Economic indicators positive, sideways and negative

Yellen says she expects FED will raise rates in 2015 if employment grows

Bill Gross criticizes the FED’s zero policy

U.S. Bank Chief Investment Officer John De Clue, in a presentation to Denver area businesses, called for oil prices to eventually settle back at $60 per barrel. De Clue pointed to the lingering global oversupply and lack of demand, cautioning that $60 oil could be several years in the making.

De Clue was a keynote presenter at the U.S. Bank Economic Update breakfast in Denver yesterday. He reviewed a macroeconomic checklist of where things stand with the economy, assessing key economic benchmarks as follows:

-

GDP growth – “not bad”

-

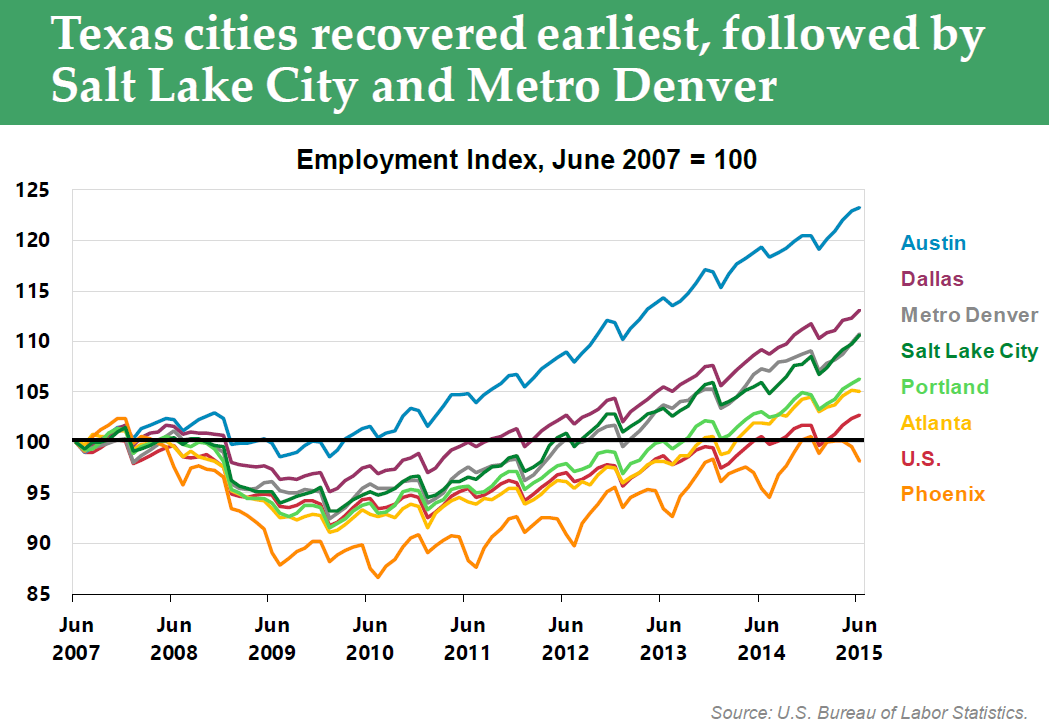

Employment – increasing; U.S. employment probably will improve somewhat in the months ahead

-

Inflation – “tame, or too tame”

-

Wages – “not too high or too low”

-

Consumer sentiment – positive

-

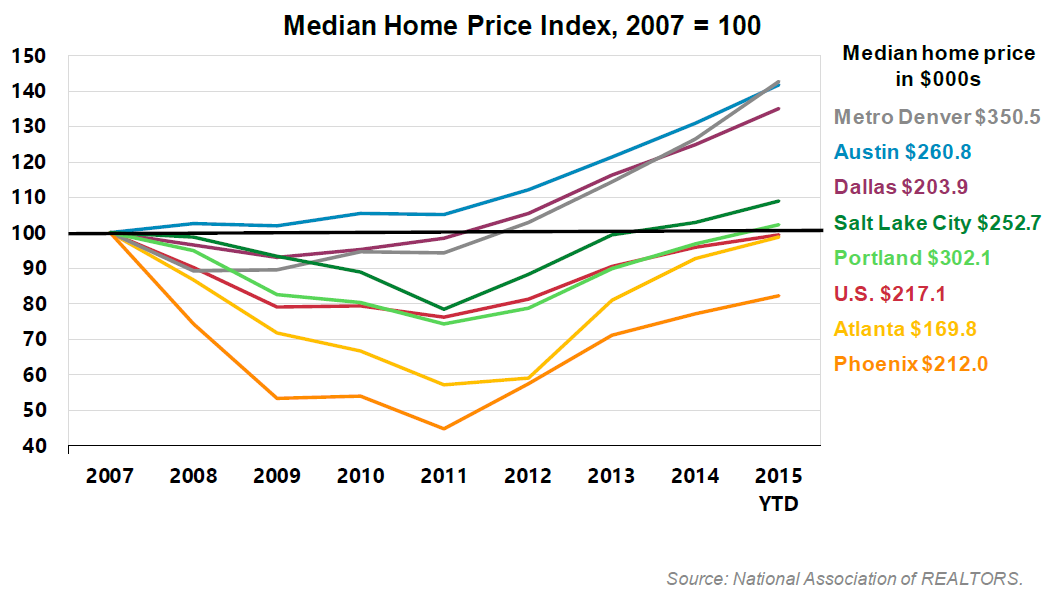

Housing – showing renewed strength

De Clue summarized his view of the U.S.’s economic headwinds as follows:

-

China’s economy – growth is slowing; De Clue warned that the Chinese government can put the country’s GDP “at any number it wants,” and the government can get involved in the economy “anytime it wants.”

-

International markets – in a correction

-

Greece – stabilized for now but “it will come back and bite us again; their economy is cratering”

-

Europe – no growth whatsoever

-

Japan: monetary policy – working; fiscal policy ( government spending) – working; reform – Japan’s economy would be helped if it makes cultural reforms

-

U. S. dollar – the dollar’s strength against other currencies has negatively affected multinational corporations: “your overseas earnings are worth a lot less, and pricing deteriorates”

Statistics released by the government and others on Thursday seemed to reinforce the U.S. Bank CIO’s prognosis.

Employment

Employment

First-time unemployment claims rose by 3,000 last week “but the level remains consistent with a labor market that is steadily adding jobs,” the Wall Street Journal reported.

Last week’s 264,000 claims were the fewest since July 18’s four-decade low. “Employers added only 173,000 jobs last month, the weakest monthly gain since March….other signs of slack include weak wage growth and the lowest share of Americans participating in the labor force since the 1970s,”the report said.

Durable Goods

August orders for durable goods fell due to an expected pullback in bookings for new cars and airplanes and overall business investment also softened, reported MarketWatch.

Orders for U.S.-made durable goods fell 2% last month, the first decline since May. However, orders for autos were up 9.2% through the first eight months of 2015 compared to the same period in 2014. Bookings fell 1.8% for fabricated metal parts. Bookings for heavy machinery rose 1%.

Companies have scaled back investment because of a stronger dollar that’s reduced exports. Cheaper oil prices have also forced U.S. energy producers to slash purchases of new rigs and other drilling-related gear, MarketWatch reported.

August New Home Sales

August New Home Sales

“Sales of newly built homes reached the highest level since early 2008 in August, evidence that demand for housing is strengthening heading into the fall,” the Wall Street Journal reported today.

Sales of new, single-family homes rose by 5.7% to a seasonally adjusted annual rate of 552,000, the Commerce Department reported.

Industrial Projects: Gulf Coast Boom

Industrial Info reports that the U.S. Gulf Coast region between Brownsville, Texas, and Pascagoula, Mississippi, “has the largest concentration of future spending of anywhere in the country.”

Over the next five years, an estimated $284.3 billion will be spent in this region, an 80% bump from the $158.2 billion spent from 2010 through 2014. “Labor demand in the region has consistently increased since 2013 and could peak at 183.5 million hours in 2017.

The Fed’s Zero Rate gets Thumbs Down from Janus’ Bill Gross

Fabled former PIMCO fund manager Bill Gross, now bond fund manager for Janus, expressed his opinion yesterday of the Fed’s zero interest rate policy: “Do central bankers not observe that Detroit, Puerto Rico, and soon Chicago, Illinois cannot meet their promised liabilities? Do they simply chalk it up to bad management and inept governance and then return to their Phillips Curves for policy guidance? Do they not know that if zero were to become the long-term norm, that any economic participant that couldn’t print its own money (like they can), would soon “run on empty” as Blackstone’s Pete Peterson once expressed it in describing our likely future scenario?” Read Gross’s new commentary on the Fed policy here: Janus Capital Group’s Monthly Investment Outlook.

Yellen’s Talk Today

Federal Reserve Board Chair Janet L. Yellen gave a speech entitled “Inflation Dynamics and Monetary Policy” today at the University of Massachusetts Amherst, at 5:00 p.m. ET.

Yellen said she expects the U.S. central bank to begin raising interest rates later this year as long as inflation remains stable and the U.S.economy is strong enough to boost employment, Reuters reported.