The timing may have taken longer than expected, but natural gas prices are finally on the rise.

Spot prices for Henry Hub closed at $2.37 on December 29, 2015, marking a six week high and the third straight day of gains in excess of 5%. Henry Hub spot prices have now gained at least 5% in four of the last six sessions, and have increased by nearly 35% overall compared to prices on December 18, which were the lowest in 16 years. Some of the gains were forfeited today as prices closed below $2.20.

Analysts and traders are contributing the gains to cold weather forecasts, along with the deadly storm that has passed through the Midwest and is on its way to the Atlantic coast. Future prices for January expired today, while the February spot price also enjoyed a 4% gain to close at $2.35/MMBtu.

Natural gas bulls are hopeful that the declining rig counts and rising prices will cut into storage levels, which are currently trending among record highs. The injection season is currently the second highest on record, following up on the benchmark set last year. Baker Hughes data reports that 162 natural gas rigs are active in the United States, down more than 50% compared to the end of 2014 and 12% less than just two weeks ago.

Natural gas bulls are hopeful that the declining rig counts and rising prices will cut into storage levels, which are currently trending among record highs. The injection season is currently the second highest on record, following up on the benchmark set last year. Baker Hughes data reports that 162 natural gas rigs are active in the United States, down more than 50% compared to the end of 2014 and 12% less than just two weeks ago.

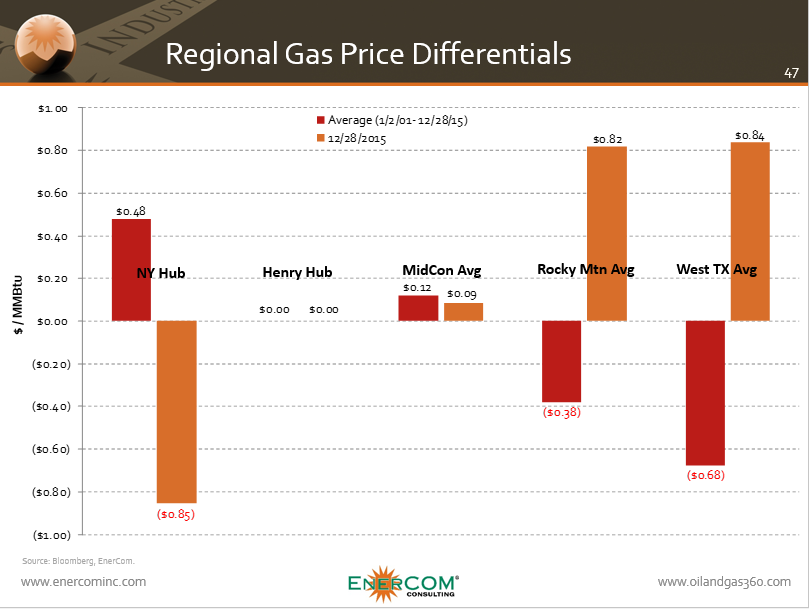

Select spot prices in the Northeast experienced triple digit increases due to a sharp increase in demand and the bottlenecks associated with its infrastructure. Other commodities, including heating oil and propane, also stand to benefit from higher gas prices.

Have We Seen a Bottom?

Gene McGillian, an energy analyst with Tradition Energy, doesn’t expect the rebound to last. “Whenever you see any kind of cold showing up in a forecast where you haven’t seen it, there is a snap back,” he said in an interview with CNBC. “Considering how much gas we have in the ground, the 50 cents rebound shouldn’t last too long.”

John Kilduff of Again Capital said natural gas futures were “extremely oversold.”

Phil Flynn, senior market analyst at Price Futures Group told Bloomberg that his firm has a record short position just weeks ago. “Isn’t it amazing how quickly things can change,” he said. “It shows you how everybody’s on one side of the equation.”

An important and revealing storage report will be issued this Thursday by the U.S. Department of Energy. You can subscribe to Oil & Gas 360®’s Natural Gas Roundup email campaign by filling in your email address below.

[email_signup type=”natgas-crudeoil” title=”Crude Oil/ Natural Gas” label=”EIA inventory reports and a collection of stories pertaining to the crude oil and natural gas markets” ]