MarkWest Co-Founder John Fox confirms stance that Marathon Petroleum should eliminate IDRs before refinery dropdowns

John M. Fox, co-founder and former chairman and CEO of MarkWest Hydrocarbon, which merged with Marathon Petroleum’s MPLX LP (ticker: MPLX) in December 2015, issued a press release today reaffirming his stance against Marathon Petroleum Company’s (ticker: MPC) proposed January 3, 2017 plan.

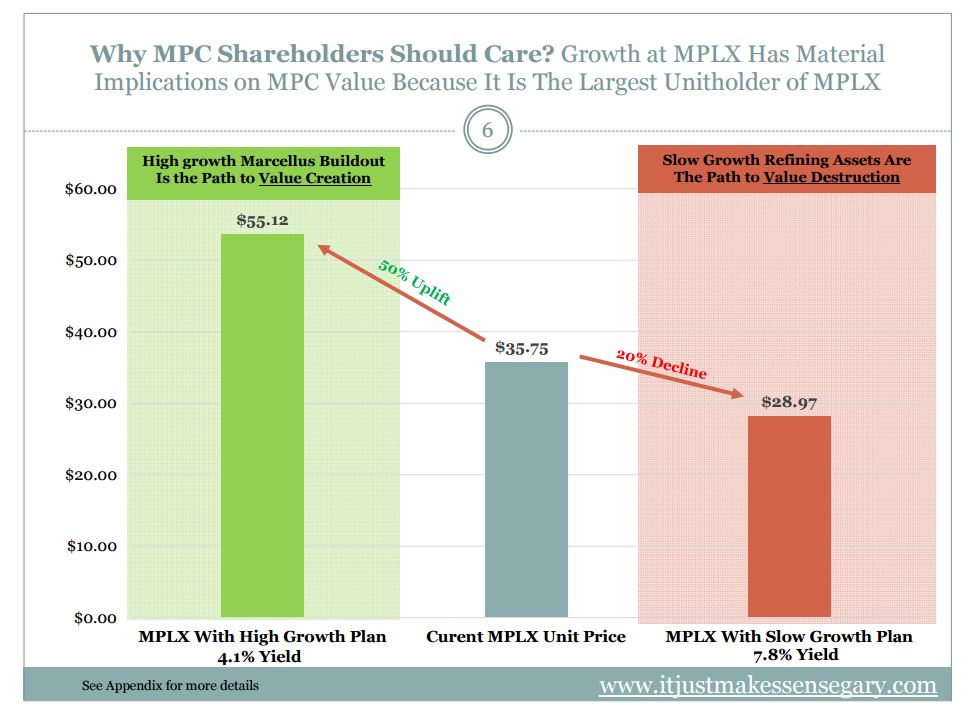

Fox said that his own proposal to eliminate Incentive Distribution Rights (IDRs) would provide immediate uplift in value for MPC shareholders. Fox said that his former company, MarkWest, generated a 143.3% total return and grew from a $1.2 billion market cap to an $8.6 billion market cap for the period of September 5, 2007, when the IDRs were eliminated at MarkWest, to December 4, 2015, when MarkWest merged with MPLX.

Fox is beneficial owner of 1,542,072 MPLX common units, and 20,900 shares of Marathon Petroleum Company, according to the press release.

“The engagement that I have had with investors, analysts and other stakeholders since my open letter to management on January 11, 2017, has confirmed that there are many that also share my concern around management’s proposed path forward,” Fox said in a news release.

“Don’t put MPLX in the penalty box,” he said in the press release. “Our simple and less risky plan puts us on a growth path to value creation. If managed properly, MPLX has years of double digit organic growth ahead with high rate of return projects built on its substantial core infrastructure.

“This high growth path retains management’s focus on high-return EBITDA projects in the Marcellus. We estimate the adoption of our plan results in an immediate uplift in value for MPC shareholders of between $20-$30 per share.”

Fox said a new slide deck highlighting key points on growth and valuation is posted at his website www.itjustmakessensegary.com.

Marathon Petroleum’s Q4 earnings conference call and webcast is scheduled for Wed. Feb. 1, 2017, at 9:00 a.m. EST.