U.S. light tight oil production expected to fall 600 MBOPD in 2016

Oil prices are up more than 7% and 5% for WTI and Brent crude, respectively, today as news from the International Energy Agency forecasts production falling amid a global glut that has seen crude oil prices shed 70% of their value.

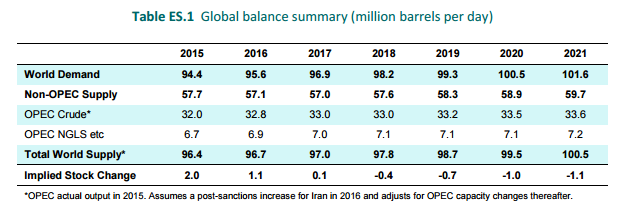

The IEA still anticipates that overall global supply will increase 300 MBOPD this year to 96.7 MMBOPD, but that production from U.S. light tight oil will begin to decline after the U.S. had posted substantial increases in oil production in 2014 and 2015.

U.S. production has remained surprisingly resilient amid lower commodity prices, but the IEA believes that 2016 will be the “straw [that breaks] the camel’s back.” According to the IEA’s Medium-Term Oil Market Report, U.S. tight oil production will decrease by 600 MBOPD this year and another 200 MBOPD in 2017, when the IEA sees supply and demand coming into balance, mirroring the Energy Information Administration’s predictions.

U.S. tight oil production expected to make up lion’s share of growth regardless

While the international agency expects U.S. production to fall about 800 MBOPD over the next two years, the IEA added, “Anybody who believes that we have seen the last of rising [light tight oil] production in the United States should think again.” Much of the increased production through 2021 is anticipated to come from the U.S. after a temporary fall in production.

Over the IEA’s medium-term outlook, U.S. liquids production is forecast to increase a net 1.3 MMBOPD compared to 2015.

While U.S. production slips 2016-2017, OPEC grows to 33.6 MMBOPD in 2021

Over the course of the medium-term outlook, OPEC crude supply is expected to stay relatively flat, with the organization’s crude production growing from 32.0 MMBOPD in 2015 to 33.6 MMBOPD in 2021, while non-OPEC supply grows from 57.7 MMBOPD to 59.7 MMBOPD after a low-point of 57.0 MMBOPD in 2017.

Despite an agreement from OPEC and major non-OPEC players like Russia to cap production at levels seen in January 2016, Iran and Iraq have continued to increase production, saying that support a freeze, but do not intend to join. Increased production from the two OPEC members was cause for some concern, but the IEA does not “expect a major increase in the production capacity of either Iran or neighboring Iraq, due to political uncertainties.”

Risk of future price spikes

The IEA also cautioned in its outlook that lower levels of investment could lead to price spikes in the future if demand begins to outpace supply.

“It is easy for consumers to be lulled into complacency by ample stocks and low prices today, but they should heed the writing on the wall: the historic investment cuts we are seeing raise the odds of unpleasant oil-security surprises in the not-too-distant-future,” said IEA Executive Director Fatih Birol.

Are shortages to follow after global capex drops off 17% in 2016, on top of a 24% decline in 2015?

Global oil E&P capex spending is expected to fall 17% this year, following a cut of 24% in 2015. With production growth slowing significantly from the massive gains from 2009-2015, the lower levels in investment could eventually lead to oil price shocks in the future.

“In today’s oil market there is hardly any spare production capacity other than in Saudi Arabia and Iran and significant investment is required just to maintain existing production before we move on to provide the new capacity needed to meet rising oil demand,” the IEA said in its report. “The risk of a sharp oil price rise towards the later part of our forecast arising from insufficient investment is a potentially destabilizing as the sharp oil price fall has proved to be.”

Shale gas production expected to grow 5.6% annually: BP

Earlier in February, BP came out with its 2016 Energy Outlook, in which it published a supplement to the study entitled “The Shale Revolution Continues.” In it the company said it expects tight oil production to more than double to 10 MMBOPD globally, driven largely by production in the United States.

Eventually, U.S. tight oil production will be constrained by a limited resource base, the study said, but shale gas is expected to continue growing by 5.6% annually as the cleaner-burning fuel is increasingly used. Natural gas is expected to be the fastest growing fossil fuel over the next 20 years, according to BP.