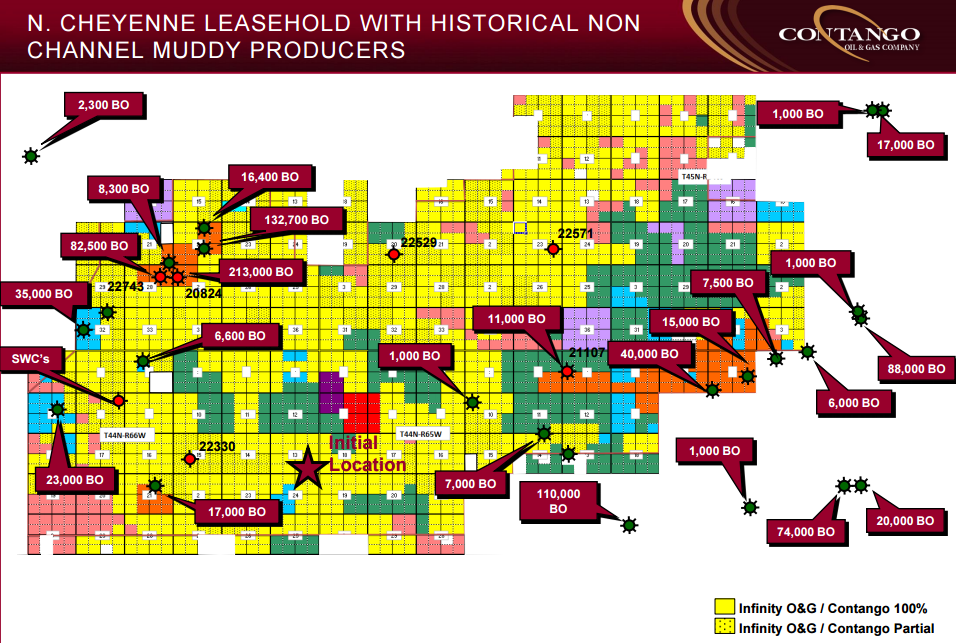

Contango Oil & Gas (ticker: MCF) announced “the discovery and successful completion” of a well located in Weston County, Wyoming, according to a company press release. The Elliott #1H well (80% working interest) is the first to be drilled by Contango in the Muddy Sandstone formation of its North Cheyenne Prospect Area.

Initially intended to be a vertical well drilled to 6,650 feet, Contango added a lateral section, increasing the total measured depth to 13,116 feet (6,235 feet of true vertical depth). Elliott #1H returned a peak 24-hour rate of 907 BOEPD (98% oil), exceeding pre-drill estimates of 500 BOEPD. Prior to completion, MCF estimated the ultimate recovery at 300 MBOE (86% oil) at costs of $5 million per well. The region is an extension of the Wattenberg Field and has similar EURs to operators in Colorado. PDC Energy (ticker: PDCE) and Bonanza Creek Energy (ticker: BCEI) both list their EURs at anywhere from just above 300 MBOE to as much as 700 MBOE in their latest investor presentations.

Contango forecasts its acreage in the region could hold anywhere from 50 to 75 MMBOE if the EURs are accurate. Two oil fields located by the Elliott #1 have cumulatively produced more than 50 MMBOE since their discovery in the 1940s. The company reported other formations and sands, including the Niobrara, are prospective for development. A nearby operator, Cinco Resources, has 24 permitted wells in the area and reports its first four wells have averaged 30-day rates of 200 to 400 BOPD.

Contango in Wyoming

Contango has two focus areas in Wyoming; the Muddy Sandstone on the eastern side and the Frontier Sands of the Mowry Shale. An estimated 200 drilling locations lie across its 35,000 net acres of the Muddy Sandstone and are part of a drill-to-earn program. One to two additional wells are scheduled to be spud later in the year, followed by a one to two rig commitment beginning in early 2016.

Its Mowry Shale position in central Wyoming is larger – 70,000 net acres – and the company is currently evaluating development in the area. Contango has also secured a foothold in the Eagle Ford Shale of Texas with about 25,000 net acres in Fayette and Gonzales County. Five wells have been drilled in three different horizons, but MCF and its 50/50 partner have elected to not release results at this time.

In the press release, Contango management said the success of the Elliot well is a “meaningful first step” to establishing drilling inventories in multiple plays to the company’s portfolio. The company expects volumes for Q2’15 to range from 90 to 100 MMcfe/d as the company shifts to multi-well pad drilling to preserve capital.