Two oilservice giants standing tall in face of downturn

The oil and gas industry may be bracing for a downturn in drilling operations, but Halliburton (ticker: HAL) and Baker Hughes (ticker: BHI) are entering 2015 on the heels of one of the finest years in each company’s respective history.

Discussions for the merger are continuing as planned and are expected to close in 2H’15. HAL said the valuation will fluctuate in relation to its common stock price, but current valuations place BHI shares at 1.12 HAL shares in addition to $19.00 in cash. The boards of both companies unanimously approved the $34.6 billion deal in November. If the merger is successful, BHI shareholders are in line to hold a 36% stake in the “new” Halliburton.

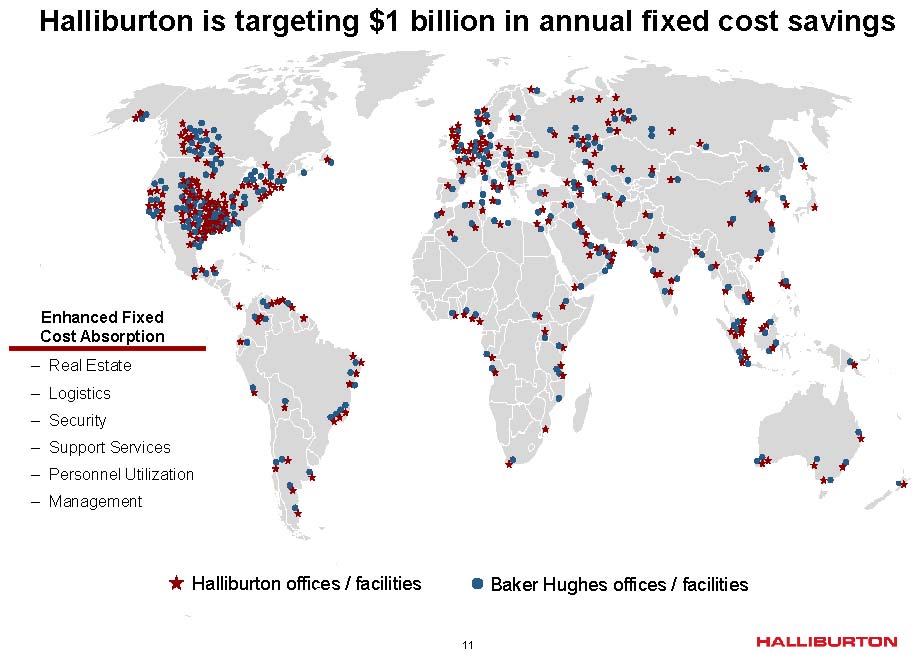

In a conference call following the merger announcement, HAL said it expects synergies of $2 billion once the acquisition is complete. Mark McCollum, Chief Financial Officer of Halliburton, reminded the public that HAL increased its dividend by 20% late in the year and has returned $7 billion to its shareholders since 2010. “The proceeds from the breakage will likely be used to buy back shares in coming years. And so we’ll be able to adjust the leverage as we go through the buybacks and get our final financing in a way that we’ll still have a very strong investment-grade credit profile,” he said.

HAL management said in its Q4’14 conference call that 33% of all cash flow from operations in 2014 was returned to shareholders.

North America the Stronghold

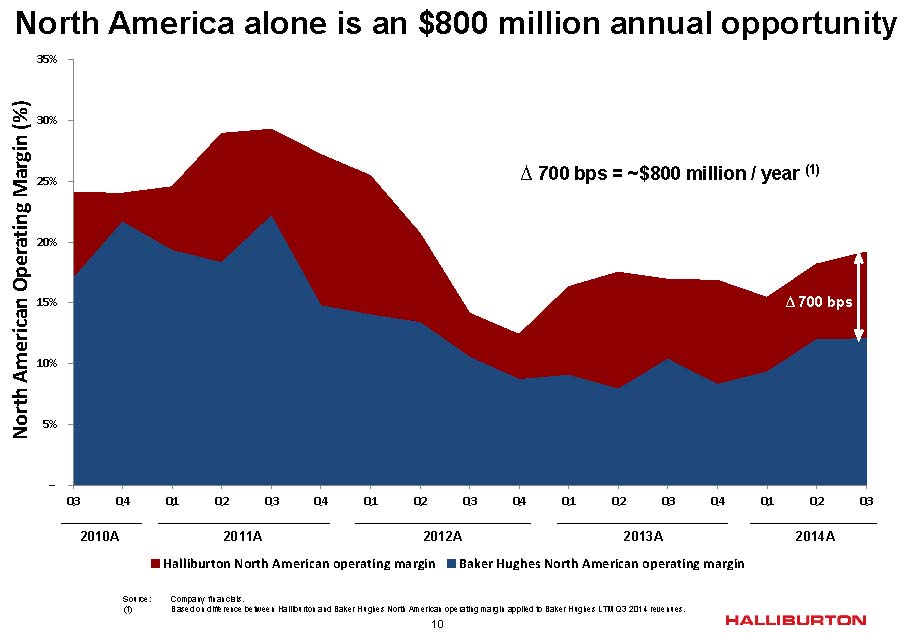

HAL management said expanding its presence in North America was a major selling point to acquiring its longtime oilservices rival, but its existing operations just closed the book on a record year in 2014. The company reported adjusted operating income in its North America segment increased by 23% on a year-over-year basis, leading to overall operating income of $5.1 billion in 2014. Revenues also grew by 16%, leading to $32.9 billion for the fiscal year. Total net income for Q4’14 was $900 million, or $1.06 per share.

BHI’s North American operations, meanwhile, set a company revenue record in Q4’14, citing increased activity levels in Canada, West Texas and the Gulf of Mexico. Latin America was its most profitable segment and was attributed to new drilling contracts in Brazil. “This is a remarkable turnaround for a business that was unprofitable only six quarters ago,” said Kimberly Ross, Chief Financial Officer of Baker Hughes.

International Operations

HAL also reported company records in its Eastern Hemisphere segment, increasing its 2014 fiscal revenue and adjusted operating income by 10% and 12%, respectively, compared to 2013. The improvements come largely from operations in the Middle East and Asia, which happens to be the fastest growing segment in BHI’s portfolio. On the other hand, HAL’s income from the Latin American segment slipped by 19% on the year due to delays in Brazil. Income from its Europe/Africa/CIS division also fell by 9% on the year, but the results from the ruble’s decline is evident in its Q4’14 results.

Operating income for Q4’14 in the Europe/Africa/CIS segment was $82 million – down from $216 million in Q3’14 and $207 million in Q4’13. HAL said the decline is due to “lower profitability in the North Sea, Russia and Angola,” and also singled out Norway’s currency weakness in the call. BHI maintained a flat quarter-over-quarter revenue in the Russia/Caspian region, but said “Increased revenue from year-end product sales of completion systems was offset by the unfavorable devaluation of the Russian ruble.”

Halliburton management said it plans on maintaining capital expenditure levels in 2015.

Prepared for a “Challenging” 2015

2014 can be seen as a positive for both companies (Capital One Securities simply said, “BHI crushed it”), but the oilservice providers were not immune from the industry downturn. Baker Hughes announced it will lay off about 7,000 employees, or roughly 11% of its workforce, to cope with the capital-tightened market. Martin Craighead, Chairman and Chief Executive Officer of BHI, said the declining rig counts “will clearly affect results in 2015,” according to the company release.

Dave Lesar, Chairman and Chief Executive Officer of Halliburton, explained the U.S. land rig count has decreased by 250 rigs, or about 15%, in the last 60 days. “It is clear that 2015 will be a challenging year for the industry,” he said. “Capital expenditure budgets from our customers remain fluid, but so far on average have been reduced 25% to 30% as they adjust their spending to operate within their cash flows.” HAL management added that, despite the activity declines, oil demand is forecast to increase by 900 MBOPD in 2015, and unconventional decline curves are currently in excess of 30%. “Although oil demand growth expectations for 2015 have weakened, it’s still growth,” said Jeff Miller, President of HAL.

Future Indicators

HAL executives identified some interesting trends in the call, which were explained in detail by Miller. “This trajectory is similar to both the 2001, 2002 cycle and the 2008, 2009 cycle and in those cases, we experienced a rapid correction to the rig count going from peak to trough over a three-quarter period,” he said. “In international markets, we keep a close eye on revenue per rig, which helps us understand the overall health of the business. Although this metric took a step backwards during the 2009 economic downturn, we’ve seen consistent improvement over the last four years. In fact, we’re in a better position now than going into the last cycle. Our 2014 revenue per rig is more than 20% higher than in 2008.”

Baker Hughes management said it is seeing a “growing inventory of wells drilled but not completed as some customers are electing to delay completions and defer production.”

HAL mentioned its demand for sand increased by 46% year over year and has been a catalyst in improving well efficiency. In EnerCom’s Oil & Gas Conference® 19, SunTrust Robinson Humphrey mentioned the word “sand” was brought up in almost every single one of the 118 company breakout meetings.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Analyst Commentary

Capital One Securities (1.20.15)

BHI 4Q Quick Take

$56.56, OVERWEIGHT, $63.00 Target

BHI crushed it. 4Q EPS of $1.44 vs our est of $1.11 and the Street's $1.07. The beat of our est was due to +16c NA, +6c LA, +3c Europe/Africa/Russia/Caspian, +7c M East/Asia, and +6c taxes which was partially offset by lower Industrial EBIT and higher corp expenses. NA revs were +4.7% q/q (+0.8% est) and margins improved q/q from 12% to 14..8% (12.4% est) and came very close to BHI's 15% tgt. LA revs were +3.5% q/q (+8% est), but margins popped q/q from 12.4% to 20% (13% est). EH revs were +7% q/q (+6.5% est), and margins grew q/q from 13.6% to 18.4% (15% est). Substantial improvement was shown across all geo-mkts, and the main question is: are these the operating results to start the decline off of in '15 or is it 3Q levels?

HAL 4Q Quick Take

$39.13, OVERWEIGHT, $41.00 Target

Positive. 4Q EPS of $1.19 vs our est of $1.07 and the Street's $1.10. The beat of our est was due to +1c NA, +2c M East/Asia, and +1c corp w/ the balance coming from taxes. NA revs were flat as expected, and margins increased slightly from 19.2% to 19.4% (19.1% est) w/ a benefit from cost efficiencies and the continued roll-out of strategic initiatives. L America revs were +2.8% (+2% est) q/q, and margins declined less than expected from 13.2% to 12.3% (11.8% est). E/A/CIS revs dropped 8.1% q/q (-7.4% est), and margins declined q/q from 14.8% to 10.5% (10.9% est). M East/Asia revs grew 10.4% q/q (+7.9% est), and margins expanded substantially from 17.8% to 20.8% (19.6% est).