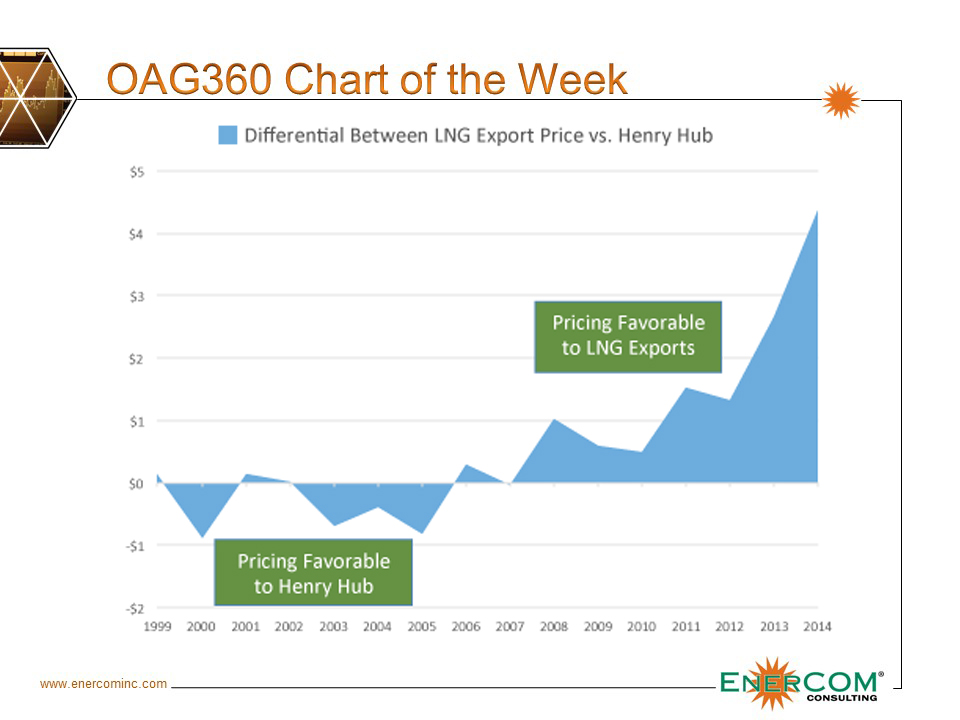

Pricing shifts in favor of selling natural gas as LNG

As natural gas has become increasingly abundant in the United States, selling production as liquefied natural gas (LNG) has become an ever-more attractive alternative to selling gas production domestically. This chart, developed by EnerCom Analytics, shows the premium price for LNG export compared to the price for natural gas at Henry Hub. As the price rises into the positive portion of the graph, the premium for LNG versus Henry Hub increases, where the “negative” portion of the graph represents a premium for natural gas at Henry Hub compared to LNG exports. The LNG price is from a global export total, and does not represent one particular LNG market.

“The push for exports makes sense for producers who have become the victims of their own success. U.S. natural gas prices have plummeted in recent years due to increased production in gas plays like the Marcellus Shale,” said EnerCom Analytics. “The price of natural gas in the U.S. now hovers just below $3 per Mcf. But in Europe that same amount of gas fetches just under $7 per Mcf, down from $11.60 two years ago. So exports would help producers by reducing domestic supply and increasing prices.”

Cheniere Energy (ticker: LNG) will be the first to take advantage of the significant premium on selling U.S. gas to international markets through LNG. Despite expectations that Asia will remain the largest growth market for energy demand moving forward, Cheniere plans to stay focused on Europe, company CEO Charif Souki said during LNG’s breakout session at EnerCom’s The Oil & Gas Conference 20®. “Asia is a significant market,” said Souki, “but we view it very opportunistically.”

Cheniere has several LNG projects at various stages of construction in Texas and Louisiana, with its Sabine Pass facility in Louisiana set to start production in Q4 2015. To see Oil & Gas 360®’s exclusive interview with Charif Souki, click here.