Lease Sale 235 Generates Less than Half of Previous Sales in the Central GOM

The Bureau of Ocean Energy Management (BOEM), an energy arm of the Department of the Interior, concluded its Lease Sale 235 in the Central Gulf of Mexico (GoM) on March 18, 2015. The sale is the BOEM’s first of the year and sold approximately 923,700 acres, generating $539 million in high bids. The offered properties spanned about 41.2 million acres ranging from depths of nine to 11,115 feet, with in-house production estimates of up to 890 MMBO and 3.9 Tcf.

A total of 42 companies participated in the sale, with Shell Offshore (ticker: RDS.B) coming away with the most blocks. Statoil (ticker: STO) and Venari rounded out the top three block holders, while Chevron (ticker: CVX) and Red Willow Offshore submitted the highest overall bids of $78.6 and $58.9 million, respectively. Red Willow won the most expensive block, the Walker Ridge/107, with a high bid of about $52.2 million.

Lowest Bid Amount for Central GoM Sale

The $539 million in high bids pales in comparison to the two previous auctions in the Central GoM. Lease Sale 227, conducted in 2013, yielded more than $1.2 billion in high bids and Lease Sale 231 generated nearly $1.1 billion in high bids in its 2014 auction. BOEM officials directly commented on the lower than usual amounts in a press release following the event.

Secretary Sally Jewell said, “While this sale reflects today’s market conditions and industry’s current development strategy, it underscores a steady, continued interest in developing these federal offshore oil and gas resources.”

Director Abigail Ross Hopper offered similar sentiment, adding that “The recent drop in oil prices and continued low natural gas prices obviously affect industry’s short-term investment decisions, but the Gulf’s long-term value to the nation remains high.”

Freeport McMoran (ticker: FCX), the most active company in sale 231, did not participate in sale 227.

BOEM Recap

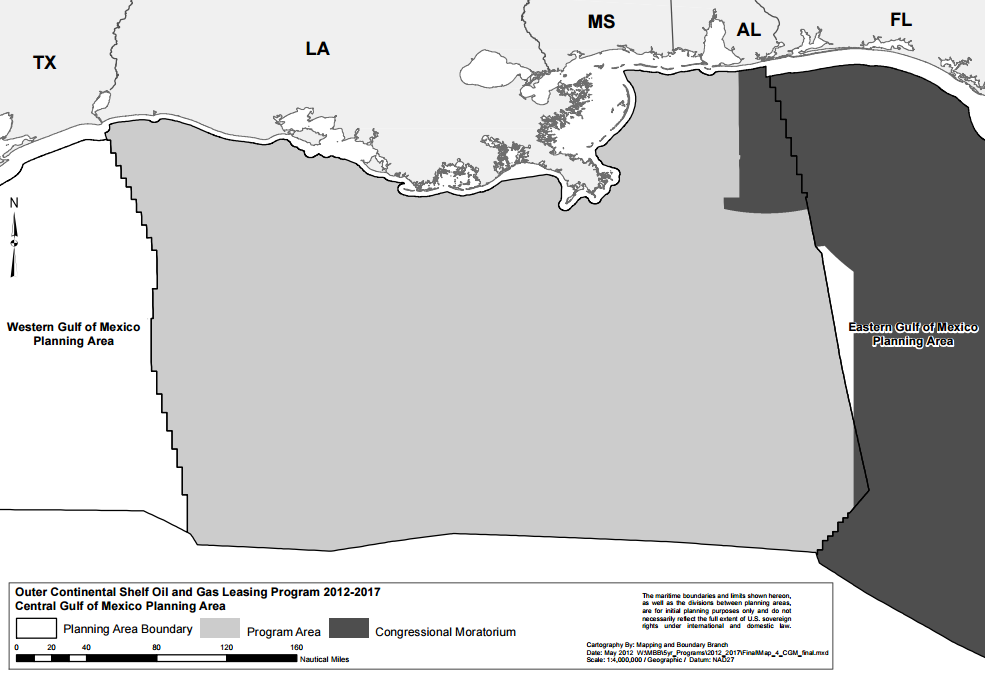

One more lease sale is scheduled in 2015 and will focus on the Western GoM. The process is tentatively scheduled for August and will be the eighth such auction conducted in the GoM, with four additional auctions scheduled to take place in the region by year-end 2017. The BOEM lease sales are part of the Outer Continental Shelf Oil and Gas Leasing Program, a five year program implemented by the Obama Administration. To date, more than 60 million acres have been purchased for development at total bid revenues of $2.4 billion. Lease Sale 227 has been the most successful thus far for the BOEM.

Through the end of 2015, the GoM is the only region to offer acreage for development, but three proposed sales in Alaska are planned to be carried out before the end of the five year plan. A draft program was submitted in January 2015 to open up 10 more sales in the GoM, three more in Alaska and one on the eastern seaboard. Development in the Atlantic Ocean would be the first since 1982 for the United States, and an Interior representative previously said the proposal is intended to “build up our understanding of resource potential.” Resource availability estimates were last conducted on the eastern seaboard about 30 years ago.

The terms may be revised and do not require Congressional approval, reports The New York Times. A poll from the American Petroleum Institute revealed 65% of Virginia residents support offshore development, while 71% of Carolina residents are in favor and 77% of Georgia residents support the practice.

Gulf Production Ready to Rise

Onshore drillers are dialing back operations due to the lower commodity prices, but there is little reason to defer GoM projects due to their high investments and long lead times. As a result, several projects remain on schedule to come online and reach production volumes of 1.5 MMBOPD by 2016 – surpassing a record set in 2009. Imran Khan, a deepwater GoM analyst for Wood Mackenzie, believes the production will continue to rise. “There’s no stopping those,” Khan said of the deepwater projects. “Once you start spending all that money, it’s hard to stop in the middle.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.