Global accounting giants speak out: oil and gas M&A values up 69% in 2014 despite a decrease in overall deal volumes, more megadeals coming in 2015

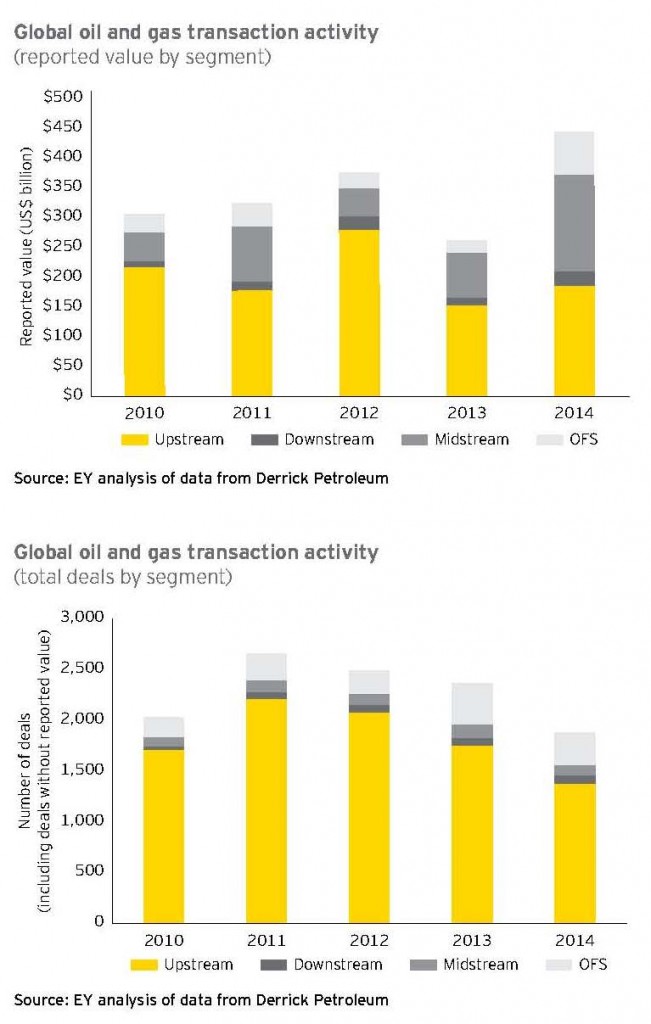

Data released by Ernst and Young (EY) shows that while the total volume of merger and acquisition deals in 2014 was 20% lower than the total volume in 2013, the overall value (or size) of the transactions grew in every sector of the oil and gas industry. Global oil and gas deal value increased by 69% in 2014 according to EY’s Global oil and gas transactions review 2014.The total value of global deals in 2014 totaled $3.2 trillion, making it the fourth largest annual value for mergers and acquisitions in history.

Despite the more than 50% decline in the price of oil since June of 2014, total global deal value in the oil and gas industry grew to $443 billion – well above the previous peak in 2012 of $374 billion. Of the $443 billion in oil and gas M&A in 2014, $71.2 billion came from foreign investors, representing a 10-year high, according to PwC US, another of the world’s largest accounting firms.

By segment, deal value in 2014 increased on a year-over-year basis by 21% in upstream, 88% in downstream, 115% in midstream, and a massive 242% in oilfield services. Deal volume declined in all sectors, excluding downstream.

Upstream

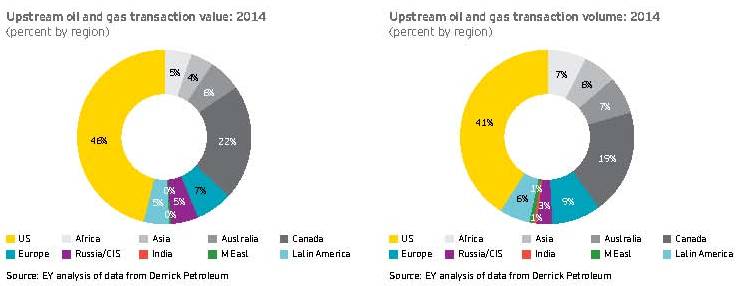

Transactions in the upstream sector of the market continued to account for the largest portion of M&A, making up almost 75% of the total global deal volume, despite a 22% decline in year-over-year volume. 2014 was also the first time upstream transactions fell below 50% of total deal value, even though year-over-year value growth was 21%.

Notable upstream M&A deals in 2014 include Whiting Petroleum’s (ticker: WLL) $6 billion purchase of Kodiak Oil & Gas and Repsol’s $13 billion acquisition of Talisman Energy (ticker: TLM). Of the total value of global upstream transactions in 2014, 65% ($120 billion) were attributable to 50 deals greater than $1 billion in value.

Downstream

Downstream transaction activity recorded its highest deal volumes and aggregate volume in two years with a 16% increase over 2013. Total deal value also grew by 88% year-over-year to $25 billion.

The U.S. accounted for the largest number of downstream transactions – approximately 56% – while Asia (including Australia) and Europe accounted for about 16% to 18% of total share, respectively. While European activity fell 30% due to economic uncertainty and supply/demand imbalances in 2014, the downstream segment shows no signs of slowing, says EY.

Andy Brogan, EY’s Global Oil & Gas Transaction Advisory Services Leader, said, “Over 70% of downstream transactions in 2014 involved storage terminals in the U.S., and that figure could be on the rise if the country begins exporting crude oil.”

Midstream

With just 102 announced deals in 2014, the number of midstream transactions fell more than 23%, but deal value more than doubled to $161 billion as a result of several large transactions. With the unconventional resource boom in the U.S., attention to infrastructure investment is at an all-time high, with the U.S. and Canada accounting for more than 78% of global deal volume and about 94% of overall deal value.

MLPs

According to EY’s research, the midstream segment experienced increased consolidation in large part due to companies in the sector pursuing the advantages of a Master Limited Partnership (MLP) structure. Enterprise Products Partners (ticker: EPD), currently the largest MLP, completed a $6 billion merger with Oiltanking Partners (ticker: OILT) in November. Kinder Morgan (ticker: KMI) made a huge contribution to the spike in midstream M&A, consolidating its three entities in August for a total transaction value of $70 billion. Oil & Gas 360® provides updated data for 26 comparative metrics for 67 oil and gas industry MLPs in its weekly MLP analytics update, “MLP Scorecard.”

Oilfield Services

Of all the sectors covered in the EY research, the oilfield service sector saw the largest growth in deal value (242% increase). The $72 billion in oilservice M&A was due in large part to an announced megadeal combining Halliburton (ticker: HAL) and Baker Hughes (ticker: BHI) for $34.6 billion, but even without the massive HAL deal, total value grew by a more modest, but still impressive, 62%. The HAL+BHI transaction is expected to close in the second half of 2015.

EY’s Brogan says, “Over the next year, we expect the transaction trend of consolidation to continue in the [oilfield service] segment as companies try to capitalize on scale, improve operational efficiency and cost bases that have been hit hard by inflation and commodity price uncertainty.”

Shale’s strong contribution: $110 billion in 2014, led by Bakken and Permian

According to data from PwC, there were more than 24 deals with values greater than $50 million related to shale plays during Q4 2014, totaling $57 billion. This represents a 139% increase in total deal value compared with Q4 2013.

For the full-year 2014, there were 107 shale deals that contributed $110.3 billion, a 107% growth in deal value when compared to full-year 2013.

By sector, shale deals represent 19 transactions worth $14.9 billion in upstream deals. By volume, upstream deals represented 76% of total upstream deals in Q4 2014. There were five midstream shale-related deals in Q4 2014, accounting for $42.1 billion.

According to John Brady, a Houston-based partner with PwC’s energy practice, “A sustained low-oil environment is driving an intense focus on returns and the deployment of assets to the most efficient shale plays.”

The most active shale plays for M&A with transaction values greater than $50 million during Q4 2014 were the Bakken and Permian, which each had four deals worth $3.1 billion and $2.4 billion, respectively. The Marcellus shale contributed three deals worth $5.7 billion. The Eagle Ford in South Texas contributed three deals worth $484 million, while the Niobrara and Haynesville each generated one deal, PwC said.

More Megadeals in 2015

Another note release by EY last week says the company expects 2015 to follow last year’s trend and show continued growth in the size of M&A deals in the oil and gas industry. The note says that low oil prices will affect the decision-making process of companies active in the M&A market, but while some see risk, many will take advantage of opportunity.

“The divergent economic performance expected in 2015, with the U.S. and U.K. outpacing the Eurozone, China’s growth moderating, and India and Japan at a crossroads, will provide further stimulus for M&A activity,” the note said.

EY expects 2014’s trend of megadeals to continue into this year. “The search for top-line growth will influence deal-making in 2015. Megadeals will continue to hit the headlines as executives hunt for growth,” said Pip McCrostie, EY’s Global Vice Chair – Transaction Advisory Services.

McCrostie also said that mid-sized deals would help propel further growth in 2015, with management teams looking to acquire assets in or adjacent to their core sectors – boosting market share, managing costs and improving margins.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.