Production overhang beginning to slow, but “sustainable price recovery more likely a 2017 event”: Wells Fargo

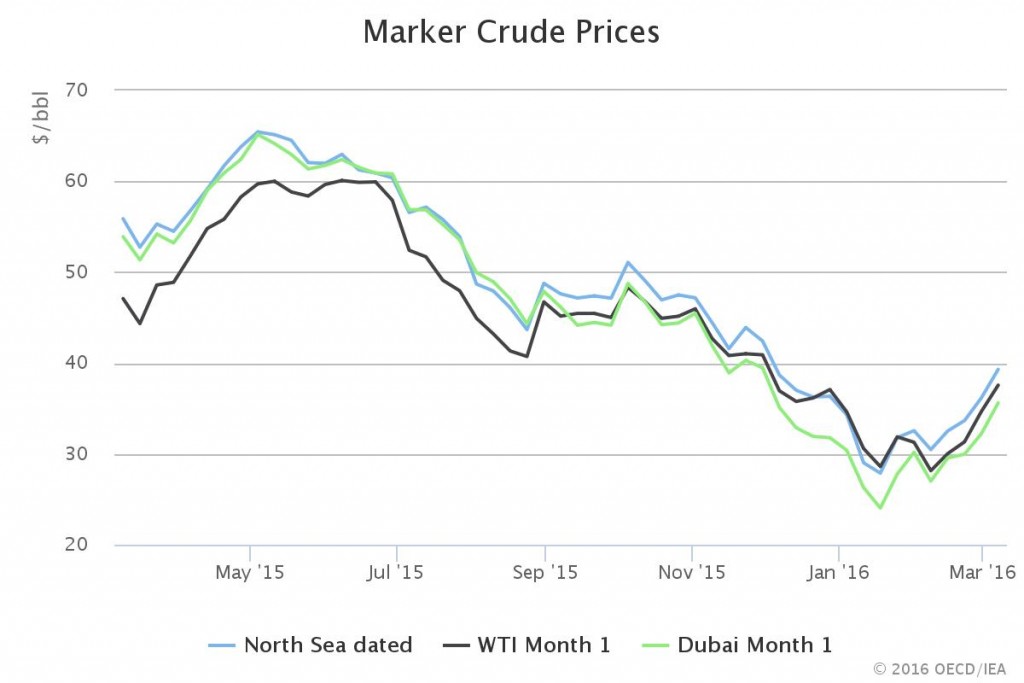

Oil prices continued their gains today as a report from the IEA indicated that prices may have finally bottomed out, and are beginning to recover. In the agency’s March Oil Market Report (OMR), the IEA noted that oil supplies decreased by 180 MBOPD in February to 96.5 MMBOPD, as production from both OPEC and non-OPEC sources declined.

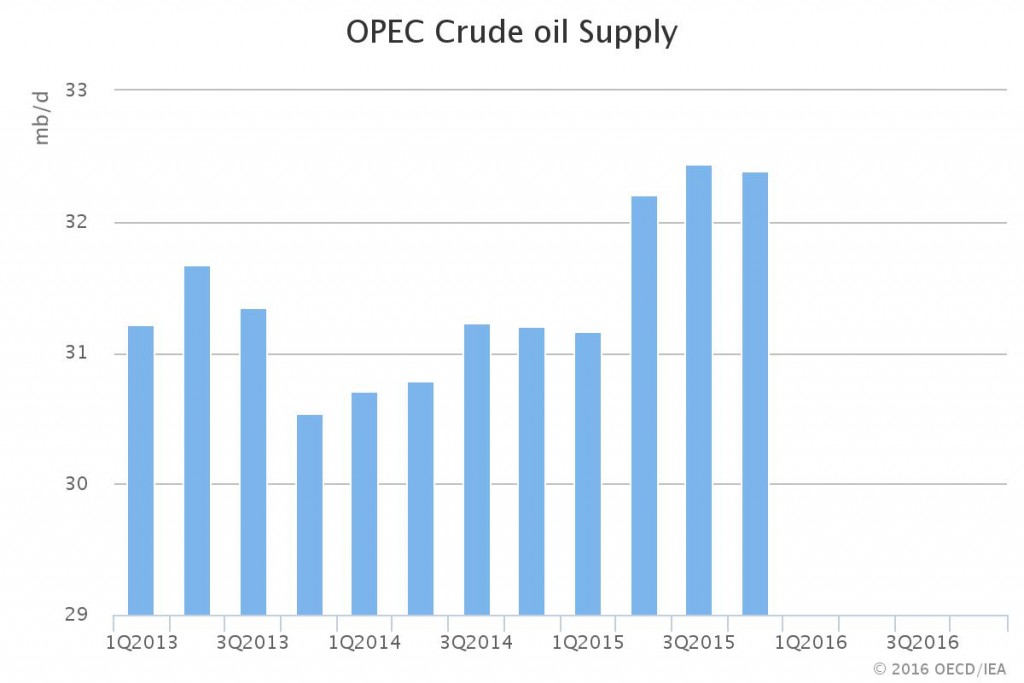

Production remains 1.8 MMBOPD higher than a year ago, however, as gains from OPEC over the last year more than offset the decline in other oil producing regions of the world. Non-OPEC production is estimated to fall by 750 MBOPED to 57 MMBOPD in 2016, 100 MBOPD more than in the IEA’s previous OMR. OPEC production fell by 90 MBOPD in February due to lower volumes from Iraq, Nigeria and the UAE, partially offset by increases from Iran. Saudi Arabia’s production remained flat.

The IEA expects that oil demand growth will remain relatively weak for now at 1.2 MMBOPD. Weakness in demand for middle distillates in the U.S. will offset stronger gasoline demand, while demand in China will grow at 330 MBOPD, below the ten-year average growth rate of 440 MBOPD.

This slow demand growth will leave the supply surplus at 1.9 MMBOPD in the first quarter and 1.5 MMBOPD in the second quarter, but the gap between supply and demand is expected to narrow to 0.2 MMBOPD in both the third and fourth quarters of the year.

A note from Roger Read at Wells Fargo agreed, saying that a substantial price recovery likely will not come before 2017.

First OECD stock draw in a year

Slowing production is beginning to have an effect in the markets, even if supply and demand are not expected to come in line with each other until next year. The IEA’s preliminary data suggests that February was the first time in a year when OECD commercial inventories saw a draw. Data for January showed a build of 20.2 MMBO while crude volumes in floating storage continued to increase.

Slowing production is beginning to have an effect in the markets, even if supply and demand are not expected to come in line with each other until next year. The IEA’s preliminary data suggests that February was the first time in a year when OECD commercial inventories saw a draw. Data for January showed a build of 20.2 MMBO while crude volumes in floating storage continued to increase.

“Based on project startups later this year and early next, our model predicts modest inventory builds again in early 2017,” said Read. “Thus a more robust and sustainable oil price recovery is more likely a 2017 event.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.