Higher royalty payments would pressure Alberta oil & gas producers

A report from BMO Capital Markets warned that increasing royalty payments in the Canadian province of Alberta could dampen business as it has in the past, but that the current review could potentially be better than those in the past, as the board has a stronger grasp of the outcomes of a royalty rate change, says BMO.

The review comes following the election of New Democratic Party (NDP) Leader Rachel Notely to the position of Premier in Alberta. The party was elected on a platform that included more taxes for corporations, and a review of the oil and gas royalty system to ensure that the government was receiving a fair share of revenues.

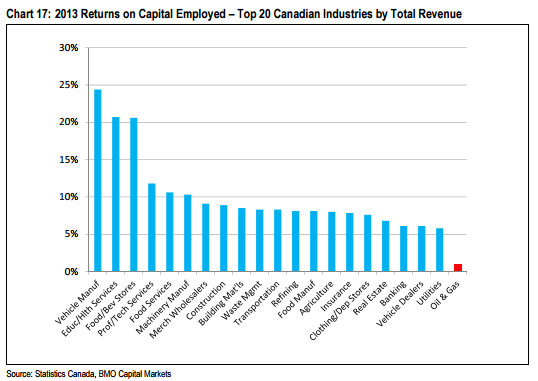

The BMO report warned that the Alberta oil and gas industry may not be competitive enough to withstand higher royalty rates, noting that the industry generates a relatively low return on capital employed compared with other industries in the province. Even at oil prices around US$100/bbl, the industry in 2013 only saw ROCE of about 1%.

Alberta’s returns on capital have been sub-4% since 2011, which is similar to B.C., but well below 11% in Saskatchewan and 9% offshore along the east coast of Canada, notes BMO. Returns on capital from for unconventional resources and natural gas are also low, about 2% each according to BMO, making them relatively uncompetitive with producers in the U.S., where returns are 8% and 11% for natural gas and tight oil, respectively.

Not the first time Alberta has worried about its fair share

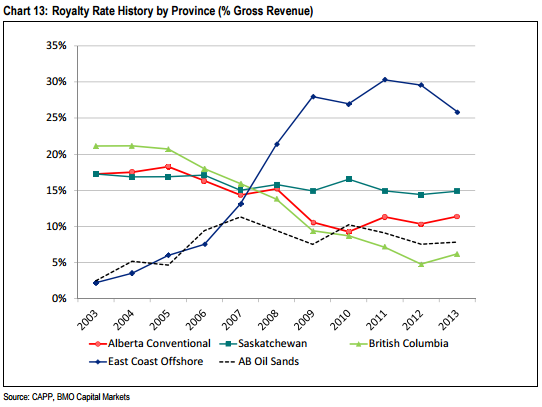

The last time the royalty structure in Alberta was review was in February 2007, when the government appointed a panel to review the processes that had been in place for the previous 10 years. The panel recommended increases of up to 20%, with the government share increasing to 64% from 47% in the oil sands, 49% from 44% for conventional crude oil, and 63% from 58% for natural gas.

The plan was strongly criticized by the oil and gas industry, which said that implementing the new royalty scheme would push investment out of the province. In October of 2007, a compromise was reached in which royalty rates were raised, but more sensitivity was given to commodity prices. Following the economic crisis, “transitional” rates were offered to certain wells, and in 2011 minor changes were made to the overall rate structure.

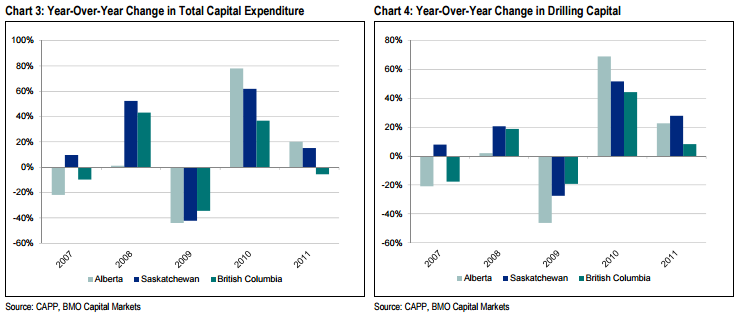

The changes in the royalty system in 2007 had a meaningful impact on Alberta’s competitiveness though, says BMO. Activity began to fall with rig utilization rates falling to 40% in 2007 from 60% the year before. Corresponding investment decreased 21% in 2007 to $18 billion and remained depressed through 2008, representing a cumulative loss of investment of nearly $10 billion leading up to the global financial crisis, said BMO.

Investment dollars from Alberta were displaced into surrounding provinces like British Columbia and Saskatchewan given their geological connection with plays in Alberta. Total capital expenditure in B.C. and Saskatchewan increased roughly 40-60% though 2008, while drilling-specific capital fell only half the amount as in Alberta during the 2009 downturn – a reflection of the relative economics, says BMO.

Potential for a positive outcome

Despite the negative effects of the last royalty review, BMO remained positive that the current review could lead to some positive outcomes. Importantly, said BMO, “the government’s appointed panel represents a good mix of relevant members that understand the economics and challenges of industry, as well as the possible unintended impacts of policy changes.” Whatever changes the panel decides to make will also not come into effect until 2017.

The Alberta oil and gas industry already faces a difficult challenge in trying to attract investment capital with its relatively low rates of return. Pressure from both other provinces and U.S. shale drilling has left the industry in Alberta in a tough position already, but BMO notes that the review will focus specifically on how royalty rates adjust to the upside in oil prices, hopefully leaving the industry unharmed in this already difficult price environment.