- Analysts Impressed by Single-Digit Margin Losses

- Awaiting the Storm: 4,000 Deferred Well Completions

Halliburton (ticker: HAL) had a tall task to live up to its record revenues from fiscal 2014, and although the company reported losses in Q1’15, its financials beat street estimates and showed resilience in an oilservice market that has become oversupplied.

Halliburton management estimated that as many as 4,000 North American wells have been deferred completion by the E&Ps until oil prices recover, while Baker Hughes estimates that as many as 20% of the recently drilled wells have been placed in inventory.

Halliburton reported a net loss of $643 million, or ($0.76) per share, for the quarter ended March 31, 2015, compared to net gains of $622 million, or $0.73 per share in the prior sequential quarter, Q4’14. The company earned a profit of $901 million, or $1.06 per share, in Q1’14. Its revenue of $7,050 million for Q1’15 represented respective declines of 4% and 20% compared to Q4’14 and Q1’14, but the swing into the red was influenced by $823 million in company-wide charges related to various write-offs, write-downs, impairments, severance costs and other charges. Operating loss in Q1’15 was $548 million.

HAL management noted that the 4% quarter-over-quarter revenue loss in Q1’15 outpaced the 19% drop in international rig counts, and said it anticipates headwinds for the remainder of the year. In what will likely be a theme for oilservice providers this earnings season, HAL reported significant income drops in its North American segment. Total revenue in North America was $3,542 million, down 9% and 25% in comparison to Q4’14 and Q1’14. Operating income declined by 54% and 70% for the same time periods. HAL said activity has dropped roughly 50% since last November, which is in line with the reduction in rig count.

Although operating income took a huge hit at face value, analysts participating in the conference call were impressed by the company’s ability to keep North American revenue losses in single figures even though rig counts and activity have essentially been cut in half. “Overall better than consensus,” said a note from Capital One Securities. “[But] lower-than-expected margins in North America, on better-than-expected revenue, indicate severe pricing pressure.”

The international markets were “more resilient than the domestic market, but were not immune” to the commodity environment, said Jeff Miller, president of Halliburton, in a conference call. Revenue in its combined international markets reached $3,508 million in Q1’15, representing an increase of 2% compared to Q4’14 and a decrease of 13% compared to Q1’14. Operating income actually increased compared to Q4’14 in its Latin America and Middle East/Asia divisions, but could not offset the loss in North America. HAL said increased activity in Venezuela, Argentina, Saudi Arabia, Iraq and India drove its sequential improvement. The company noted declines occurred in Angola, Norway, Mexico and Australia.

HAL management expects a “mid-teens” year-over-year reduction in international spending, with the Middle East being the most stable region due to recent project awards in four OPEC countries, including Saudi Arabia. International revenues and margins for Q2’15 are expected to be in line with Q1’15.

Overall, its completion and production segment was hit hardest by the downturn, with its Q1’15 operating income of $462 million representing declines of 30% and 56% compared to Q4’14 and Q1’14. The completion segment has historically accounted for about two-thirds of HAL’s revenue. Its drilling and evaluation segment posted operating income of $306 million in the most recent quarter, equating to declines of 24% and 36% for the respective quarters listed above.

Baker Hughes Q1’15 Results

Meanwhile, revenues for Baker Hughes totaled $4,594 million in Q1’15, down 20% and 31% compared to Q4’14 which was $5,731 million, and Q1’14 which was $6,635 million. The company reported a net loss of $589 million, or ($1.35) per share, for the quarter ended March 31, 2015, compared to gains of $328 million, or $0.75 per share, and $663 million, or $1.53 per share, for Q4’14 and Q1’14, respectively. BHI’s North America segment has historically accounted for roughly half of its revenue, and its presence in the region was a key driver in HAL’s recent takeover offer.

Similar to its acquiring company, BHI realized the largest revenue reductions in North America, with its Q1’15 revenue of $2,006 million representing declines of 28% and 39% compared to Q4’14 and Q1’14. Its combined international markets posted $2,588 million in the latest quarter, representing declines of 12% and 22% for the same quarters listed above. Profits before tax declined across all geographic regions, with North American operations posting a loss of $209 million.

Synergies and Divestures Update

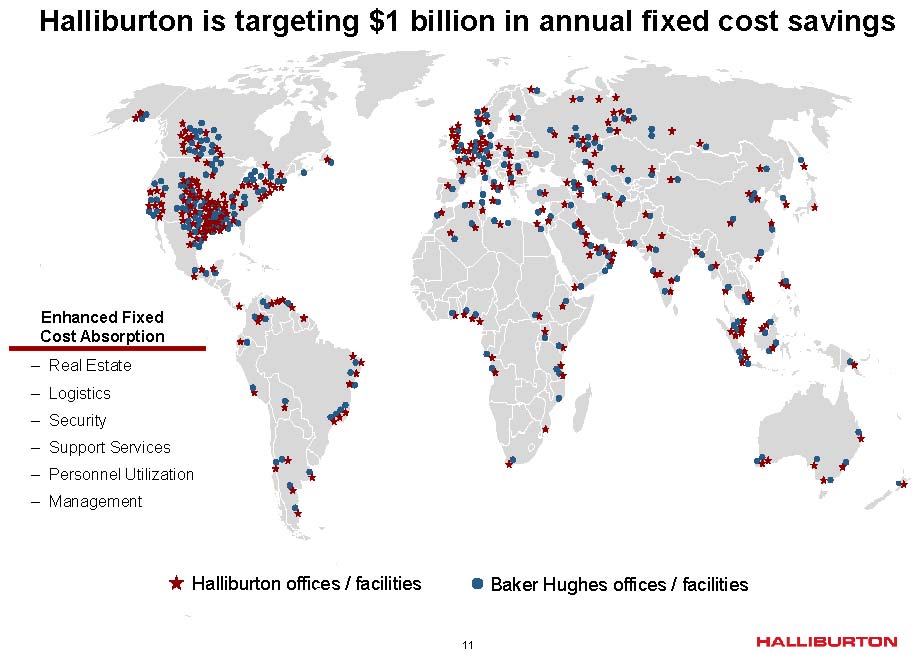

The two oilservice giants are moving forward with the proposed $34.1 billion merger and still expect the deal to close in Q2’15, but an actual timeline cannot be set due to its ongoing discussions with the Department of Justice. Shareholder approval of the deal was virtually unanimous from both parties.

The companies previously expected divest as much as $10 billion in assets in order to avoid antitrust concerns with the United States government, but recent comments from management believe the level of divestures “will be substantially below the $7.5 billion threshold previously laid out in the merger agreement.”

On April 7, Halliburton announced plans to sell its Fixed Cutter and Roller Cone Drill Bits, Directional Drilling and Logging-While-Drilling/Measurement-While-Drilling businesses. Mark McCollum, Chief Integration Officer of Halliburton, said he expects the businesses to be sold well above book value based on the level of interest. “These types of assets only come on the market once in a generation,” he said in the conference call. “We’ve had a tremendous outpouring of response to very quality potential buyers.”

The company also said it intends to preserve its global delivery infrastructure in the current environment but will contribute to the $2 billion in expected synergies once the transaction is finalized.

Halliburton did not comment on guidance past Q2’15 due to the murky waters of recovery, but did mention that “encouraging” estimates from government agencies consist of production leveling off in major U.S. basins. Accordingly, its 2015 capital guidance was revised downward to $2.8 billion on the year, a reduction of $0.5 billion.

Miller stopped short of calling it a recovery, saying the information at this point is too unclear, but said market fundamentals in North America gives it an advantage compared to its international peers. “We’re not going to call the bottom, but historically it’s taken rig count three quarters to move from peak to trough,” he explained. Christian Garcia, Acting Chief Financial Officer, added that HAL typically outpaces changes in the rig count, likely due to its prominence in the field.

Capital One said the 4,000 uncompleted wells may result in a tailwind to some degree, but it is too difficult to predict when the wells will be completed and placed into service. The firm said near-term pricing pressure and uncertainty will continue to cloud short-term forecasts. Those factors may be more impactful on smaller oilservice players this earnings season, considering HAL and Schlumberger (ticker: SLB) have the size and stability to weather the commodity storm.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.