For the first time since 1938, Mexico’s oil frontier is open for business.

Mexico’s newly privatized oil industry was officially signed into law on August 11, 2014, ending Petróleos Mexicanos’ (Pemex) 76 year nationalization reign on the country’s hydrocarbon resources. Pemex provides roughly one-third of Mexico’s tax revenue, but years of corruption and inefficiency have cut sharply into its production.

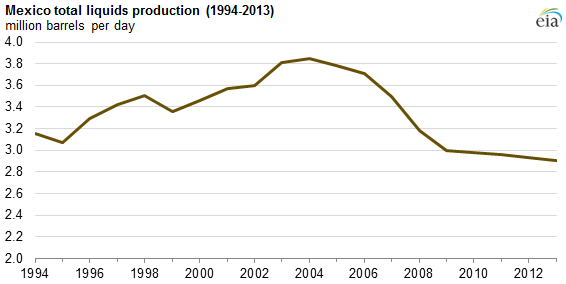

The company has lost roughly $8 billion to date in 2014, according to Reuters. Volumes for Q2’14 dipped to 2,468 MBOEPD, and management expects overall output for 2014 to average 2,441 MBOEPD. If the numbers prove to be accurate, production will have declined by 36% since 2004 (3,848 MBOEPD), or an annual average of roughly 140 MBOEPD. If the entire ten year period is considered, the lost production of 1,407 MBOEPD is roughly equal to Q2’14 volumes produced by both Apache Corp. (ticker: APA, 636 MBOEPD) and Occidental Petroleum (ticker: OXY, 741 MBOEPD).

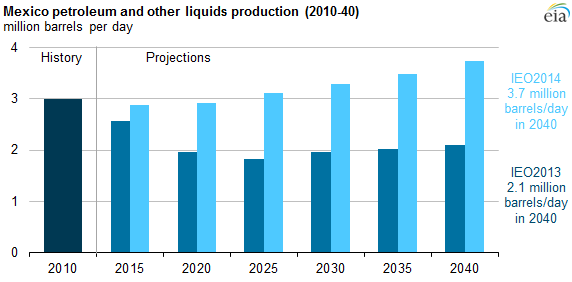

EIA’s Updated Projections

The Energy Information Administration revised its projections for Mexico’s long term outlook in its International Energy Outlook 2014. Production is still expected to decline in the near term and stabilize by 202, but the EIA believes production will rise to 3,700 MBOEPD by 2040 – an increase 76% of compared to last year’s projections of 2,100 MBOEPD (when Pemex was still nationalized). The projections represent a swing of 800 MBOEPD at its 2020 production forecast of 2,900 MBOEPD.

Mexico Opportunities

According to the Oil & Gas Journal, Mexico has an estimated 10 billion BOE of proved oil reserves and another 17 Tcf of gas reserves. An estimated 545 Tcf is technically recoverable, which is the sixth largest amount in the world. As a part of opening the doors to private investors, Pemex was allowed to stake claim certain regions for development. The country announced Pemex will retain all of its currently producing areas, 83% of the country’s proved and probable reserves and 20% of prospective and undiscovered resources. The majority of its proved and probable reserves are based either onshore or in the shallow waters in the Gulf of Mexico. Pemex currently has no producing offshore wells.

The Associated Press reported bidding for projects will likely begin in February 2015 and a handful of supermajors, including Royal Dutch Shell (ticker: RDS.B) and ExxonMobil (ticker: XOM) both issued statements expressing interest in Mexico development. Pemex is expecting to receive $50 billion in investments once the bidding war opens.

The Associated Press said, “It remains to be seen whether Mexico can assign complex contracts to private companies without the kind of kickbacks, favoritism and insider deals seen in the past,” but that “The law creates a national oil commission to take such decisions out of the hands of Pemex.”

Mexico’s oil company will implement new financial regulations in an effort to cut down on corruption and make its balance sheet more transparent. Private companies may be gun shy of operating in Mexico due to Pemex’s checkered corruption history (80% of Mexicans associate the company with corruption, according to a 2013 Washington Post article) and the violent drug wars along the border. However, the EIA says the benefits are significant if Mexico can straighten out its problems. The Administration says, “The potential is enormous, and successful implementation of the energy reforms could substantially transform the outlook for Mexico’s oil production.”

E&Ps are Intrigued but Cautious

In late August, Barclays Capital hosted a conference call on Mexican energy reform with Pablo Monsivais (Barclays Mexico Infrastructure Equity Research Analyst), Koon Chow (EM FICC Strategy Research), Alfonso Martin Fernandez (Barclays Commodities Market Specialist) and Marco Oviedo (Barclays Chief Economist for Mexico). During the call, the discussion centered around three key asset classes: mature fields, super heavy oil and deep water. The panel said 169 fields were open for private investment—109 exploration and 60 development—as part of the country’s overhaul of its energy industry.

During the call, the panel members said they look for Mexico to make $5 billion in new investment in 2015. They estimated the petrochemical industry in Mexico, related to natural gas, to double industrial production in five years. On the E&P side, they said the goal is to cap the oil revenues the government takes at 4% every year. The extension of the Eagle Ford Shale into Mexico “Will be a tough sell to U.S. independents,” considering Mexico claimed its onshore properties.

Deep water assets will be a different story. “The deal breaker will be if they can’t book reserves.”

The panel discussed that one of the big challenges Mexico has to face is market prices and market risk, and “a lot of returns are driven by oil prices.” They also discussed that Mexican companies needing fuel have not been exposed to price volatility and that all or most subsidies of energy prices will be removed, another challenge.

“The main focus the government wants to see is lower electricity prices,” they said. The panel brought up the cheap natural gas in the United States and the U.S.-to-Mexico export pipelines. “Prices of electricity were subsidized,” the group said. “If Mexico can improve efficiencies in the power industry, they could see a reduction in the electricity tariff.”

The panel discussed the inability of U.S. producers to export crude produced in the U.S. and the effect that North American oil could have on the global market, with “more flow of barrels going to Asia.” Another perspective was the oil market looks weak because the U.S. is outperforming while demand is not there to support growth, resulting in lower spot prices.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom has a long only position in Shell.