Deal metrics for U.S. oil and gas M&A are down with oil prices

The precipitous drop in the price of oil has hit the industry hard. Many in the oil and gas business thought a price rout would quickly take production offline, helping to rebalance markets, but production around the globe has been stronger than analysts anticipated.

As oil prices continued to push lower following the OPEC 2014 Thanksgiving Day decision to keep the cartel’s production near full capacity, many began to predict a rash of distressed assets coming to market and a wave of consolidation as companies went bankrupt.

Part of that prediction did come to pass, with 42 oil and gas companies filing for bankruptcy in 2015, but the surge in M&A that was anticipated did not materialize. Distressed and free are desired, but the Bid/Ask chasm was real.

M&A down 68% in dollar value

Not only has there been no uptick in M&A, it is actually down 68% in overall dollar value, according to information provided to Oil & Gas 360® by PLS. The total value of oil and gas M&A in 2014 was $97.3 billion, dropping to just $30.8 billion in 2015.

Many operators are hesitant to sell assets in today’s market; part of the worry today is that the assets are being sold at the bottom of the market. However, Rosetta Resources (ticker: ROSE) was clairvoyant when it agreed to a merger with Noble Energy (ticker: NBL). Noble paid $2.1 billion to acquire 100% of Rosetta Resources’ Permian and Eagle Ford production and resources on May 11, 2015. At the time of the announcement, the acquisition was done at $33,333 per flowing BOE. The forward 12-month crude oil strip was $61.87 per barrel on May 11, 2015. To complete the transaction, Noble issued 41 million new shares, representing 11% of NBL’s 370 diluted shares outstanding at Q1’15. Between May 11, 2015 and April 20, 2016, NBL’s shares are down more than $14.40 per share, or 29.32%. Jim Craddock and the Rosetta team sold the company when crude oil prices were peaking. On April 21, 2016, the forward 12-month crude oil price is $45.28 per barrel.

“M&A markets are slow right now because sellers are reluctant to sell unless forced,” PLS Managing Director Brian Lidsky told Oil & Gas 360®. “Currently, the deal markets in the U.S. upstream space as measured by deal value are down about 80% peak to trough (Q3’14-Q1’16), as well as by deal volume.”

Deal values took a similar plunge following the global financial crisis, with overall deal value in major plays like the Bakken and Marcellus falling by 90% and 83%, respectively, from 2008 to 2009. Deal value showed a quick rebound in 2010, with overall deal value in the Bakken jumping from $0.2 billion to $4.9 billion, and deals in the Marcellus going from $0.8 billion in 2009 to $16.1 billion in the course of a year.

M&A drops 90% from the end of 2014

Deal metrics have fallen sharply in the last two years. The price of assets on a dollars-per-flowing-BOPD and dollars-per-Mcf/d have decreased 67% and 46%, respectively, from the first quarter of 2014 to the first quarter of 2016. The peak for deal metrics was just prior to the OPEC decision in Q3’14, when the average price-per-flowing-BOPD was $95,542, while the high-point for gas came in Q2’14 when an Mcf/d of production was selling for, on average, $7,138.

The third quarter of 2014 saw the most M&A activity in overall dollar amounts, with PLS data showing $29.1 billion in deals. The correction downward after November was sharp. The fourth quarter of the year saw $28.6 billion in deals completed, while total M&A deals in the first three months of 2015 amounted to just $2.9 billion, a 90% drop in just a few months.

The contraction in the M&A market is unsurprising as companies hope to hold on to assets through the downturn. Selling assets now at a fraction of a price they paid for them initially is a distant second choice compared to holding on to them until it becomes economical to increase production.

There have been a handful of deals in this market, however, with companies looking to maintain their balance sheet, and focus on their core assets while prices remain low.

Deal metrics: a comparision of M&A transactions as companies look for premier assets

“Public E&Ps are largely net sellers in this environment as they strive to focus on profits and cash management,” said Lidsky. “For example, Occidental (ticker: OXY) exited from non-core Bakken via a $600 million sale to Lime Rock Resources back in October 2015.”

Occidental sold those assets for roughly one-third of what many securities agencies believed they were worth at the time. The sale to Lime Rock, which included 303,000 net acres, worked out to approximately $1,980 per acre. Many agencies believed the region held roughly $3.0 billion in value, or $6,000 per acre, prior to the commodity downturn, with Capital One Securities valuing the assets as high as $3,300 per acre.

A number of major M&A deals took place in 2015 despite the cratering price of oil. In May 2015, Noble Energy (ticker: NBL) made an entrance into two of Texas’ premier plays, acquiring Rosetta Resources for $3.9 billion in an all-stock transaction. The deal netted Noble 50,000 acres in the Eagle Ford Shale, and 56,000 acres in the Permian Basin.

The 1,800 gross horizontal drilling locations and net unrisked resource potential of 1,000 MMBOE gave Noble a sizeable footprint in two of the most prolific plays in the United States. The company paid $58,500 per flowing BOEPD, which the company thought would show 15% compound annual growth rate.

The deal metrics on the Rosetta acquisition were slightly above average for the second quarter of 2015, based on the information from PLS. On a flowing BOPD basis, the average deal price in Q2’15 was just $52,680, about 10% less than what Noble paid for its Texas acreage.

More high-quality assets likely coming to market

“In terms of value of acreage, the markets are only paying for core-of-the-core positions in the Eagle Ford, the Permian and the Marcellus,” said Lidsky.

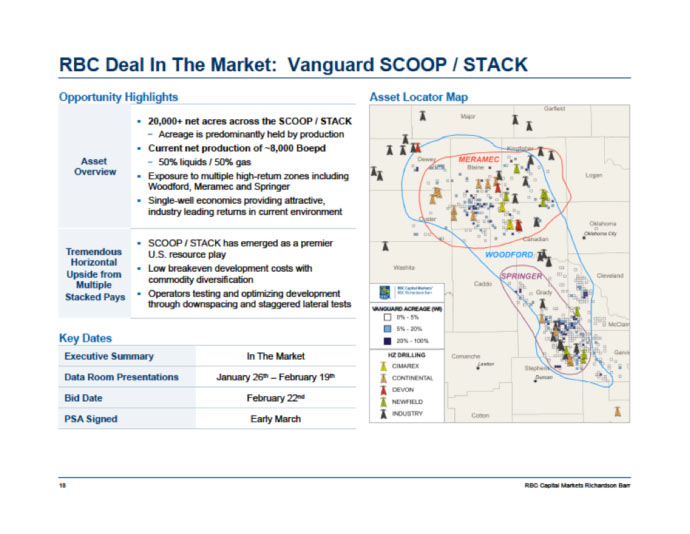

“We are beginning to see higher quality assets hit the markets,” he added. “For example, Vanguard Natural Resources is marketing a high quality position in the SCOOP/STACK play in Oklahoma, currently one of the top economic plays in the country.”

Titanium Exploration Partners agreed to purchase Vanguard’s SCOOP/STACK assets for $280 million, according to a press release from the company dated March 30, 2016.

Devon Energy (ticker: DVN) became the preeminent operator in the Cana-Woodford through deals that totaled some $4 billion in December. The company acquired private STACK operator Felix Energy in a cash-and-stock exchange which totaled $1.9 billion, adding 80,000 net acres to its STACK position.

Producing volumes from the assets were reported at 9,000 BOEPD, with estimated risked resources of approximately 400 MMBOE. At the time of purchase, Devon’s management estimated just 10% of the acreage had been developed, giving the company a drilling inventory consisting of 1,400 risked, and 3,000 unrisked, locations.

On a per-acre basis, Devon’s STACK acquisition averaged $23,750. Applying the remaining $300 million to production, the company paid $33,333.33 per flowing BOE. Applying 100% of the acquisition price to the deal, DVN paid $211,111 per flowing BOE. To put that in perspective, during the fourth quarter of 2015, the average price per flowing BOPD for all M&A transactions was $41,782.

On April 21, Chesapeake Energy (ticker: CHK) closed its $106 million sale of SCOOP assets to Casillas Petroleum, a Kayne Anderson backed private company. The transaction amounts to $8,333 per acre.

If recent deals in the SCOOP/STACK (South Central Oklahoma Oil Province and Sooner Trend Anadarko Basin Canadian and Kingfisher Counties, respectively) have been any indication, buyers are still willing to pay top-dollar for these assets.

Private Equity: waiting for the right moment

One of the many differences between today’s downturn and the one seen in the 1980s that is often cited is the immense amount of private equity waiting to buy assets. The total value of the dry powder private equity is waiting to employ has been estimated at more than $80 billion, giving firms plenty of financial firepower to make M&A deals happen.

This, of course, begs the question: why haven’t we seen a wave of private equity M&A?

There have been a handful of deals involving private equity, including Tailwater Capital’s investment into Southcross Holdings that helped bring the company out of bankruptcy in just two weeks, but on the M&A front, private equity has been surprisingly quite given the amount of financing it holds ready.

“There is a tremendous supply of private capital available to put to work via either direct institutional investments or private-equity backed independents,” said Lidsky. “However, the private capital market is not making big bets on a quick recovery of oil prices and by and large are seeking safe assets with bids for PDP reserves.”

Private equity needs to see a certain level of return on its investments, and the assets that have come to market so far have not been attractive enough to entice private equity firms. Companies are still holding on to their best assets, hoping that they can benefit from the production as oil prices begin to recover. They are not yet willing to part with their best assets for pennies on the dollar.

This does not mean there has been zero activity though, said Lidsky. “Foreign capital into the U.S. is still flowing, albeit at a slower pace. We have seen Canadian and Chinese investments into this markets. For example, last October the Canada Pension Fund Investment Board took 95% of a $900 million buy of high quality DJ Basin assets sold by Encana.”

Canada Pension Fund Investment Board’s $855 million purchase in the DJ was for 51,000 net acres, producing 52 MMcf/d of natural gas, and 14.8 MBOPD of oil and NGLs. On a per acre basis, the investment fund paid $16,764, while on a flowing MMcf/d basis, the company paid $16.41 for its DJ assets.

Which price is the right price for M&A?

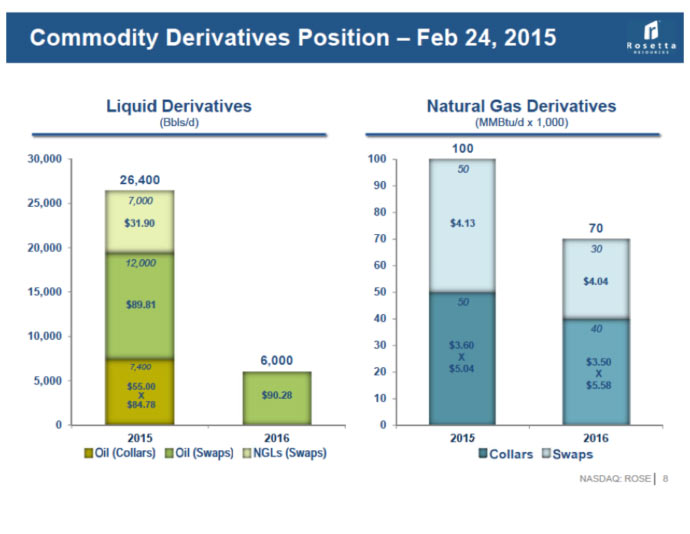

The right price is in the eye of the seller, and the pocket book of the buyer. Today’s oil price volatility makes it extremely difficult to accurately predict what a barrel of oil might be worth in six days, weeks or months. Part of the M&A strategy (property or corporate acquisition) is to acquire assets with upside (drilling zones/locations), synergies (job eliminations), and hedges. The buyer could then work to add hedges to the acquired assets to achieve an acquisition payout period or hurdle that meets the acquiring company’s internal target. In an April 2015 presentation by ROSE, the company provided a snapshot of its hedging position as of February 24, 2015. Essentially 43.1 MMBOE per day of production was hedged in 2015, or approximately 63% of ROSE’s Q2’15 daily production.

Companies filing for bankruptcy, bankruptcy courts and commercial banks are motivated to get to an agreed valuation as quickly as possible so that the assets don’t lose more value. Emerald Oil announced such a fast track restructuring process back on March 23, 2016. The purpose of the process was to “initiat(e) a process intended to preserve value and accommodate an eventual going-concern sale of Emerald’s business operations.” Prior to the Chapter 11 filing, Emerald entered into a non-binding agreement with Latium Enterprises to sell substantially all of Emerald’s assets under section 363 of the bankruptcy code. “Emerald continues to evaluate and discuss alternatives with its stakeholders and believes that an in-court sale process will maximize value and position Emerald for future profitability.”

One valuation methodology is to acquire assets at or below $50,000 per flowing BOE. Callon Petroleum announced a $334 million Permian Basin acquisition on April 21. In the company’s presentation, Callon used “own” $30,000 per flowing barrel metric to value the production in the transaction. Apply 100% of the value of the acquisition to the production, and the deal was priced at $115,811 per flowing BOE per day. Use $30,000 per flowing barrel for the production, and the deal is priced at $15,317 per net acre. As of Friday, April 15, CPE’s enterprise value to trailing twelve month production was $127,285 BOE per day.

At the moment, six of the seven highest trading U.S. E&Ps (using this metric) operate in the Permian Basin: Callon Petroleum, Concho Resources, Diamondback Energy, Parsley Energy, Pioneer Energy, RSP Permian. Cash will be the currency of choice of the sellers with M&A transactions. In the current negative interest borrowing rate and low inflation, cash plays. Someone in Washington, D.C. might come up with another “I’m-building-my legacy” idea by letting another despot regime out of the nuclear arms penalty box and add pressure on crude oil prices, and common shares of publicly traded E&P operators.

WPX Energy received $910 million on a sale of its Piceance Basin assets. Kayne Anderson-backed Terra Energy Partners bought an asset that represented about 53% of WPX’s daily Q4’15 production base. On a flowing BOE per day metric, the sale was for about $10,200. In this market, WPX indicated that the transaction supported its stated goal of reducing indebtedness and pivot its focus to assets management believes will deliver superior results. “I’m pleased with the success of our asset sales,” stated Rick Muncrief, WPX president and chief executive officer. “We exceeded our 2015 target and will continue to prioritize debt reduction in 2016.”

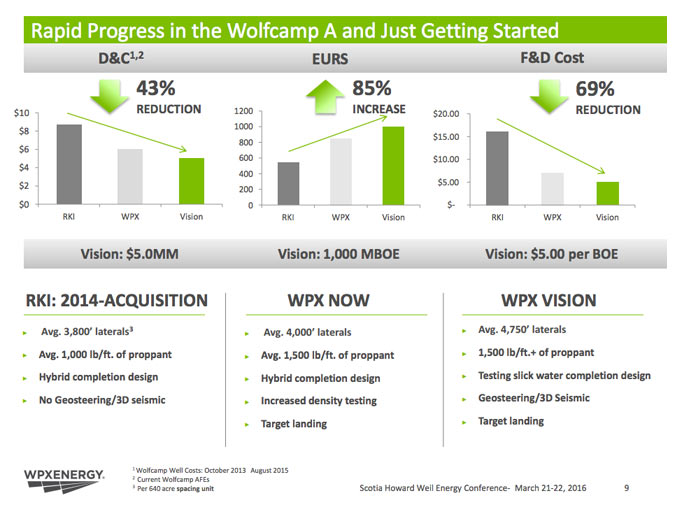

Let’s look at July 14, 2015, WPX acquisition of RKI’s Permian Basin assets for $2.35 billion plus the assumption of $400 million of debt. This was a transaction valued at $50,000 per flowing BOE per day. WPX put forward its belief that this was a transformative deal for WPX and its shareholders. The company presented in March that it was realizing marked operating improvement on the acquired Delaware Basin assets. Drilling and completion costs for Wolfcamp A wells were down 48%, EURs were up 85% and F&D costs were down 69%. At acquisition, RKI’s Wolfcamp A wells had an average EUR of 550 MBOE. By March 2016, the EURs were up to 850 MBOE, up 54.5%. WPX’s vision is to push the EURs to 1,000 MBOE or more.

Oil and gas M&A is similar to baseball: each side starts out happy with a trade, but give it three years and the winner in the deal will become clearer.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.