Pioneer offers low leverage for a high EBITDA margin

Lower oil prices have put strain on even the best of companies. Those that have managed to maintain strong balance sheets stand to weather the storm the best, as low oil prices persist. Pioneer Natural Resources (ticker: PXD) has kept its debt load low compared to its peers, giving it more breathing room in the current price environment.

In EnerCom’s E&P Weekly, Pioneer has the lowest debt-to-market cap ratio of any large-cap company. According to EnerCom Analytics, PXD carries a 13% debt-to-market cap ratio, compared to a median of 56% among its large-cap peers. Even in EnerCom’s entire E&P universe, Pioneer Natural Resources compares favorably, with the median debt-to-market cap for all 83 companies tracked at 134%.

Pioneer also announced on November 30, that the company priced an offering of $1 billion of senior notes, with the primary purpose being the purchase of the PXD’s senior notes with a maturity date of 2016 and 2017, shoring up its balance sheet through the end of the decade.

Pioneer Natural Resources highlights:

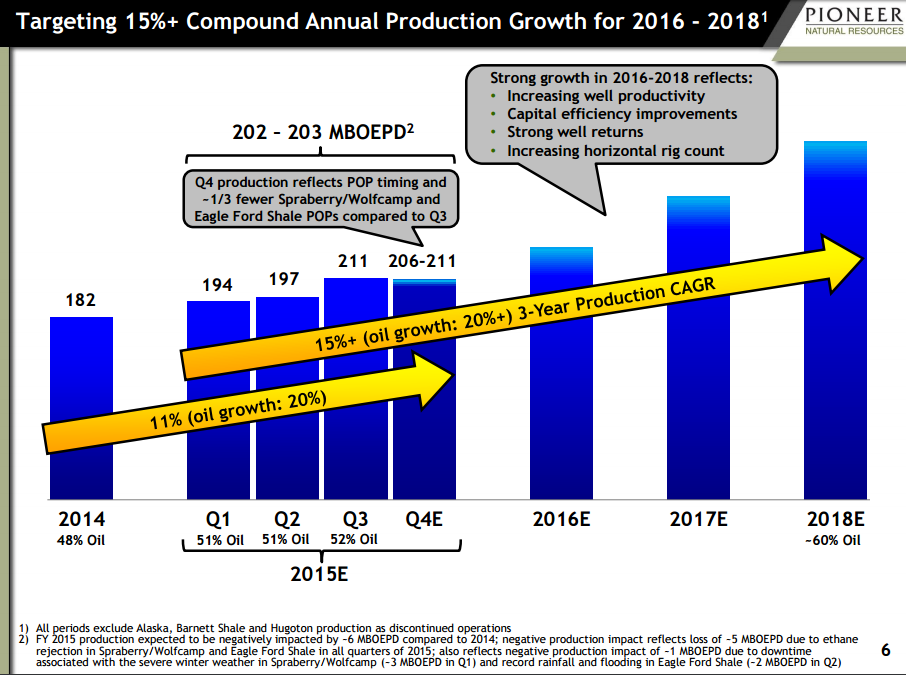

- Production for 2016 remains on target for 15% compounded annual growth rate (CAGR) through 2018 by adding two to three rigs per year on its Northern Midland Basin acreage.

- Northern Midland Basin acreage is seeing IRRs at approximately 30%+ on current strip prices, according to the company.

- Strong balance sheet allows for flexibility in operations plan. PXD is evaluating the option of keeping drilling and completions activity flat or even pulling back its rig count if prices remain at current levels, particularly on its Eagle Ford acreage.

- Strong results per BOE: Pioneer’s trailing twelve month (TTM) EBITDA per BOE of $32.63, more than twice the large-cap group’s median of $15.30.

According to the company’s investor presentation, Pioneer had net debt at the end of Q3 of $2.1 billion, which excluded both the $1 billion sale of senior notes, and a $500 million sale of its Eagle Ford midstream assets. The company’s unsecured credit facility of $1.5 billion was extended to 2020 in Q3’15, and was undrawn as of September 30, according to Pioneer.

Speaking about the company’s hedges, Senior Vice President of Investor Relations Frank Hopkins said about 90% of oil production is covered this year, with 85% coverage in 2016. “Looking at current prices, most of that coverage is three-way collars, which would get you right around $60 in today’s low price market, and then we’re covered 20% in 2017,” he said.

Hopkins said Pioneer will be focusing on the Permian Basin in 2016, with roughly 80% of its budget targeted there. “Our capital program this year, $1.95 billion for drilling, another $250 million for other capital, primarily infrastructure, a total of $2.2 billion,” said Hopkins. The capital for the company’s operations next year will come from operating cash flow, according to the SVP.