Meritage Midstream to provide 75 MMcf/d of gas gathering and processing in Canada

Meritage Midstream Services announced that its Canadian affiliate, Meritage Midstream Services III, has entered into a definitive agreement with Canadian International Oil Corporation (CIOC) to build natural gas gathering, compression and processing assets and crude oil gathering assets to support the development of CIOC’s Montney and Duvernay Shale positions in west-central Alberta.

Meritage III will provide 75 million cubic feet per day (MMcf/d) of gas gathering and processing capacity, which will be expandable to 225 MMcf/d, and up to 10 MBOPD of crude oil gathering capacity.

Construction of both systems began in May, according to the company press release. The pipeline will be located about 60 miles south of Grand Prairie, Alberta, and run about 42-kilometers (about 26 miles) long. The plant is expected to come into service in April 2016 and will offer connections for residue gas to the TransCanada Pipeline and other delivery points. The oil gathering system follows the same route as most of the gas gathering pipeline and will connect to Pembina Pipeline Corporation’s Karr Lateral pipeline, which will serve Pembina’s terminal in the Lator area of northwest Alberta.

“The Montney and the Duvernay are poised to become two of the most prolific plays in North America,” said Meritage CEO Steve Huckaby. “These agreements establish our position in the region and allow us to continue to focus on developing the infrastructure needed to stay ahead of the immediate and long-term needs of our Canadian customers.”

Meritage Midstream’s other operations include natural gas gathering, NGL treatment, crude oil and condensate gathering, handling flowback water, and others in the Powder River Basin. Most of the company’s U.S. operations are focused on serving operators in the Powder River Basin, where the U.S. Geological Survey estimates 1 billion barrels of recoverable oil remain in-place.

The Montney: Canada’s liquids-rich gas play

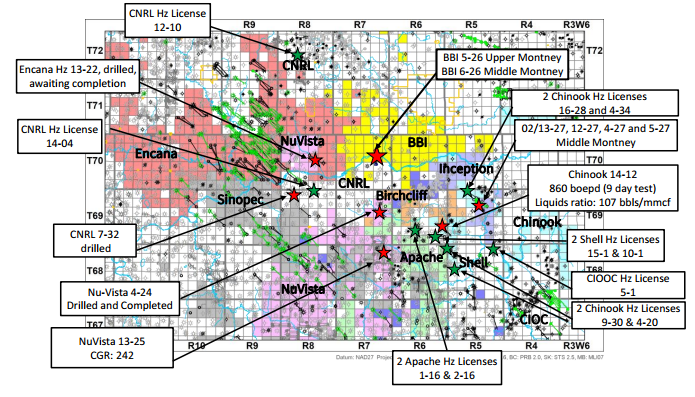

The Montney shale play, which stretches from Western Alberta northwest into British Columbia, has traditionally been gas focused, but a liquids- and condensate-rich window in the Montney has been attracting the attention of major names in the oil and gas industry. Companies like Shell (ticker: RDSA), Encana (ticker ECA), Apache (ticker: APA) and CNRL (ticker: CNQ) have all been building positions in the Elmworth area of the Montney, looking to further delineate the resources in place.

Recently, Nuvista Energy (ticker: NVA) purchased 12.5 sections located in the Elmsworth area for $35.5 million (about $2.9 million per section). Just two and a half miles away, Canadian small-cap Blackbird Energy (ticker: BBI) has built up a position of 81 sections in the play’s liquids-rich window for $6.9 million (about $85,000) by purchasing smaller blocks.

“Being a smaller company in the Montney has proven to be an advantage in building our land position from 27 to 81 sections in the past year,” Blackbird CEO Garth Braun told OAG360® during an exclusive interview.

“The Montney, like the Eagle Ford, has very specific sweet spots where the resources transitions from a dry gas play to a highly liquids-rich/free condensate play,” said Braun. “The results from our first two wells, the 6-26 middle Montney well and the 5-26 upper Montney well, indicated we’re in the sweet spot.” The 6-26 well tested at over 130 bbls/mmcf and the 5-26 well tested at over 340 bbls/mmcf, according to the company.

Because of their high liquids ratio, Blackbird puts the breakeven costs for its Montney wells in the mid-$40 per barrel range, making the play attractive, even as oil prices remain low.