Electricity Demand for Heating Down 6% Nationwide in 2015

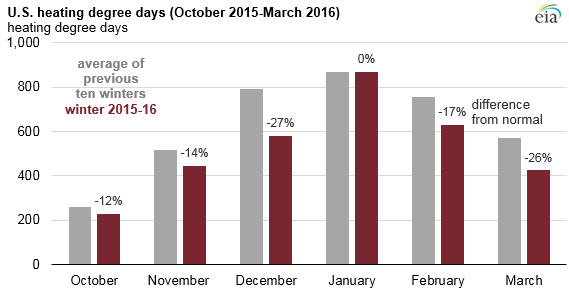

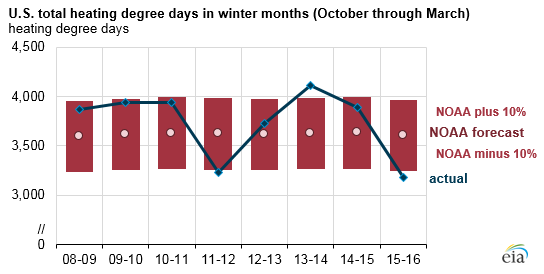

Above-average winter temperatures caused by a strong El Nino pushed total U.S. heating degree days (HDD) to their lowest point in at least the last eight years. Fewer cold days meant less demand for heating fuels like propane and heating oil, which saw demand decrease by 16% and 45%, respectively, while demand for electricity fell 6%, according to the EIA.

The El Nino currently creating warmer temperature patterns in the Pacific Ocean is one of the three strongest on record. El Nino events typically last 9-12 months, and this particular El Nino has lowered demand during the typical natural gas draw season, compounding problems with natural gas storage, which continues to grow.

At the national level, the number of heating degree days as 18% lower than the previous winter season and 12% lower than the National Oceanic and Atmospheric Administration’s forecast in September 2015.

Price for residential heating sources being affected differently

While the overall lower demand for heating this last winter has certainly affected every source of fuel used to generate heat, some have fared better than others.

Natural Gas

Natural gas, which is used in half of all U.S. homes for space heating, saw prices down about 5.6% compared to the previous winter. Lower demand and a production glut combined to push natural gas underground storage to 1,472 billion cubic feet, 69% higher year-over-year this winter.

Heating Oil

Heating oil was hit hard by lower demand and low crude oil prices. Residential heating oil prices were about 29% lower this winter compared with the previous winter. Heating oil prices are expected to rebound quickly with the end of El Nino, however, with forecast showing prices increasing 18% next winter.

Propane

Residential propane prices remained relatively flat during the winter season, averaging $1.98 per gallon. As of April 1, 2016, U.S. propane stocks were up by 2.0 MMBO to 64.9 MMBO, 6.9 MMBO (11.9%) higher than a year ago. On average, U.S. households paid 15% less for propane this winter compared with the previous winter. In the Midwest, which uses more propane than other regions, prices declined by more than 22% from the previous winter, according to the EIA.

Electricity

Electricity prices for heating change more slowly because rates in many parts of the country are set using regulatory mechanisms with long lag times. Residential electricity prices fell slightly, declining 0.5% in winter 2015-2016 from winter 2014-2015.