Sanctions against Iran have dramatically reduced its crude oil exports

The five permanent members of the United Nations Security Council and Germany (P5+1) are set to reach a comprehensive agreement with Iran regarding its nuclear agreement by June 30, potentially lifting the sanctions put on place on the country, and allowing it to export its crude oil.

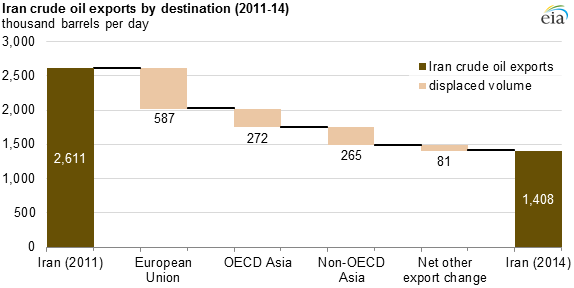

Since the implementation of crude oil sanctions on Iran, the country’s exports have fallen to 1.4 MMBOPD from 2.6 MMBOPD in 2011, a decline of 46%. Most of this decline was seen in the E.U. and OECD Asia, particularly to China (550 MBOPD), India (320 MBOPD, Japan (315 MBOPD) and South Korea (250 MBOPD), according to the Energy Information Administration (EIA).

Iran primarily exported light- and heavy-grade crudes. When exports of Iran’s crudes were halted, many of their former buyers replaced the lost imports with similar grade crudes from Saudi Arabia, Kuwait, Nigeria, Angola and Iraq.

China increased purchases of oil from Angola and Iraq, reports the EIA, while other Asian countries imported more from Nigeria. The E.U., which mostly purchased Iranian light crude oil until the embargo in 2012, substantially increased volumes from Nigeria and Saudi Arabia.

The EIA notes that while Iranian exports have been replaced by similar crude oils, they are not one-to-one equivalents. The main factor affecting refinery operations are the quality of the characteristics of the crude oil itself. The decision to import more costly light, sweet oil or cheaper heavy, sour crude can depend on the refinery’s level of complexity.

If the P5+1 decide to lift sanctions on Iran and allow it to export its oil freely, it could take back some of its market share and contribute even more oil to the global glut. In March, the official IRNA news agency cited an Iranian oil official as saying the country would raise oil output by 170 MBOPD by the end of the current Iranian year, which ends on March 20, 2016.