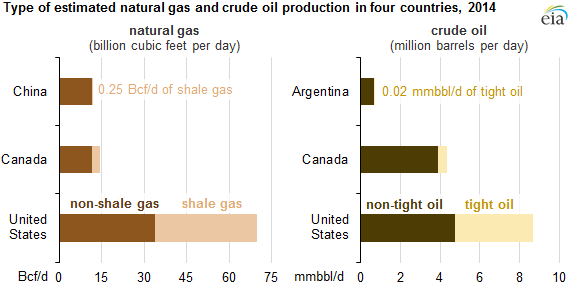

The United States and Canada are the only two countries in the world to commercially produce both shale gas and tight oil, the Energy Information Administration said on February 13, 2015. Two other countries, China and Argentina, are the only other nations to extract resources from shale, but both are exclusively producing one of the two hydrocarbons. Russia and Australia have produced from their respective shale formations but are not classified as “low permeability formations.”

The Rise of Shale

The EIA reports the effects of hydraulic fracturing are apparent in three major U.S. plays, all of which have become staples of the oil and gas industry. Production from the Marcellus Shale has more than tripled in the last three years and returned volumes of 14.6 Bcf/d in 2014. Range Resources (ticker: RRC) was one of the early movers into the Appalachia region and has established line of sight growth of at least 20%, supported largely by its acreage position and efficiency. In December, the company said it set a regional production record by drilling a 59 MMcf/d Utica well in West Virginia.

The EIA reports the effects of hydraulic fracturing are apparent in three major U.S. plays, all of which have become staples of the oil and gas industry. Production from the Marcellus Shale has more than tripled in the last three years and returned volumes of 14.6 Bcf/d in 2014. Range Resources (ticker: RRC) was one of the early movers into the Appalachia region and has established line of sight growth of at least 20%, supported largely by its acreage position and efficiency. In December, the company said it set a regional production record by drilling a 59 MMcf/d Utica well in West Virginia.

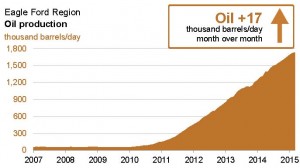

Fracing has allowed Texas’ Eagle Ford Shale to quickly catch up to its intrastate counterpart, the Permian Basin. The Eagle Ford produced just 29 MBOPD in 2010, but its meteoric rise has volumes for March 2015 projected to exceed 1,700 MBOPD – second only to the Permian Basin. The region has gone from an afterthought to single-handedly outproducing four members of the Organization of Petroleum Exporting Countries in just a few years. Sanchez Energy (ticker: SN) is one of the many E&Ps who have flocked to the Eagle Ford, and has invested more than $1.1 billion to secure 226,000 net acres since March 2013. The type curve for its Lower Eagle Ford wells in the Catarina is massive – up to 700 MBOE.

Fracing has allowed Texas’ Eagle Ford Shale to quickly catch up to its intrastate counterpart, the Permian Basin. The Eagle Ford produced just 29 MBOPD in 2010, but its meteoric rise has volumes for March 2015 projected to exceed 1,700 MBOPD – second only to the Permian Basin. The region has gone from an afterthought to single-handedly outproducing four members of the Organization of Petroleum Exporting Countries in just a few years. Sanchez Energy (ticker: SN) is one of the many E&Ps who have flocked to the Eagle Ford, and has invested more than $1.1 billion to secure 226,000 net acres since March 2013. The type curve for its Lower Eagle Ford wells in the Catarina is massive – up to 700 MBOE.

The Bakken Shale is the third listed beneficiary of fracing and has also experienced a similar rapid trajectory, though not the extent of the Eagle Ford. The Bakken produced 1,100 MBOPD in 2014, up nearly threefold from 2011’s average of 400 MBOPD. The increase has spurred investment into the entire region, resulting in a trickle-down benefit to the real estate market and overall economy. Whiting Petroleum (ticker: WLL) holds approximately 885,000 net acres in the region, the most of any E&P, and has proved reserves of 780 MMBOE. The company has been using slickwater techniques to maximize its returns and has established type curves of 600 MBOE with an average cost of $8 million per well.

Volumes from Canada have jumped as well, though not to the extent of its American neighbors. Tight oil and shale gas production has roughly doubled from 2011 to 2014, if including the resources from the Montney formation. The Montney and Duvernay formations are the primary targets of EnCana Corp. (ticker: ECA) in 2015, with gross midpoint investment of $1.75 billion if its joint ventures are included. ECA is one of the few E&Ps to project increases in 2015 spending compared to expenditures from 2014.

When will everybody Else Catch Up?

The EIA says shale exploration efforts are being conducted on a global basis, but full scale development requires “the ability to rapidly drill and complete a large number of wells in a single productive geologic formation.” The majority of countries do not have the knowledge or ability to effectively operate in such a way, due to limited experience/education along with manufacturing and distribution hurdles.

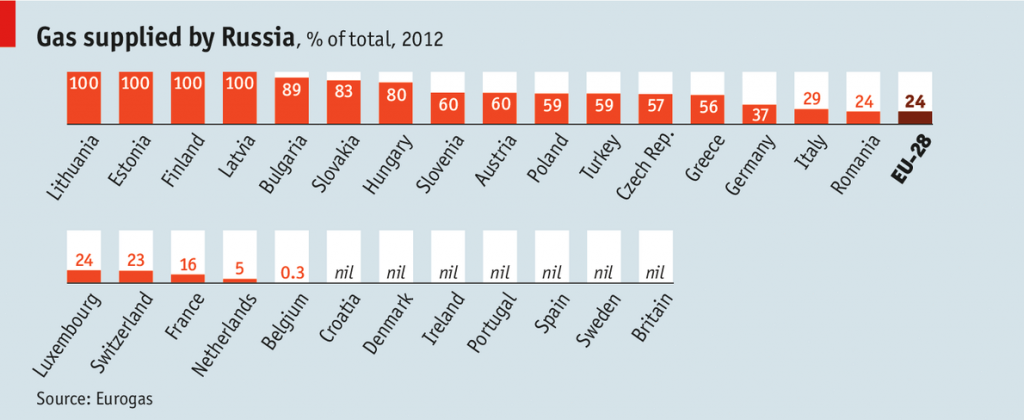

Other politically-fueled obstacles, such as tax regimes, social acceptance and mineral rights ultimately discourage E&Ps from coordinating with foreign nations. Social acceptance is a major issue in Europe – several countries have implemented outright frac bans, even though large amounts of energy are purchased from Russia. Despite its many consumers, Russia’s supermajor partners like BP (ticker: BP), Royal Dutch Shell (ticker: RDS.B) and ExxonMobil (ticker: XOM) have suspended shale development projects in the country in response to sanctions and the downswing in commodity prices. Michael Kelly, Chief Economist for Credit Agricole, told OAG360 in a feature interview that the latter has had a greater impact on Russia and its oil industry.

A handful of countries in Latin and South America are also testing techniques on shale, but few have been able to lure E&P investments due to several unfavorable political moves. Brazil’s Petrobras is mired in a massive scandal, Venezuela has seized rigs from joint venture partners and Colombia is struggling to cope with its deteriorating security. Mexico opened its resources for international investment last year, ending a nationalization that was in place since the 1930s, but potential suitors are wary of drug wars that ensue along the Texas/Mexico border – right on top of the Eagle Ford Shale.

Source: The Economist

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.