The Revolution Project will give ETP an additional 440 million cubic feet per day of capacity

Earlier today, Energy Transfer Partners (ticker: ETP) released additional information on its Revolution project, which will increase the company’s operations in the Marcellus and Upper Devonian areas of Western Pennsylvania. The company expects the overall cost of the project to be approximately $1.5 billion, according to a company press release.

ETP has entered into a long-term gas gathering, processing and fractionation agreement with EdgeMarc Energy in order to facilitate the deal. As part of the Revolution Project, Energy Transfer Partners purchased 20 miles of pipeline from EdgeMarc and will build a new cryogenic gas processing plant, a new fractionator and an additional 100 miles of 24- and 30-inch pipelines, with total gather capacity of 440 million cubic feet of gas per day. The pipeline will originate in Butler County, Pennsylvania and will run to the Revolution cryogenic processing plant, which will be built in Western Pennsylvania.

The project will also include a new fractionation plant that will be constructed at SXL’s Marcus Hook Industrial Complex in Marcus Hook, Pennsylvania. Both the cryogenic plant and the fractionation facility are expected to be online in the second quarter of 2017.

The $1.5 billion price tag will be supported by long-term fee-based agreements, according to the company. The new project should fit well into ETP’s current portfolio, which is currently 85% to 90% fee-based, according to a company presentation.

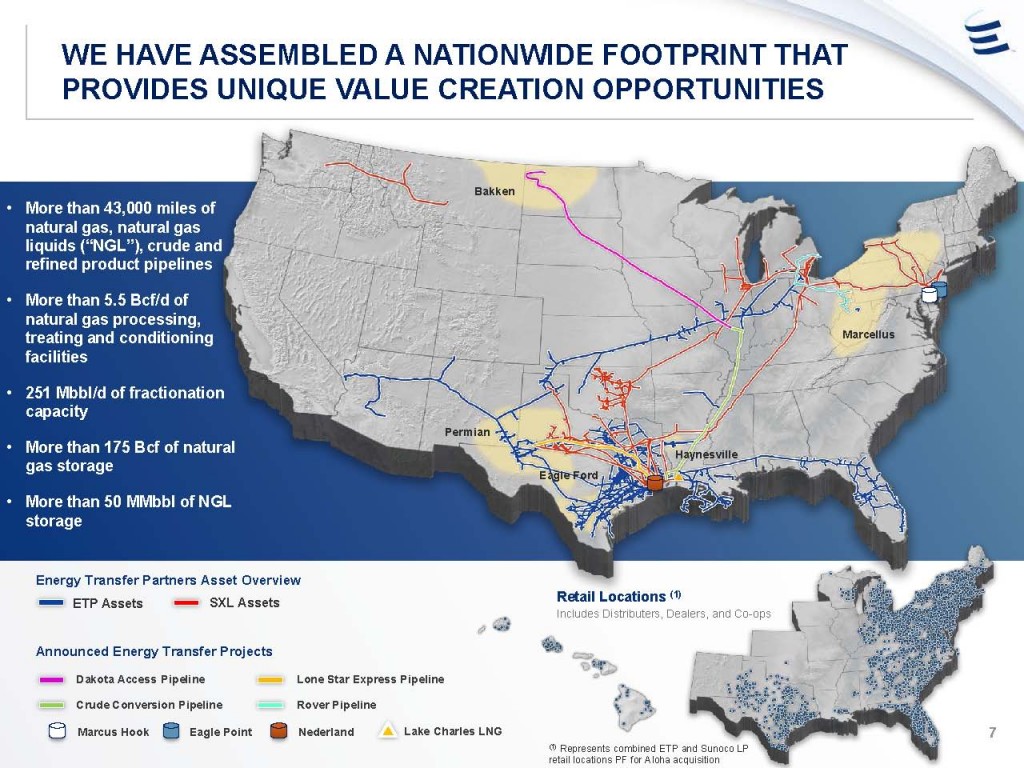

An estimated $5.8 billion will be spent on growth projects in the upcoming year, adding onto the $23 billion that has been spent on such growth opportunities and acquisitions since 2011. The company raised $2.5 billion in senior notes in March to fund its growth budget and pay off existing debt. Another $816 million was raised in the same month as part of an asset dropdown to Sunoco LP (ticker: SUN), a retail focused subsidiary.

Energy Transfer Partners is the fifth-largest MLP in EnerCom’s MLP Weekly. For the week ended June 5, 2015, ETP had a current yield of 9.4%, well above the median yield of 6.7%. The company also shows returns near the group’s average, with ROIC of 9.1%, ROA of 7.0% and ROE of 17.8%. For the group, the medians on ROIC, ROA, and ROE are 9.4%, 8.6% and 17.8% respectively.