The United States Department of the Interior, in conjunction with President Obama, Secretary of the Interior Sally Jewell and Bureau of Ocean Energy Management Director Abigail Ross Hopper, released a Draft Proposed Program for development of offshore properties in an official release on January 27, 2015.

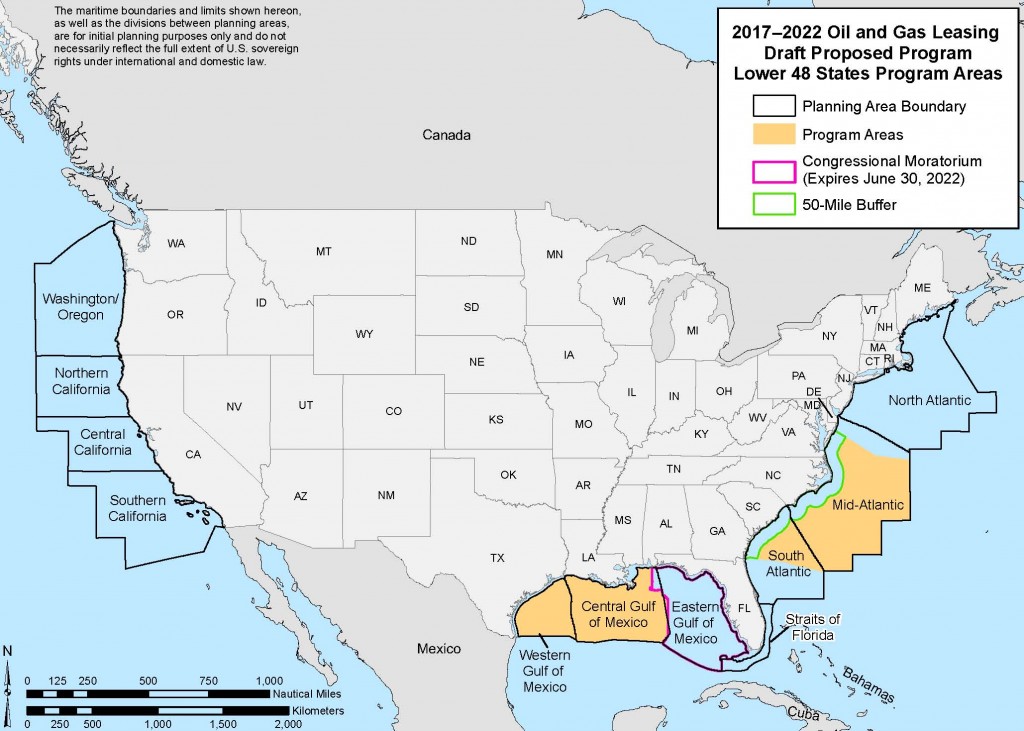

The Program opens up 14 potential lease sales in eight planning areas, including:

- 10 in the Gulf of Mexico

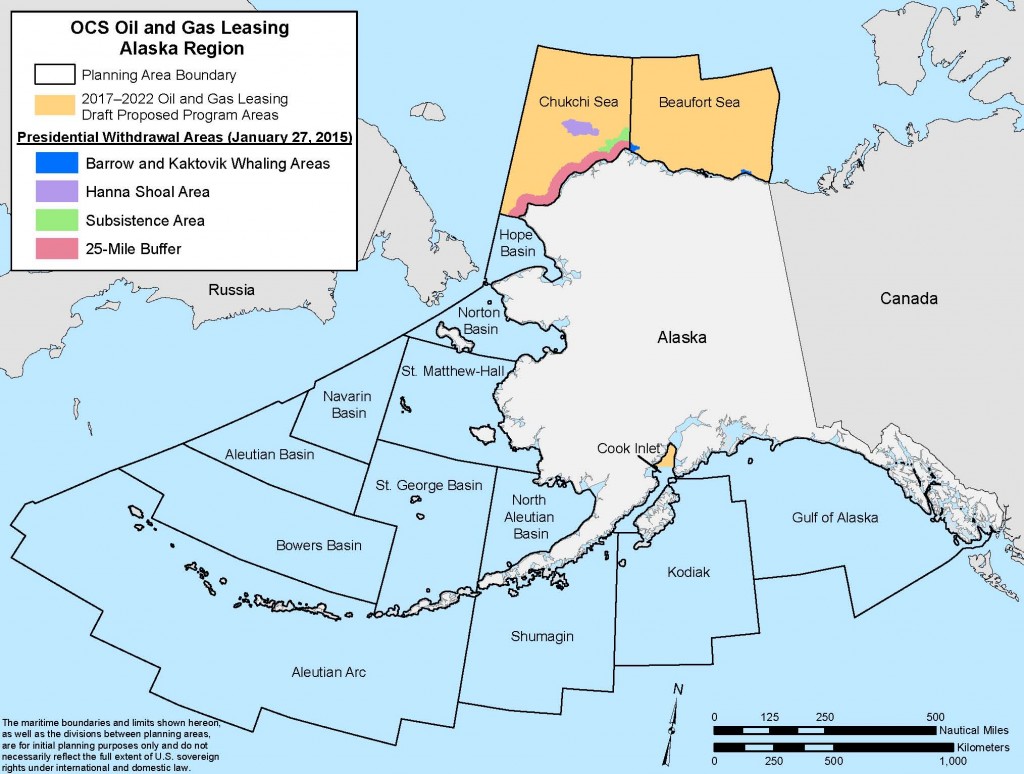

- Three off the coast of Alaska

- One in the mid to south Atlantic, spanning Virginia, the Carolinas and Georgia

In the release, Secretary Jewell said: “This is a balanced proposal that would make available nearly 80% of the undiscovered technically recoverable resources, while protecting areas that are simply too special to develop.”

ANWR = Off Limits

Ms. Jewell’s quote implies the 12.28 million acres of Alaskan wilderness, which was effectively banned from development in a decision made over the weekend. “The President is taking thoughtful action to protect areas that are critical to the needs of Alaska Natives and wildlife,” she said. Two Alaska senators had harsh words on the decision, calling it “an attack on our sovereignty” and “war on Alaskan families.” Hydrocarbon development accounts for 85% of the state’s revenue and production on the North Slope has been in slow, steady decline for roughly two decades. Bristol Bay is another area that prohibited development in December 2014.

Offshore = Open for Exploration

Back in the contiguous states, the President’s Five Year Program (covering the years of 2017 to 2022) has reached the proposal stage. Per terms of the program, the Secretary of the Interior will prepare a five-year schedule of lease sales that includes the size, timing and location of the blocks. All must meet standards involving environmental and social concerns. There are currently around 6,000 offshore leases (32 million acres) managed by the BOEM, with the majority in the Gulf of Mexico. A 60-day public commentary period has commenced and will end on March 28, 2015.

“The draft proposal prioritizes development in the Gulf of Mexico, which is rich in resources and has well-established infrastructure to support offshore oil and gas programs,” said Jewell. “We continue to consider oil and gas exploration in the Arctic and propose for further consideration a new area in the Atlantic Ocean, and we are committed to gathering the necessary science and information to develop resources the right way and in the right places.”

The terms may be revised and do not require Congressional approval, reports The New York Times.

Offshore Development

An inventory of Gulf projects are scheduled to come online in 2015 and contribute to record regional production as early as 2016, according to USA Today. Development off the eastern seaboard, however, is an entirely different story. There are currently no operations in the Atlantic Ocean, and the last estimates on its resource availability were conducted in the early 1980s. Based on two-dimensional seismic surveys from the period, recoverable resources amounted to 3.3 billion BO and 31.3 Tcf.

Jewell said the Interior’s plan is to “build up our understanding of resource potential.” The sale would include a 50-mile buffer from the nearest coastline. A poll from the American Petroleum Institute revealed 65% of Virginia residents support offshore development, while 71% of Carolina residents are in favor and 77% of Georgia residents support the practice. A study from Quest Offshore Resources believes the Atlantic could yield 3.5 MMBOPD of production to the United States.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.