Arctic Offshore Leases Cancelled Through 2017; Shell, Statoil Fail to Extend Leases

The Chukchi Sea’s 29 billion barrels (U.S. Bureau of Ocean Energy Management’s estimate of BOE) will have to wait for better times.

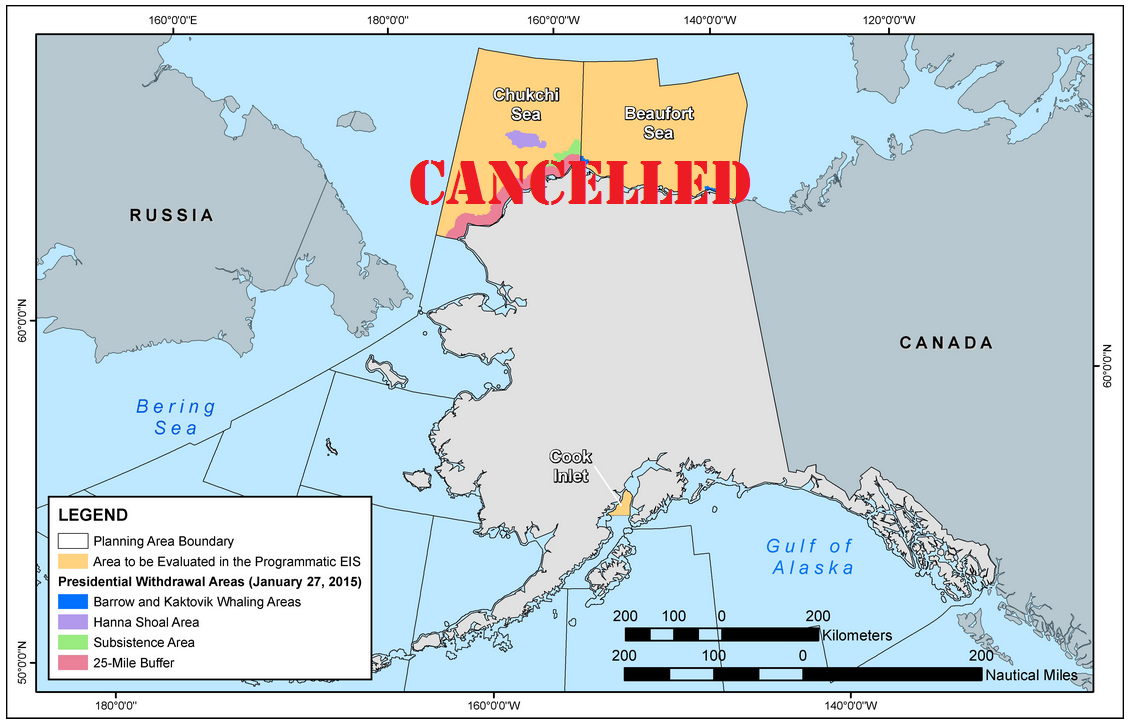

The U.S. Department of Interior announced last Friday that it will put a halt to future auctions for the current leasing program, which runs through 2017. In its announcement, the DOI said it would cancel the two potential Arctic offshore lease sales scheduled for the remainder of the leasing program due to “current market conditions and low industry interest.”

In addition, the Interior Department denied lease suspension requests from two oil majors, further dampening the prospects for Arctic offshore development. The actions are effective for its current five-year plan, which runs from 2012 to 2017. An auction for Cook Inlet acreage (Lease Sale 244, located on the southern edge), is still scheduled to commence in late 2016.

In addition, the Interior Department denied lease suspension requests from two oil majors, further dampening the prospects for Arctic offshore development. The actions are effective for its current five-year plan, which runs from 2012 to 2017. An auction for Cook Inlet acreage (Lease Sale 244, located on the southern edge), is still scheduled to commence in late 2016.

Commenting on the decision not to extend the leases for Shell (ticker: RDS.B) and Statoil (ticker: STO), the DOI said, “Among other things, the companies did not demonstrate a reasonable schedule of work for exploration and development under the leases, a regulatory requirement necessary for BSEE to grant a suspension.”

Shell expects to write off $4.1 billion as part of its exploration program, which ended after determining its exploration well was non-commercial in the current environment. The $4.1 billion write down will be in addition to the $7 billion Shell had invested in the Arctic up to this point, including $2.1 billion to acquire its license in the Chukchi Sea, where its Burger J exploration well was located.

Sally Jewell, Secretary of the Interior, said, “In light of Shell’s announcement, the amount of acreage already under lease and current market conditions, it does not make sense to prepare for lease sales in the Arctic in the next year and a half.”

Sally Jewell, Secretary of the Interior, said, “In light of Shell’s announcement, the amount of acreage already under lease and current market conditions, it does not make sense to prepare for lease sales in the Arctic in the next year and a half.”

Mixed Feelings

Shell’s decision to suspend operations was met with mixed feelings. Environmental activists were unsurprisingly happy to hear the news, but some analysts also joined the chorus as Shell pulled the plug on operations.

“Alaska has been a bone of contention for many investors, thus today’s update is a positive,” said Bernstein analysts. “Investors don’t want Shell to deliver more capex into Alaska,” said Bernstein’s Oswald Clint. “I imagine investors will be OK with a $1 billion hit versus tens of billions in the future.” Clint further estimated that exiting the Arctic would bring Shell’s annual exploration expenses below $3 billion, which investors will also see as a plus, reports The Wall Street Journal.

The reaction from the Alaska Oil and Gas Association (AOGA) was much less upbeat.

“It is a sobering day for Alaska; both in the short and long-term. [The] news from Shell is a painful reminder that exploration is expensive, involves huge risk, and does not guarantee success. Shell’s departure underscores the need for legal, fiscal, and permitting certainty and predictability,” said Kara Moriarty, president and CEO of AOGA.

“There are very few companies that could meet these federal requirements and expensive demands, but even large companies with the financial resources like Shell will walk away from mega opportunities when they cannot continue to spend billions of dollars without any promise of a return. The Arctic Offshore has rightly been viewed as the next generation of oil and gas development in this state, so for those plans to disappear overnight is beyond painful,” Moriarty said.

Alaska Governor Bill Walker called the DOI’s decision a “loss of hope” for Alaska’s offshore development potential, but he remains “adamant and aggressive” about opening up a smaller coastal spot for development. Oil taxes provide about 90% of Alaska’s general fund revenue, and the state is currently burdened with a $3.5 billion deficit.

Don Young, Alaska’s lone Congressman, believes the state will sue the Department of the Interior regarding its decision. Dan Sullivan, its junior U.S. Senator, said the decision was “hypocritical” in the sense that it takes away job opportunities and income for locals. As of August 2015 (the most recent statistics, according to the U.S. Department of Labor), Alaska’s unemployment rate of 6.6% was the fifth highest in the country.

Alaska Background

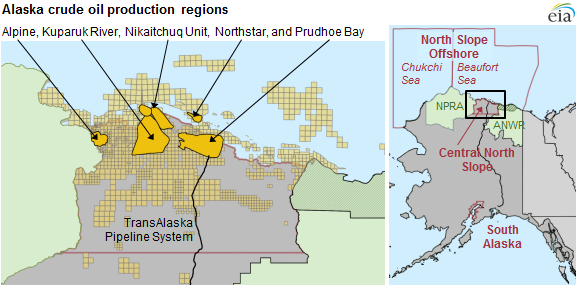

The Department considers the Arctic regions to be “frontier areas,” taking into account the general lack of infrastructure and scarcity of previous sales. “Outside of the Beaufort Sea and Cook Inlet, there is little, if any, existing infrastructure and activity,” explains its latest Oil and Gas Leasing Draft Proposed Program.

The Chukchi Sea, the location of Shell’s exploration well and the now-canceled site of lease sale 237, has not hosted an auction since February 2008. Despite generating more than $2.6 billion in revenues from the sale, the Chukchi Sea has never yielded commercial oil and gas production. The DOI reiterated that the Chukchi planning area holds the greatest amount of hydrocarbon potential, but severely lacks the infrastructure to move product to market. The DOI said it received no industry nominations when it gauged interest in 2013.

The Chukchi Sea, the location of Shell’s exploration well and the now-canceled site of lease sale 237, has not hosted an auction since February 2008. Despite generating more than $2.6 billion in revenues from the sale, the Chukchi Sea has never yielded commercial oil and gas production. The DOI reiterated that the Chukchi planning area holds the greatest amount of hydrocarbon potential, but severely lacks the infrastructure to move product to market. The DOI said it received no industry nominations when it gauged interest in 2013.

Activity in the Beaufort Sea, the site of Lease Sale 242 in 2017, has not featured drilling activity since 2012. The region has, however, produced 28.7 MMBO since 2001 and conducted ten sales since 1979. Recent interest was minimal, however, as only one information nomination was filed by the industry in July 2014. The DOI said the results “[raised] concerns about the competitiveness of any such lease sale at this time.”

GOM Lease Program Feeling the Pinch Too

The DOI’s offshore leases are largely focused in the Gulf of Mexico (GOM); of the 15 proposed lease sales in the 2012-2017 schedule, 12 were in the Gulf. The 2017-2022 schedule currently has 14 planned lease sales, with 10 consisting of GOM acreage.

Despite the region’s popularity, proceeds from the sales have dropped significantly in the new commodity environment as E&Ps reign in exploration costs. Two lease sales (235 and 246) conducted in 2015 combined for only $561 million in high bids, compared to sales in 2013 and 2014 that generated more than $1.0 billion in high bids apiece. DOI officials directly blamed the commodity price environment for the bid differentials. Two more GOM auctions are scheduled for 2016, with the first slated for March.