Juan Jarrah, Oil & Gas Equity Research Associate at TD Securities, and Chris Snyder, Senior Director of Environmental Risk Management for Corporate Credit Canada at CIBC spoke at The Oil & Gas Conference® 21 last week in Denver.

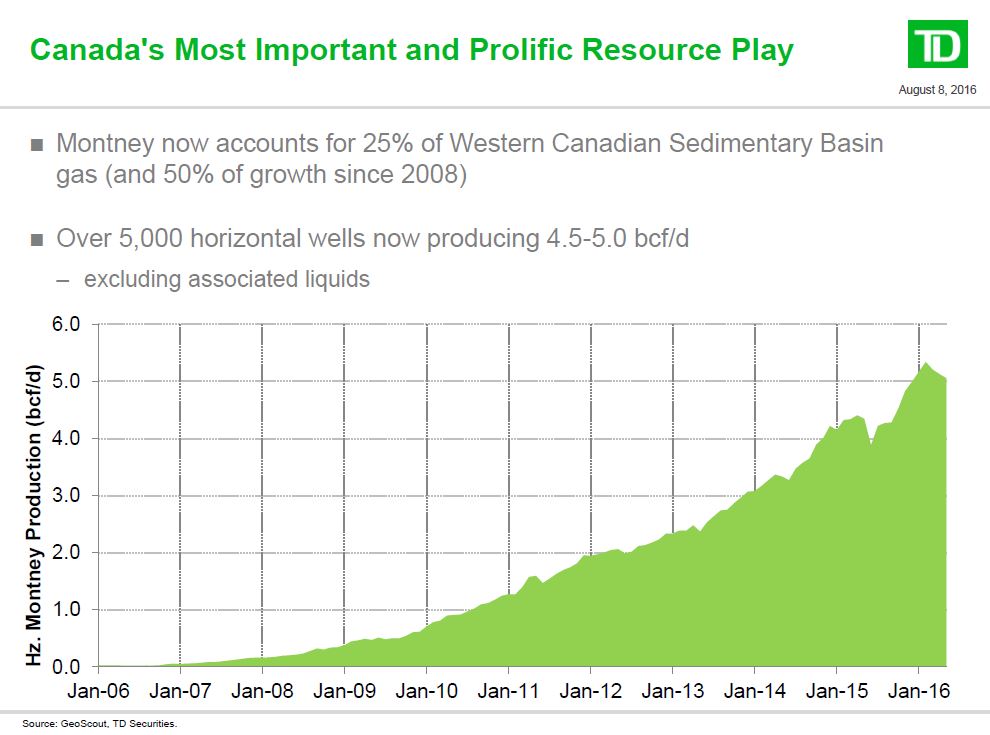

The topic of the panel was future development of Canada’s Montney play in Alberta and British Columbia.

The play has received a lot of attention in recent years due to its attractive economics, massive resource potential, and diverse investment options offered. It also offers a 30% discount to American investors due to the current USD/CAD exchange rate.

Show Me the Montney

Jarrah started by laying out the case for investing in the Montney.

“What’s the deal?”

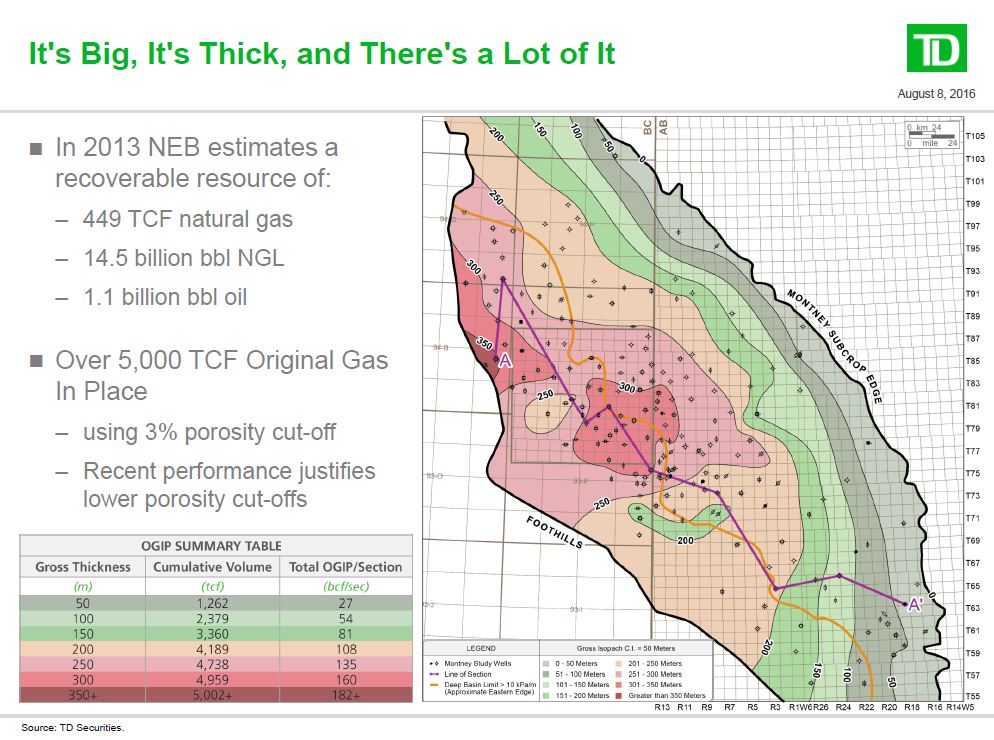

First off, it’s big, thick, and there’s a lot of it, Jarrah told the crowd. The play is roughly the same size as the Marcellus (50,000 square miles) but is also much thicker. In fact, the height of the Eiffel Tower (324 meters) is as thick as the Montney is from top to bottom, he said.

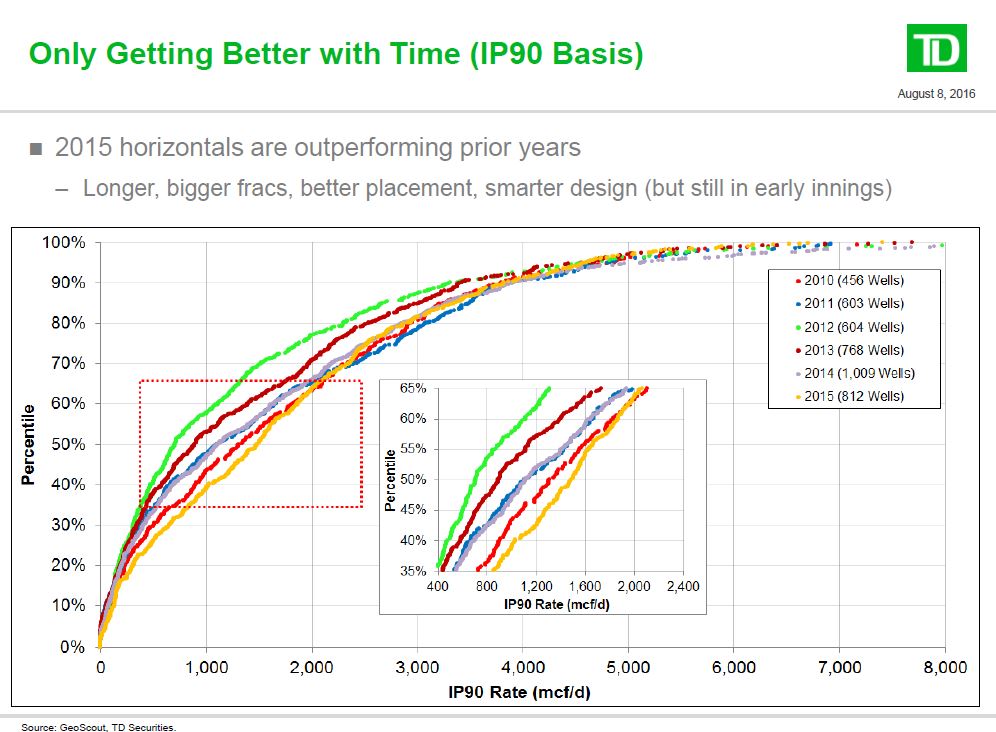

Secondly, it’s only getting better with time, Jarrah said.

Horizontals have continually outperformed prior years on IP90 and IP365 bases. Longer laterals, bigger fracs, better placement of fracs, and smarter designs are the technological trends driving this process, and all are still in their early stages.

Horizontals have continually outperformed prior years on IP90 and IP365 bases. Longer laterals, bigger fracs, better placement of fracs, and smarter designs are the technological trends driving this process, and all are still in their early stages.

Third, positive revisions to Montney well EURs have consistently driven year-over-year corporate production and reserves growth. Finally, the play’s economics are as attractive, if not more so, than many of the best U.S. shale plays, Jarrah said.

Canada’s Carbon Price Uncertainty Weighs on Future Development

Concerns over a possible environmental tax could potentially hinder growth in the Montney and the rest of Canada. Canada’s new federal government is seeking to place a national price on carbon emissions, following Canada’s commitment at the Paris Climate Conference to reduce emissions in line with the two degree Celsius global target.

Additionally, many provinces are seeking to introduce their own regulations. Efforts by the federal government to harmonize a countrywide price on carbon with the provinces are taking place over the next six to twelve months.

Along with the outcomes of the carbon cost harmonization efforts, the May 2017 British Columbia provincial election will provide greater perspective on regulatory development.

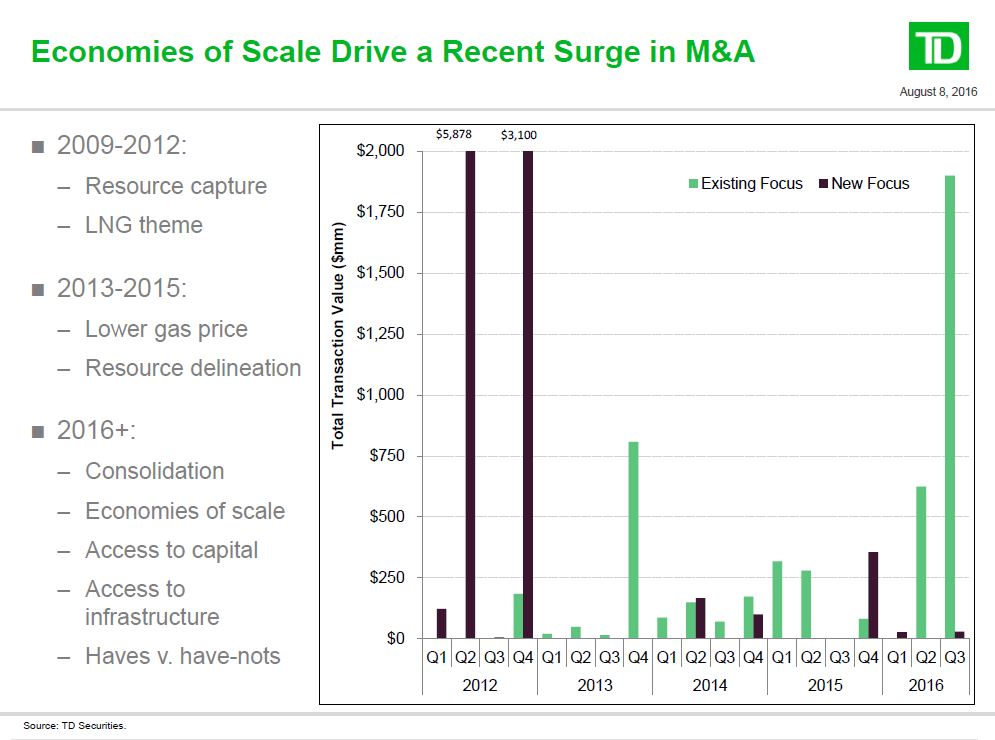

Surging M&A Driven by Economies of Scale

Between 2009 and 2012, resource capture was the primary trend as large companies paid up for acreage while 2013 through 2015 saw greater delineation of resources through drilling.

Going forward from 2016, Jarrah identified the main themes will likely be consolidation of acreage through A&D, with economics of scale, access to capital, and access to infrastructure driving the decision-making.

On the M&A front, prices per acre have increased as companies have are willing to pay high prices for current operators’ coveted acreage in order to consolidate their positions. For example, Birchcliff Energy (ticker: BIR) and Seven Generations Energy (ticker: VII) recently purchased concentrated land positions from early entrants Encana (ticker: ECA) and Paramount .

British Columbia Acreage is Next for Consolidation

Jarrah believes acreage in British Columbia is due for consolidation next. Regional BC operators have fragmented holdings and will seek to access pipeline capacity and alleviate regional pricing differentials. The outlook for LNG exports will also influence operator decisions.

Predictably, prices per flowing barrel and per 2P reserves have decreased, as reserves and production were mostly purchased during the resource capture period. Companies’ main focus now is increasing production and reserves from existing acreage and generating cash flow from their high-quality assets.

Will the Montney Take Off?

While Canada’s greenhouse gas regulatory environment remains uncertain, the continued development of the Montney is certain, as the play continues to prove that it is among the most attractive in North America.

Several presenting companies at last week’s EnerCom’s The Oil & Gas Conference® 21 have operations and/or assets in the Montney, including:

- Advantage Oil & Gas (ticker: AAV)

- Birchcliff Energy (ticker: BIR)

- Blackbird Energy (ticker: BBI)

- Painted Pony Petroleum (ticker: PPY)

- Tamarack Valley Energy (ticker: TVE)

Access to these companies’ presentations and webcasts are linked above.

Montney players Blackbird Energy CEO Garth Braun, Advantage Oil & Gas CEO Andy Mah, and Tamarack Valley CEO Brian Schmidt were interviewed on video by Oil & Gas 360®’s Angie Austin at the EnerCom conference. The videos will be posted this week on Oil & Gas 360®.