Lower oil prices push liquid storage levels higher

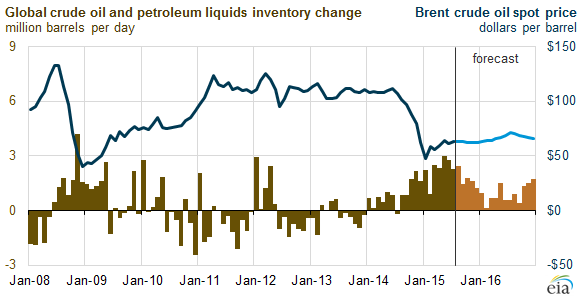

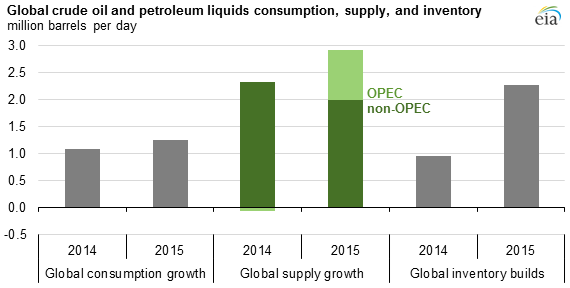

As global oil production continues to outpace demand, storage levels for petroleum and other liquids has grown at a pace not seen in 17 years. Total global liquids inventories are estimated to have grown by 2.3 MMBOPD through the first seven months of 2015, the highest level of inventory builds through July of any year since 1998, according to the Energy Information Administration (EIA).

Continued builds in liquids inventories has put significant downward pressure on oil prices throughout 2015, with West Texas Intermediate breaking below $40/bbl and Brent crude breaking below $45/bbl today.

Most of the supply growth in 2015 has come from producers outside of OPEC, with EIA estimates placing non-OPEC petroleum and other liquids production growth at an average of 2.0 MMBOPD in the first seven months of the year, while OPEC liquids production is estimated to have grown by 0.9 MMBOPD over the same period.

U.S. production slowing but glut persists

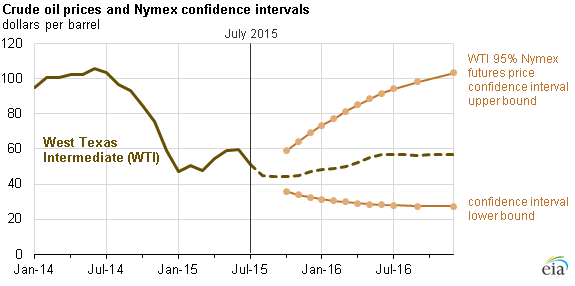

While non-OPEC production continues to be the largest contributor to global liquids growth, the EIA’s Short-Term Energy Outlook (STEO) showed production from the U.S. declined by 100 MBOPD in July. The EIA expects production will continue to decline through mid-2016 before growth resumes late next year.

Despite slowing production from the U.S., the global crude oil glut is expected to persist, continuing to put downward pressure on oil prices. Last week, the EIA lowered its price expectations for WTI for both the remainder of this year and for 2016. The EIA’s new price deck expects WTI to average $49 per barrel for 2015, and $54 per barrel next year, a decline of $6 and $8, respectively.

The pace at which global liquids inventories are growing was a deciding factor for the EIA’s lower price expectations, along with slower economic growth in emerging markets, continuing supply growth, and the possibility of Iranian crude oil adding to the global supply glut.