With so much oil being produced in the U.S. and nowhere to store it, why are we still importing?

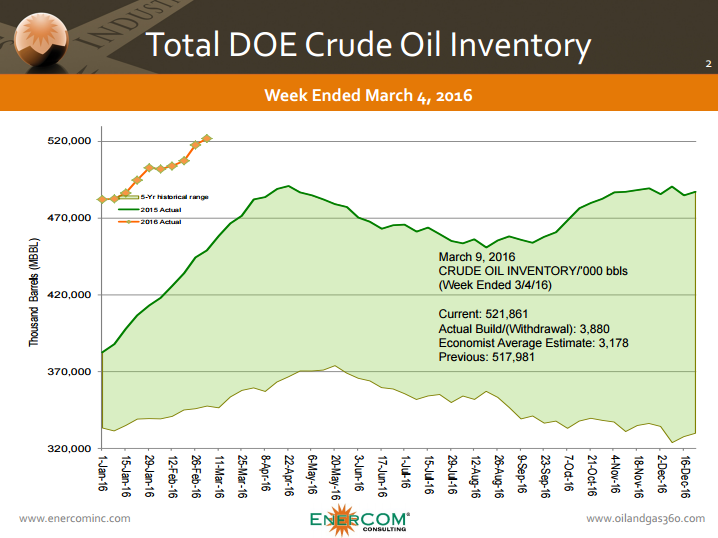

Crude oil stocks continued to build last week to levels well above the five-year average as global oversupply persists. Production in both OPEC and non-OPEC countries is beginning to decline, according to information from the IEA, but demand still has not caught up with the amount of oil being pumped out of the ground. And sanction-free Iran is telling the world it will ramp up to 4 MMBOPD.

Many producers continue to transport their crude into storage around the U.S. particularly to Cushing, Oklahoma, where concerns over oil filling all the available storage have persisted since last year. Crude inventories at the storage facility hit a record high on March 4, with nearly 3.5 MMBO more in storage than in April 2015, according to Genscape, which monitors usage at the facility.

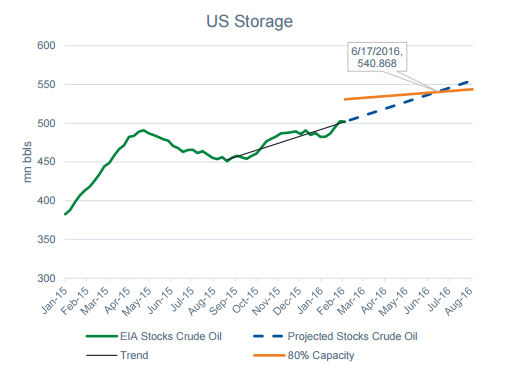

Total utilization of storage at Cushing remains below 80%, which Genscape believes is the effective maximum utilization rate possible at the facility, but it the company’s projections show that this level could be reached by the middle of the year.

Source: Genscape

Against the background of crude storage tanks filling in Oklahoma and elsewhere, the U.S. continues to import crude oil from other parts of the globe.

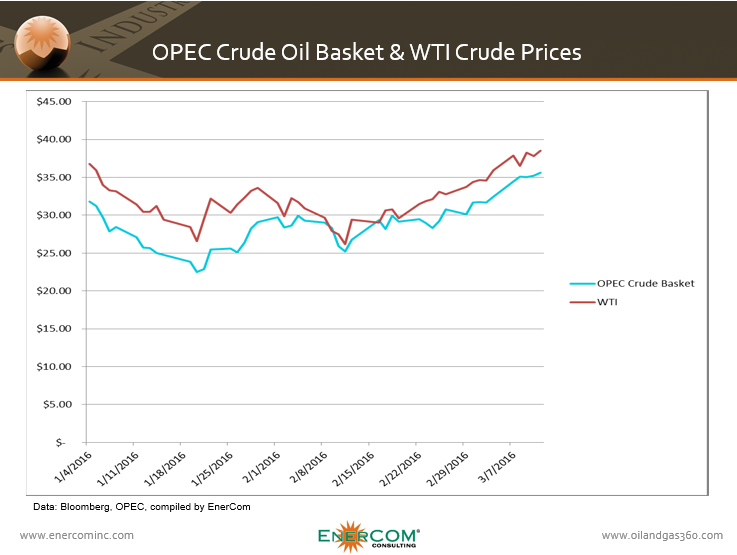

Light, sweet crude oil, like that produced in the U.S., typically trades at a premium to heavier crudes because it is easier to process.

Costs to produce light sweet crude in other parts of the world remains less than in some parts of the U.S. The fact that light sweet can be had cheaper from other countries encourages U.S. refiners to import crude from countries like Iraq and Nigeria.

The price of the OPEC crude basket, which is made up of various grade grades produced by the group, including light crude from Iraq and Nigeria, remained below U.S. crude benchmark WTI, making it a more attractive option for refiners despite having to import the crude from overseas. The price of OPEC’s crude basket on March 11 was $35.62, compared to $38.50 per barrel for WTI.

Hold on: new tanks will create room to grow in Cushing

Despite the continued growth of stockpiles at the present Cushing storage facilities, utilization could begin to decline with the buildout of additional storage. Plains All American (ticker: PAA, PlainsAllAmerican.com) is currently building three storage tanks with total capacity of 810 MBO, which are expected to come online before the end of March. The company also recently started construction on another tank expected to be finished before the end of the year with 540 MBO of capacity.

Dr. Russell Evans, an economist at Oklahoma City University believes the fears of reaching storage capacity are overstated.

“There’s land there, so it’s easy to expand capacity,” Evans, who provides energy forecasts for Oklahoma City, told a local news station.

Potential of international exports leaving Cushing

With the end of the U.S. crude oil export ban, there is now an opportunity for producers to begin shipping oil out of Cushing and around the world. So far, no major shipments have been made from Cushing abroad, but French oil major Total (ticker: TOT, Total.com) has been exploring the possibility.

Last month, the U.S. trading arm of the French company Atlantic Trading & Marketing Inc. (ATMI) inquired about chartering an Aframax oil tanker to load crude shipped to the Gulf Coast from Cushing, an arbitrage that, at the time, would have yielded theoretical profits of as much as $2-$3 per barrel, reports Reuters.

ATMI was bidding to buy immediate WTI crude in Cushing for delivery just a few weeks later, an unusual move given the lack of storage availability on such short notice. The company also purchased discounted space on TransCanada’s (ticker: TRP, TransCanada.com) MarketLink pipeline to the Gulf, according to industry sources.

The differential between crude from Oklahoma and imports from abroad narrowed enough that the deal was no longer economical before the end of the month, but the stockpiles held in Cushing could offer an opportunity for oil traders looking to take advantage of price arbitrage.

Transporting crude to Port Arthur via MarketLink cost $0.30 per barrel in early February, Reuters reported. Add on another $2.75 for shipping and terminal fees, and crude from Cushing could reach Europe at a cost of around $31.50. Prices have escalated. Right now, WTI near month is trading at $37.41. May delivery Brent is at $39.75.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.