Demand to edge up as some production goes offline in 2015

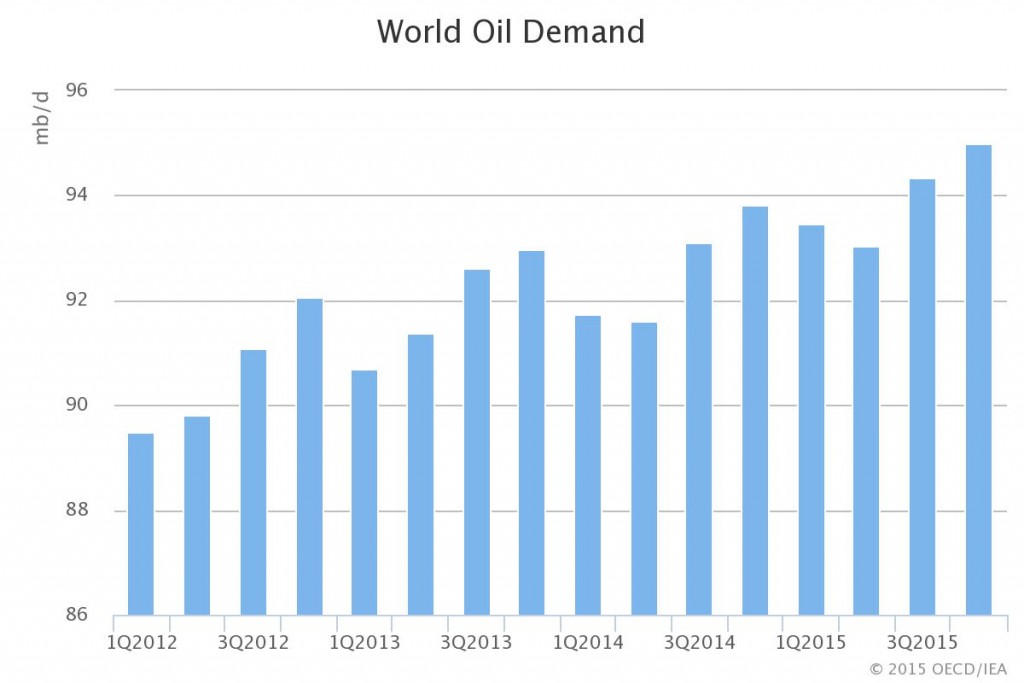

The International Energy Agency (IEA) released its monthly Oil Market Report (OMR) for the month of June today, projecting stronger than anticipated global demand growth through 2015. Global demand is expected to grow at 1.7 MMBOPD for the first quarter of 2015 and 1.4 MMBOPD for the rest of the year. Growth is expected to ease off after this quarter with the return of normal weather and the partial recovery of oil prices.

The IEA’s report noted that global supply has also eased off the gas in recent months, with global oil supplies falling by 155 MBOPD in May to 96 MMBOPD. Most of the slowed growth was the result of lower production from non-OPEC countries, the IEA noted. Global production remained 1 MMBOPD higher than in May of 2014.

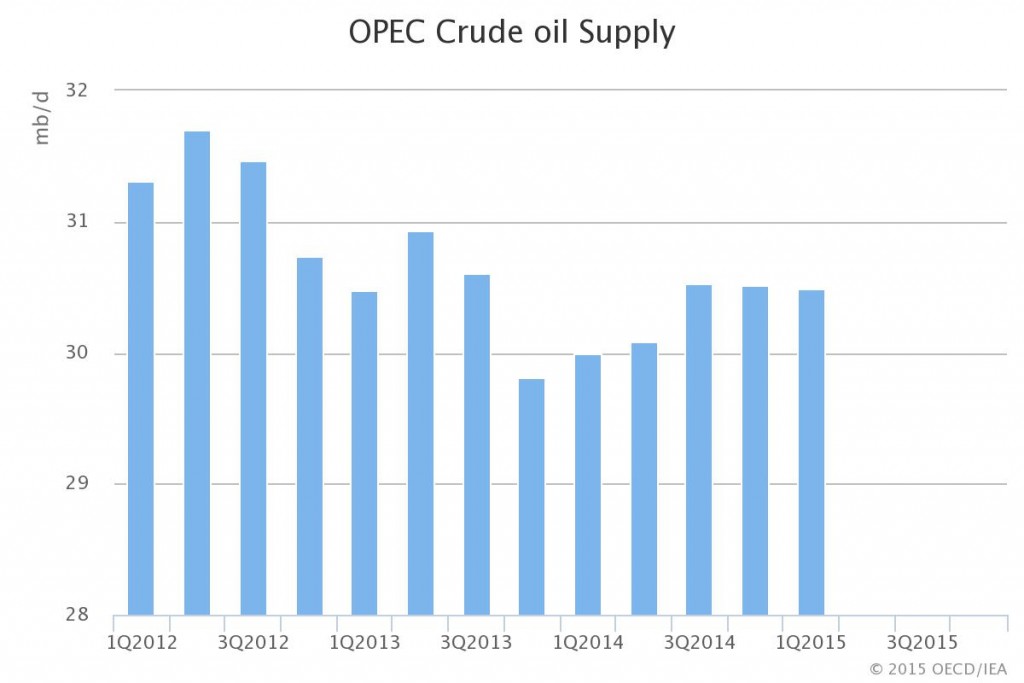

Oil supply from OPEC countries continued to rise, with the IEA estimating that the group produced 31.33 MMBOPD in May, 50 MBOPD higher than in April, and the group’s highest levels of production since August 2012. In OPEC’s June Oil Monthly Report, the group restated a strong commitment to maintaining market stability even as production was pushed higher. Saudi Arabia, Iraq and the UAE all produced at record levels in order to keep OPEC production 1 MMBOPD over its stated quota, says the IEA.

The IEA’s report notes that prices are being supported by an “imbalancing act” in the global refining industry. Global refinery crude runs reached an estimated 77.9 MMBOPD in April, 0.3 MMBOPD lower than in March, and 1.7 MMBOPD higher than a year earlier, said the report. Delayed new capacity of 1.5 MMBOPD in non-OECD regions lifted product cracks and OECD refining utilization rates, causing backwardation to re-appear in oil products markets.

Inventories continued to build as production outpaced demand, but their breakdown by product and region doesn’t match that of demand, says the IEA. This mismatch in supply and product demand seems to be supporting prices, according to the international agency. This support could weaken as more refining capacity comes online.