An early Spring is on its way – at least, according to America’s favorite amateur weather forecaster.

On February 2, 2016, in the small town of Punxsutawney, Pennsylvania, the folk hero groundhog emerged from his burrow and declared his annual prediction to a crowd recovering from libations the night before.

The President of the Groundhog Club spoke on his behalf. And assuming nothing was lost in translation, the 20-lb. rodent was apparently unfazed by his shadowless surroundings and declared an early spring is on the horizon. According to legend, in the event that Phil sees his shadow, he retreats to his burrow in Scrooge-like fashion and forecasts six more weeks of winter. Today was not the case.

Temps in the 20s

Temps in the 20s

The prediction was met with soft cheers from the crowd enduring temperatures in the 20s. Natural gas bulls, if within earshot, would not have elicited the same response. Rising temperatures amid an already-mild winter would add to the natural gas oversupply, and for Phil to make such a declaration above the very ground of the Marcellus Shale is ironic in every sense of the word.

If the kingpins of natural gas had a choice, they’d prefer a climate like that in the Groundhog Day movie of 1993. And to quote Bill Murray, they’d say: “I’ll give you a winter prediction: It’s gonna be cold, it’s gonna be grey, and it’s gonna last you for the rest of your life.”

Fact Check: How Accurate is Phil?

Today was Punxsutawney Phil’s 130th appearance, so he’s certainly earned his stripes. But even though he is unquestionably on the Mount Rushmore of American animal folklore, how often is he actually right?

Since 1988, roughly the time of the last oil and gas commodity crash, Phil has been right just 13 out of 28 times. Historically, the Punxsutawney mascot has seen his shadow 102 times, compared to not seeing his shadow just 17 times. Any naysayers to his accuracy can more closely align with Mr. Murray’s prognosis, which he refers to as a “large squirrel predicting the weather.”

Natural Gas Forecast

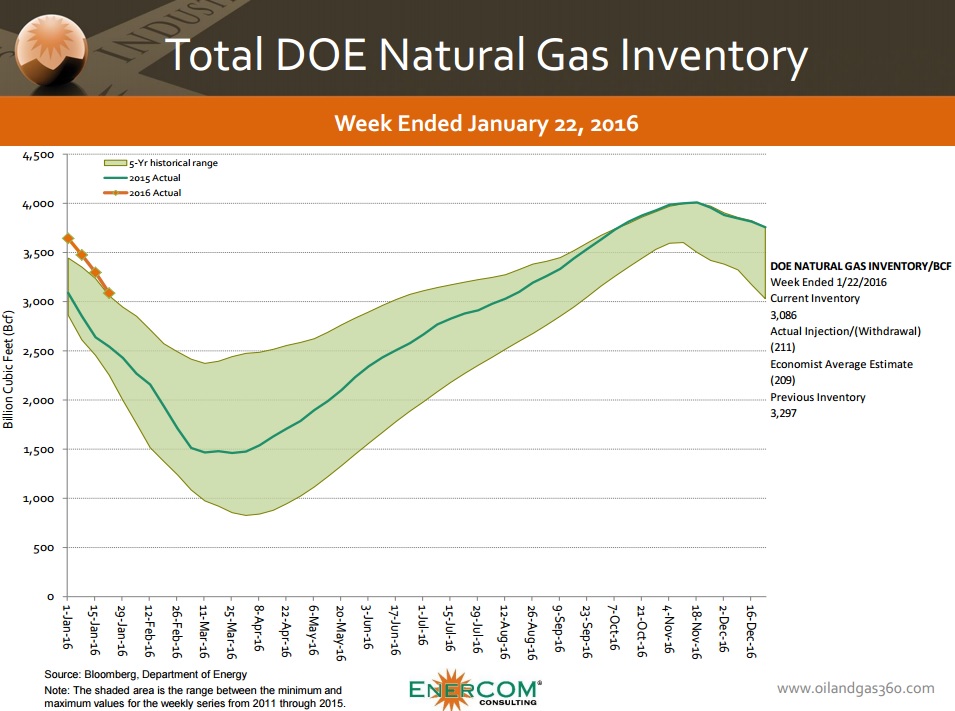

It’s early in the game, but Phil’s prediction appears to be correct thus far. Natural gas prices dipped below the $2.00 threshold in trading today, reaching a one month low. Gelber & Associates, an energy advisory firm, says the latest weather pattern suggests that the last cold snap of the season is in the near future. So clearly, the higher than normal temperatures are not cooperating with a market that is oversupplied, and market consensus is that a quick change is not in the cards.

Even though last week revealed the largest draw of the season, the reductions can’t offset the builds that sent inventories to record levels over the past year. Raymond James believes an additional 2.4% of gas supply will reach the market in 2016 due to infrastructure advancements.

And in honor of Groundhog Day, for your viewing pleasure: