Electrical generation from natural gas fired plants increased 19% in 2015 due to lower natural gas prices and increased legislation on carbon emissions. Coal and natural gas are now neck and neck in electrical generation capacity with EIA projecting natural gas to surmount coal as the top source of electricity.

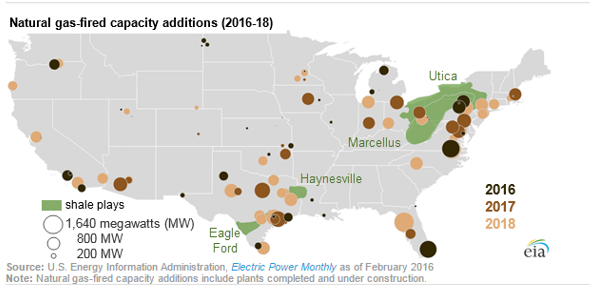

Natural gas-fired generation is expected to continue growth over the next several years. With the potential for a zero-emissions natural gas plant on the horizon, the carbon footprint of natural gas is well below many other sources of fuel such as coal. 18.7 gigawatts (GW) of new capacity is scheduled to come online between 2016 and 2018 according to EIA. Many of the new natural gas-fired capacity additions in development are near major shale gas plays. The Mid-Atlantic states and Texas have the most natural gas-fired capacity additions under construction with planned online dates within the next three years (2016–18).

Many of the natural gas capacity additions are concentrated around the Marcellus and Utica shale regions, largely located in Pennsylvania, West Virginia, and Ohio. Expanding pipeline networks in the Northeast are increasing takeaway capacity from the Marcellus and Utica shales, which will support the growth in natural gas-fired generating capacity.

Significant levels of natural gas-fired capacity are under construction in Texas, with 3.2 GW expected to become operational over 2016–18. Texas produces more natural gas than any other state and is home to several major shale plays, including the Eagle Ford and Barnett shales.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.