Goodrich Petroleum (ticker: GDP) is turning two of its six uncompleted Tuscaloosa Marine Shale (TMS) wells online and expects initial production within two weeks.

The Houston-based exploration and production company will turn the remaining four wells online before its borrowing base redetermination in October. Three nearby completed wells, all operated by GDP, returned respective 24-hour rates of 1,370, 1,275 and 1,240 BOEPD with an average length of about 6,000 feet with 20 frac stages.

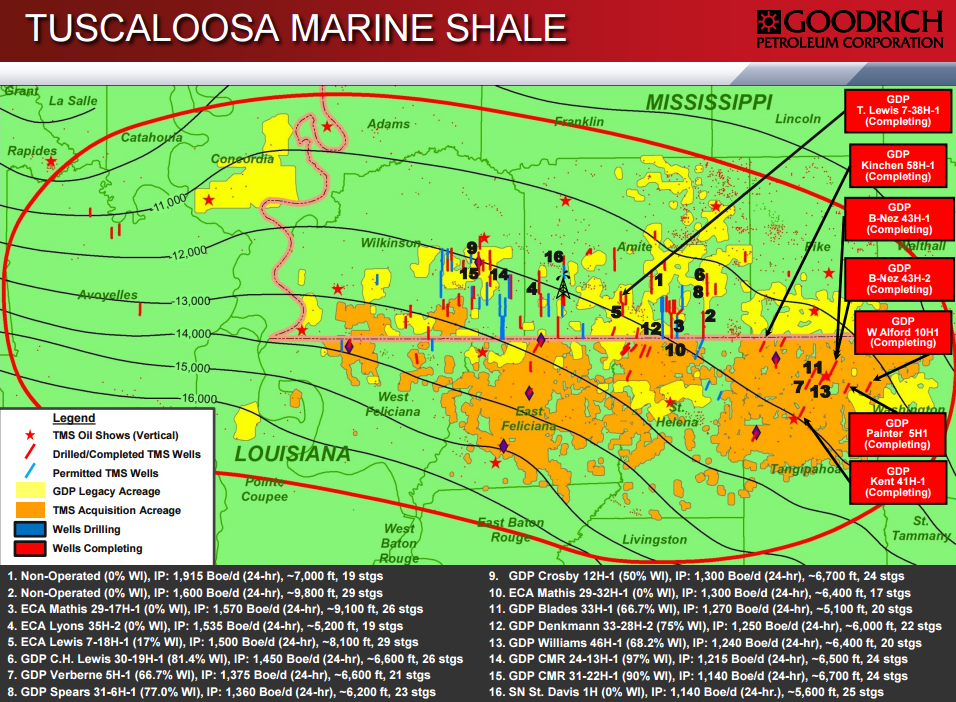

GDP reaffirmed its budget guidance of $90 to $110 million with fiscal 2015 production of 8.6 to 9.5 MBOEPD (about 55% oil). The company has no running rigs in its core properties, which consist of 526,500 gross acres (392,930 net) in the TMS, Eagle Ford and Haynesville. More than 325,000 net acres are located in the TMS, spanning across Louisiana and Mississippi.

TMS Update

Goodrich Petroleum has piqued industry interest due to its involvement in the TMS – a deep, technologically challenging play. The results are certainly there: GDP’s type curves range from 600 to 800 MBOE. However, the well costs of about $10 million apiece, combined with the general uncertainty regarding the play’s characteristics, add to the difficulty. Considering the well costs and type curves, the internal rate of return for the mentioned type curves can range from 14% to 30% at $55 oil prices. The company also gains about a $4 premium to West Texas Intermediate, considering the TMS yields Light Louisiana Sweet oil.

GDP plans on returning a rig to the region in October.

Encana Corp. (ticker: ECA), another regional operator, is not running a full-time rig and has type curves of 600 to 700 MBOE at costs of $11 to $13 million per well. ECA management does not consider its TMS assets as core acreage. In a previous interview with Oil & Gas 360®, Rob Turnham, President and Chief Executive Officer of Goodrich, said well costs were initially about $13 million apiece but have declined as GDP has acquired greater knowledge of the play.

The company continues to evaluate opportunities for expansion via a joint venture of the sale of its Eagle Ford Shale assets. It still holds more than $100 million in liquidity.