Bridging the budget gap

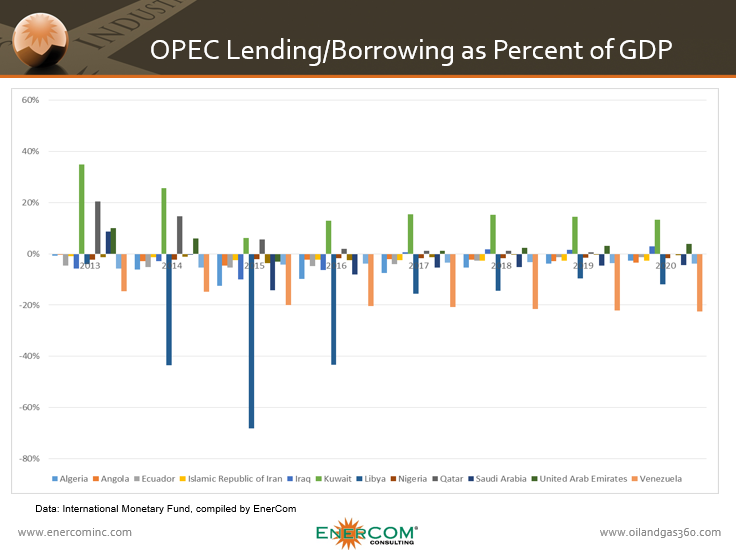

Lower commodity prices have hurt the economies of all of OPEC’s members considerably, with many of them needing to borrow money to bridge the budget gap. Libya, in particular, is expected to need large loans through the rest of the decade, with its borrowing as a percent of GDP reaching 68.15% this year, and an expectation that it will need to borrow 43.35% of its GDP next year as the country deals with both low oil prices and a civil war, according to the IMF. Venezuela is also expected to borrow substantial amounts of money, with the international lender of last resort projecting the country will borrow 20%-22% of its GDP through the end of the decade.

IMF Sees OPEC Borrowing at Elevated Levels through 2019

Saudi Arabia’s increasing debt has been a point of focus among international markets as analysts watch how OPEC’s largest producer continues to handle the aftermath of a decision it spearheaded last November to maintain production and let oil prices drop.

Yesterday, it was reported that Saudi’s debt levels could reach as high as 50% of the country’s gross domestic product (GDP) within the next five years, according to a senior official.

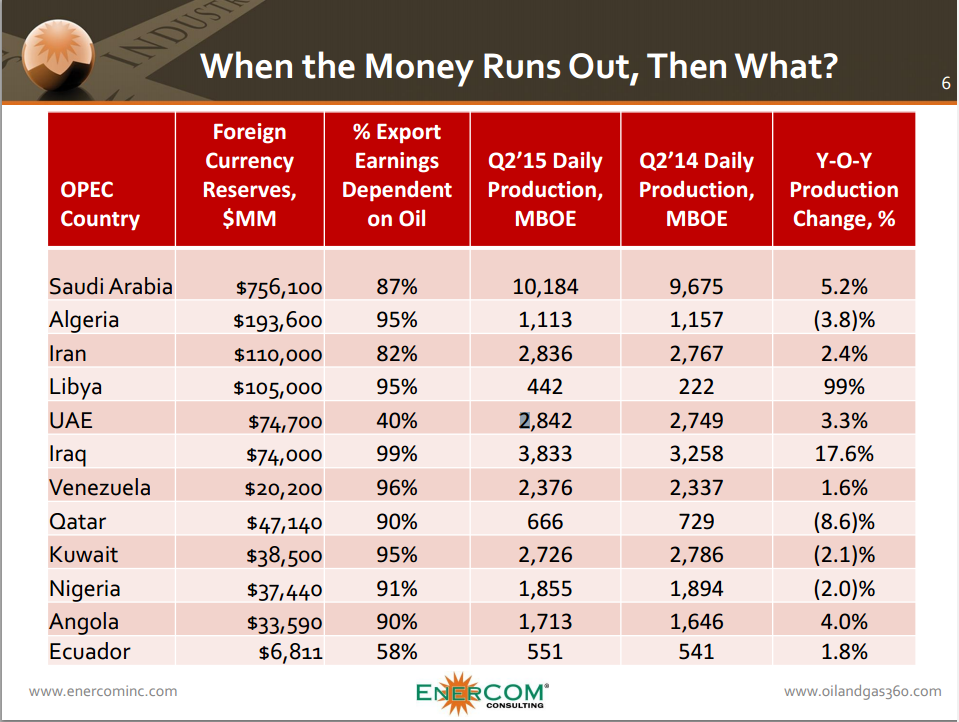

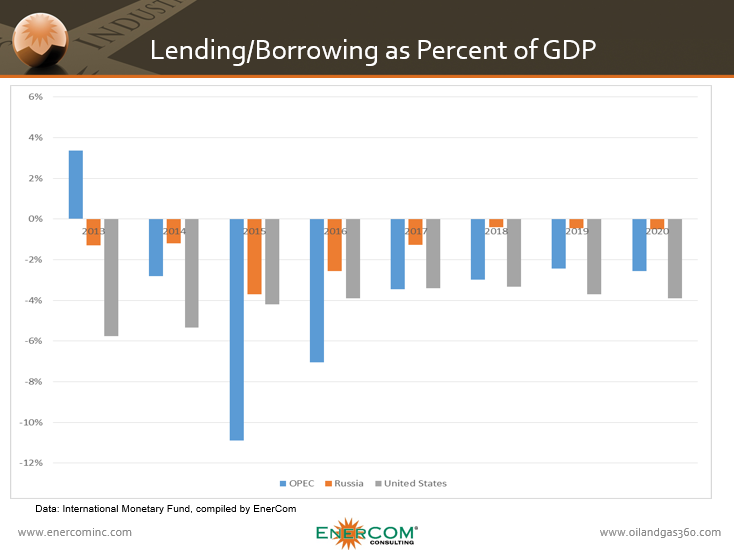

Saudi Arabia’s OPEC compatriots also face a serious shortfall in funding however, with many of OPEC’s member-states holding much smaller reserves than the kingdom. Based on data from the International Monetary Fund (IMF), the average borrowing as a percent of GDP for OPEC countries will exceed 10% this year, and remain above the 2.8% average seen in 2014 for the next five years.

Other national economies that are strongly dependent on oil prices for income, such as Russia, will also be adversely affected by the continued downturn in the price of their main revenue-generating product. Russia’s borrowing as a percent of GDP is expected to decline faster than OPEC’s, however, with the country borrowing 3.69% of GDP this year, and then lowering that to about 0.5% by 2018.

The IMF forecasts that the U.S. will borrow less as a percent of GDP each year until 2018, when the fund sees borrowing at 3.34%, before increasing through the end of the decade to 3.91% in 2020.

This increased borrowing on the behalf of OPEC members is also expected to pull down the levels of savings the countries are putting back into their sovereign funds, unsurprisingly.

The OPEC member states have been using their sovereign funds as a cushion during the current commodity downcycle. Saudi Arabia’s use of sovereign funds in particular has been well publicized, with some estimates putting the kingdom’s spending at $12 billion per month to plug its budget deficit, as long as Brent crude prices were below $45/barrel.

The New York Times reports that Saudi’s foreign reserves has declined by $90 billion in the last year, but still sits at about $647 billion overall. The IMF had previously advised Saudi Arabia to raise debt, saying the country could deplete its spending support within five years if it had continued at the current pace.

The percent OPEC countries are expected to save will increase to near-2014 levels by 2017, according to the IMF, but with the group already shoveling money out of their coffers to bridge budget deficits, they will have some ground to regain following the increased spending and borrowing already seen this year, which is expected to continue in 2016.