Divested Assets Worth 3% of EPD’s Gross Operating Margin

Enterprise Products Partners (ticker: EPD), the largest master limited partnership in EnerCom’s MLP Scorecard Benchmarking Report, has sold its offshore Gulf of Mexico pipelines and services business to Genesis Energy LP (ticker: GEL) for $1.5 billion. The assets consist of 2,350 miles of offshore crude oil and natural gas pipelines and six offshore hub platforms.

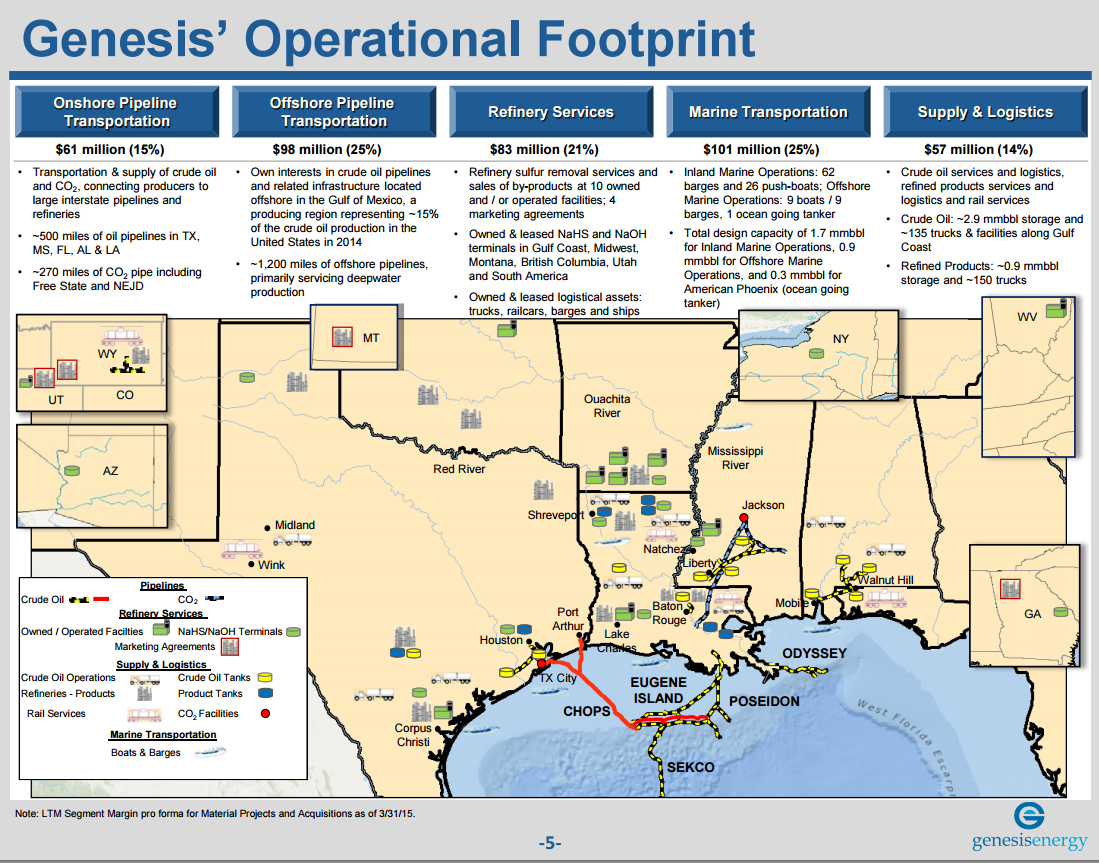

Genesis holds assets throughout the Gulf of Mexico and includes projects in refining, supply, and both onshore and offshore transportation. EPD management said its divested assets would be very complementary to GEL. “I cannot think of a better owner for the future development of these assets than Genesis,” said Michael Creel, chief executive officer of Enterprise. “For over twenty years, Grant Sims, the chief executive officer of Genesis, has been a pioneer and a visionary in the development of midstream energy infrastructure in the Gulf of Mexico.”

Prior to the acquisition, Genesis’ offshore pipeline assets consisted of interests in three separate pipelines, with none greater than 50%.

Enterprise Update

EPD management plans on allocating proceeds to onshore development, particularly in the Eagle Ford and Permian regions. The divested assets contributed to only 3% of EPD’s gross operating margin, speaking to the size of the midstream giant. Its assets still consist of 49,000 miles of onshore pipelines, 225 MMBO of liquids storage capacity and 14 Bcf of natural gas storage capacity.

EPD management said the divesture “eliminates our need for equity capital for the remainder of 2015 based on our current expectations,” and the first payment of the EFS Midstream acquisition is now fully financed. EFS was purchased from Pioneer Natural Resources (ticker: PXD) in June 2015 for $2.15 billion and will be paid in two installments, with the first installment of $1 billion to be received no later than June 2016.

The EFS Midstream system includes approximately 460 miles of natural gas gathering pipelines, 10 central gathering plants, 780 MMcf/d of natural gas treating capacity and 119 MBOPD of condensate stabilization capacity in the Eagle Ford Shale.

Capital One Securities viewed the divesture favorably in a note on July 16, 2015, saying, “Given the partnership’s current project backlog and planned build-out of its integrated midstream system, we have no doubt that EPD can backfill the lost cash flow with more accretive growth projects, particularly focused within the Eagle Ford, Permian, and along the Gulf Coast.”